Right this moment we’re happy to current a visitor contribution by Jamel Saadaoui (College Paris 8).

The latest literature establishes that local weather threat reduces the fiscal house, see Beirne et al. (2021) for instance. The rationale is intuitive and straightforward to know. Monetary markets will value the affect of local weather threat within the type of larger bond yields and decrease scores on long-term international foreign money debt. This local weather threat premium can have necessary detrimental implications for the financing of the inexperienced transition, particularly for rising markets. Nevertheless, the literature has not explored the position of monetary growth and political stability on the local weather threat premium. Intuitively, it appears affordable to suppose that nations with higher monetary techniques and a extra secure political setting will expertise smaller pressures on their fiscal house. In a latest paper with John Beirne, Donghyun Park, Jamel Saadaoui, and Gazi Salah Uddin, we examine this difficulty. For a pattern of 199 economies in 1990-2022, we first empirically affirm that local weather dangers adversely have an effect on fiscal house. We discover that such results are most pronounced for economies most susceptible to local weather change. Nevertheless, our proof signifies that political stability and monetary growth can mitigate such results. We additionally determine nonlinearities within the local weather risk-fiscal house nexus. Extra particularly, the affect of local weather threat on fiscal house is bigger when fiscal house is most constrained, i.e., on the higher quantile of the distribution.

Determine 1. Warmth plot for the low vulnerability rating.

To measure local weather threat, we use the ND-GAIN Vulnerability scores. These scores are forward-looking artificial measures of vulnerability to local weather change. Within the Figures 1 and a pair of, we are able to see that nations situated in sub-Saharan Africa and in South Asia are probably the most susceptible to local weather dangers. Together with the presence of extra superior nations in Determine 1, we discover a number of nations that don’t belong to the group of the extra superior economies when it comes to financial growth. These nations have low vulnerability rating (i.e., the next resilience to local weather dangers) as a consequence of glorious scores in some sub-categories of the ND-GAIN general vulnerability rating, just like the infrastructure high quality or the power autonomy sub-categories.

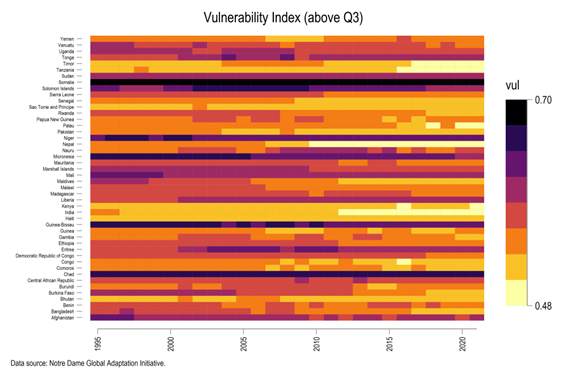

Determine 2. Warmth plot for the excessive vulnerability rating.

In Determine 2, we are able to observe that nations which have the next vulnerability (above the third quartile). These are nations which are usually on the decrease phases of financial and institutional growth. These nations additionally are inclined to have much less developed home monetary markets. Comparatively to the group of nations introduced in Determine 1, this group of nations is extra homogenous. We discover nations in sub-Saharan Africa and South Asia. In these nations, the paved highway protection, the electrical energy entry and the entry to dependable ingesting water stay scare. For instance, Chad and Afghanistan have very excessive vulnerability scores in each the agricultural capability and the medical employees protection.

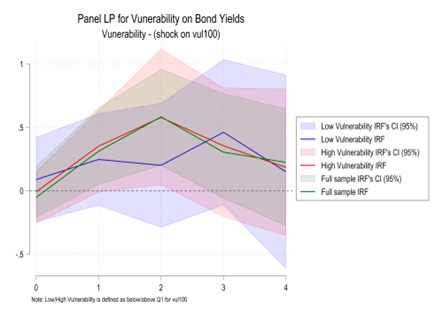

In Determine 3, we use Panel Native projections and an inventory of home and world controls in step with the literature. Our baseline case throughout all nations signifies a statistically vital premium on sovereign bond yields as a consequence of local weather threat vulnerability, reflecting the excess return demanded by buyers for holding that debt. Additional, we break up the pattern between high and low local weather threat vulnerability, relying on the worth of the vulnerability rating. For the much less climate-vulnerable nations, a statistically vital impact shouldn’t be discovered. That is in step with financial instinct, i.e., low ranges of local weather publicity won’t result in climate-related premia on sovereign bonds. For nations which can be extremely uncovered to local weather change, the affect on bond yields is critical, as anticipated. Apparently, the impact is broadly in step with that for the panel as an entire when it comes to magnitude, suggesting that the nations which can be extremely susceptible to local weather change could also be driving the general outcomes.

