It’s commonplace to correlate time period spreads with future financial exercise measured a technique or thSo, whereas different. Recessions within the US do appear to be predictable on the premise of time period spreads; however recessions are a binary variable insofar because the NBER, ECRI, and different establishments outline it. What about development as a steady variable — be it development of GDP or industrial manufacturing?

Chinn and Kucko (2015) famous that the predictive energy of the 10yr-3mo unfold for industrial manufacturing development appeared to have decreased over time, with the slope coefficient statistically vital 1970-97, and never so 1998-2009. What in regards to the newer information? Utilizing quarterly information 1967-2023Q3 (so for recession indicators as much as 2024Q3) a Bai-Perron sequential break take a look at signifies a break at 1984Q2, with the slope coefficient extremely vital within the early interval, and never so within the later.

What can we are saying about whether or not the slope coefficient has predictive energy for some indicators and never others. Sometimes, on the month-to-month frequency, the proxy for development has been industrial manufacturing since this has been the one long-span indicator out there. Now, nevertheless, now we have quite a lot of indicators, so we will now consider the predictive energy of the unfold (in addition to different monetary indicators) on month-to-month information.

Right here, I examine month-to-month GDP from S&P International (previously IHS-Markit, Macroeconomic Advisers) and the Philadelphia Fed’s coincident index towards industrial manufacturing. The dependent variable is the year-on-year development charge calculated utilizing log-differences.

Determine 1: 12 months-on-12 months development charge of business manufacturing (black), of month-to-month GDP (sky blue), and coincident index (tan). NBER outlined peak-to-trough recession dates shaded grey. Supply: Federal Reserve and Philadelphia Fed through FRED, SPGMI (Nov 1 launch), NBER, and writer’s calculations.

Observe that whereas all three measures are revised over time, the month-to-month GDP and coincident indexes are considerably and repeatedly revised (similar to the quarterly official GDP collection).

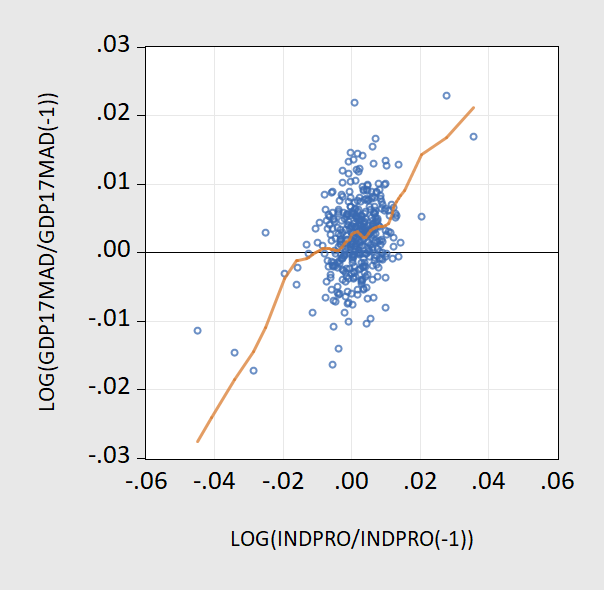

So industrial manufacturing development deviates considerably on a y/y foundation from GDP development; and it does so much more when taking a look at m/m, as proven in Determine 2 (the place I’ve truncated excessive actions in IP to be -6% m/m < development < +6% m/m.

Determine 2: Scatterplot of m/m development charge of month-to-month GDP towards month-to-month industrial manufacturing, for vary of -6% m/m < IP development < +6% m/m (blue circles), nearest neighbor match (crimson line).

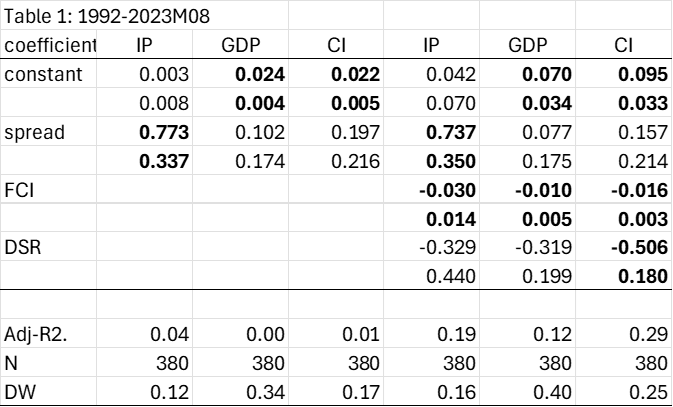

In Desk 1 are the outcomes for estimating the connection over a standard 1992-2023M08 pattern (so the final statement on the dependent variable is the y/y development charge in 2024M08). 1992 is the place to begin as month-to-month GDP is just not out there sooner than that. The primary three columns report easy bivariate regressions, whereas the subsequent three increase the time period unfold with the Chicago Fed Nationwide Monetary Circumstances Index and the debt-service ratio (see Chinn and Ferrara (2024) for particulars of the latter, from the BIS).

