Reader Michael writes:

…excessive earnings wage progress has grown a lot sooner than medium and low earnings wage progress patterns.

Right here’s a stab at looking on the knowledge. First wages:

Determine 1: 12 months-on-12 months progress fee in common hourly earnings from CES (blue), common wage from CPS (inexperienced), median wage from CPS (tan), from 2nd quintile (purple), all in %. NBER outlined peak-to-trough recession dates shaded grey. Supply: BLS, Philadelphia Fed Wage Tracker, NBER, and writer’s calculations.

What about relative to inflation? Right here, one would attempt to match up with probably the most acceptable deflators. Right here’s my try.

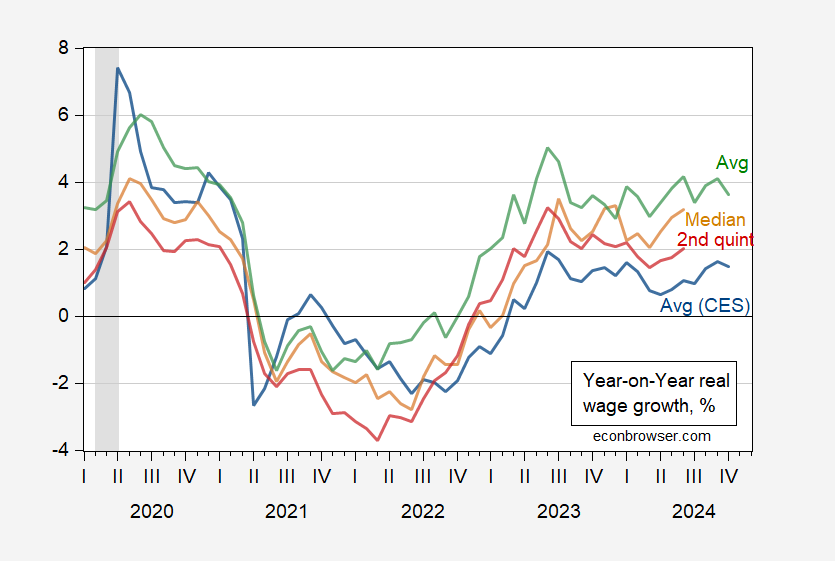

Determine 2: 12 months-on-12 months progress fee in common hourly earnings from CES, deflated by CPI-U (blue), common wage from CPS, deflated by CPI-wage earners (inexperienced), median wage from CPS, deflated by median family earnings CPI (tan), from 2nd quintile deflated by 2nd quintile family earnings CPI (purple), all in %. NBER outlined peak-to-trough recession dates shaded grey. Supply: BLS, Philadelphia Fed Wage Tracker, BLS, NBER, and writer’s calculations.

So year-on-year actual wage progress has been optimistic from between 2022M10 to 2023M02 onward.