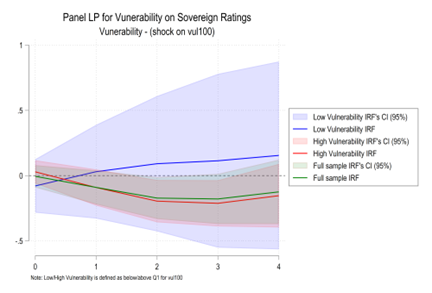

In Determine 4, we carry out the identical baseline evaluation for sovereign scores, our second measure of the fiscal house. We discover a constant consequence to that carried out on bond yields, whereby a local weather vulnerability shock will result in a persistent lower within the sovereign scores for the complete pattern and the extremely climate-vulnerable nations. For the much less susceptible nations, we don’t observe such a persistent deterioration in sovereign scores, as anticipated.

Determine 3. Panel LP for the affect of vulnerability on bond yields.

Determine 4. Panel LP for the affect of vulnerability on sovereign scores.

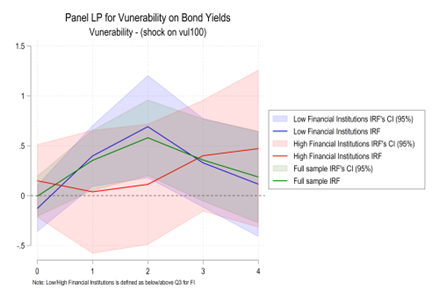

In Determine 5, we use the Monetary Establishment Growth index (Svirydzenka, 2016) to analyze the affect of monetary establishment growth on the affect of vulnerability shocks on the fiscal house. For nations with mature monetary establishments, local weather vulnerability shocks don’t set off any improve within the bond yields.

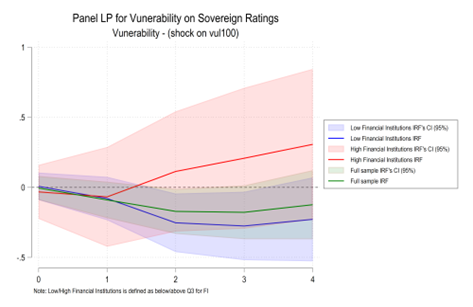

In Determine 6, we are able to see that local weather vulnerability shocks would not have any vital affect on sovereign scores for nations with elevated ranges of monetary establishment growth. Alternatively, local weather vulnerability shocks provoke a persistent deterioration in sovereign scores for the nations with low monetary establishments and for the complete pattern, underlying the significance of sound monetary establishments. The mitigating affect of enhanced monetary growth on the climate-fiscal nexus follows instinct, whereby there may be better depth and liquidity in native monetary markets and insurance coverage markets are higher developed.

Determine 5. Panel LP for the affect of vulnerability on bond yields (Monetary Establishments)

Determine 6. Panel LP for the affect of vulnerability on sovereign scores (Monetary Establishments)

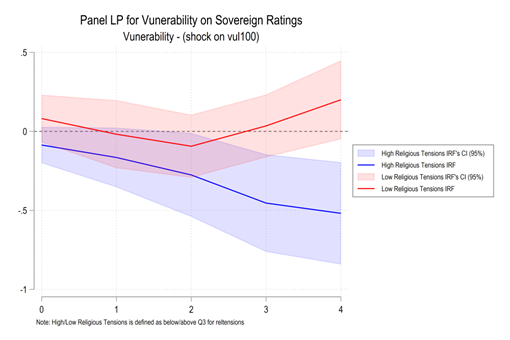

Our consequence, utilizing ICRG information (PRS group), affirm our predominant instinct for a number of dimensions of political stability (Exterior battle, Inside battle, Authorities stability, Ethnic tensions). Nations with extra secure political techniques skilled a smaller local weather threat premium. Remarkably, the local weather threat premium is everlasting just for one dimension of political stability, which is the spiritual tensions. These outcomes could assist the policymakers to know the position of political stability and monetary growth within the funding of the ecological transition.

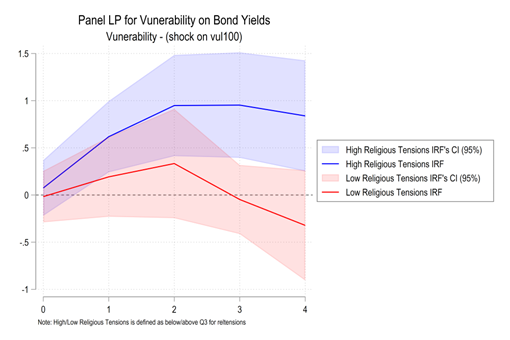

Determine 7. Panel LP for the affect of vulnerability on bond yields (Non secular Tensions)

Determine 8. Panel LP for the affect of vulnerability on sovereign charges (Non secular Tensions)

This put up written by Jamel Saadaoui.