Notes: Dependent variable is 12 month log distinction of business manufacturing (IP), month-to-month GDP (GDP), or coincident index (CI). unfold is the 10yr-3mo Treasury unfold in bps, FCI is Chicago Fed Nationwide Monetary Circumstances Index, and DSR is the debt-service ratio for personal nonfinancial sector, in decimal kind. Daring face denotes statistical significance at 5% msl, utilizing Newey-West sturdy commonplace errors. Supply: writer’s calculations.

The unfold is a statistically vital determinant of the commercial manufacturing development charge, however the proportion of variance defined is extraordinarily low. Apparently, this discovering of a big coefficient doesn’t carry over to month-to-month GDP, or to the coincident index (which is an element primarily based on primarily labor market indicators).

If we increase the specification with FCI and DSR, these enter in considerably for IP development. The FCI additionally enters in considerably for GDP development and CI development as effectively, with the distinction being the unfold is just not statistically vital in both of these two instances. DSR is just vital for the Coincident Index.

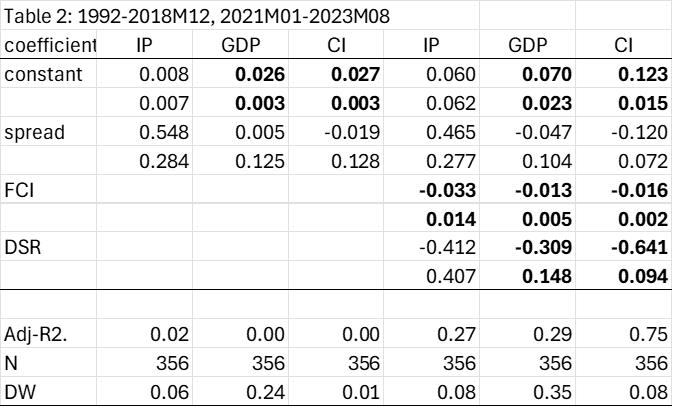

One may surprise if the outcomes are being distorted by the inclusion of the pandemic interval. So as to verify this, I drop rate of interest information from 2019M01-2020M12.

Notes: Dependent variable is 12 month log distinction of business manufacturing (IP), month-to-month GDP (GDP), or coincident index (CI). unfold is the 10yr-3mo Treasury unfold in bps, FCI is Chicago Fed Nationwide Monetary Circumstances Index, and DSR is the debt-service ratio for personal nonfinancial sector, in decimal kind. Daring face denotes statistical significance at 5% msl, utilizing Newey-West sturdy commonplace errors. Supply: writer’s calculations.

Now the unfold doesn’t enter in considerably in any specification (though it’s vital on the 10% msl for the bivariate IP-spread regression). In truth, the significance of the unfold appears to be an artefact of the pandemic interval. For the pattern predating the pandemic, one obtains the next estimates.

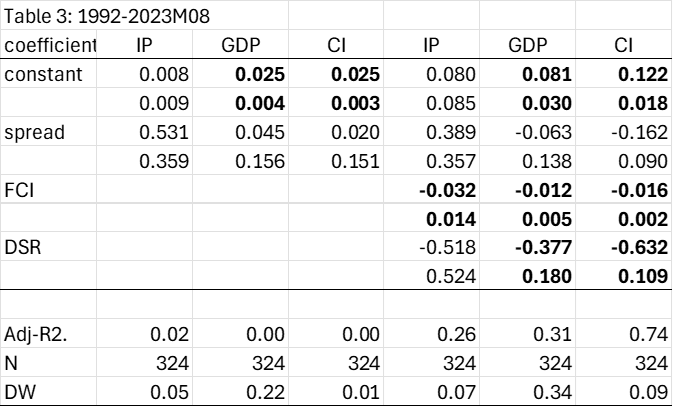

Notes: Dependent variable is 12 month log distinction of business manufacturing (IP), month-to-month GDP (GDP), or coincident index (CI). unfold is the 10yr-3mo Treasury unfold in bps, FCI is Chicago Fed Nationwide Monetary Circumstances Index, and DSR is the debt-service ratio for personal nonfinancial sector, in decimal kind. Daring face denotes statistical significance at 5% msl, utilizing Newey-West sturdy commonplace errors. Supply: writer’s calculations.

Whereas it has been commonplace follow to take industrial manufacturing as a proxy for a broad mixture, that is just about an expediency, reasonably than one thing economically motivated. Industrial manufacturing (mining, utilities and manufacturing) accounted for less than 13% of GDP in 2023. So if one needs to analyze the implications of economic indicators for mixture financial exercise, it makes extra sense to focus upon GDP.

The conclusion is that the time period unfold does predict IP development, however doesn’t predict total financial exercise, during the last thirty years. Apparently, in line the findings in Ahmed and Chinn (2024), the international time period unfold does predict GDP.