Right now, we current a visitor publish written by Charles Engel, Donald D. Hester Distinguished Chair in Economics at UW Madison and Steve Pak Yeung Wu, Assistant Professor of Economics at UCSD.

It’s usually believed that commonplace macroeconomic empirical fashions of overseas alternate charges don’t match the information properly. (See for instance, Meese and Rogoff (1983), Cheung, et al. (2005), and Itskhoki and Mukhin (2021).) Nonetheless, we discover that these fashions match very properly for the U.S. greenback within the 21st century. A “standard” mannequin that features actual rates of interest and a measure of anticipated inflation for the U.S. and the overseas nation, the U.S. complete commerce stability, and measures of worldwide threat and liquidity demand is well-supported within the information for the U.S. towards different G10 currencies. The “monetary variables” (that’s, actual rates of interest and anticipated inflation) and non-monetary variables play equally vital roles in explaining alternate fee actions. Within the Nineteen Seventies – early Nineties, the match of the mannequin was poor, however the mannequin efficiency has improved steadily to the current day. We make the case that it’s higher financial coverage (inflation focusing on) that has led to the advance, because the scope for self-fulfilling expectations has disappeared. We offer quite a lot of proof that hyperlinks modifications in financial coverage to the efficiency of the exchange-rate mannequin.

The hyperlink to the working paper is right here. This observe leaves out the technical particulars and references to the literature, that are within the paper. We study the determinants of the greenback relative to the euro, the U.Ok. pound, the Canadian greenback, the Australian greenback, the New Zealand greenback, the Norwegian krone, and the Swedish krona. The Japanese yen and Swiss franc are particular instances which we deal with individually.

The empirical mannequin hyperlinks modifications in bilateral month-to-month alternate charges to:

- Actual rates of interest within the U.S. and the “foreign” nation. Most macro fashions of alternate charges posit {that a} increased actual rate of interest induces a stronger foreign money. A rise within the U.S. actual rate of interest leads the greenback to understand, and a better overseas actual rate of interest is related to a greenback depreciation.

- Inflation. Maybe paradoxically, increased inflation within the U.S. ought to result in a greenback appreciation (and better overseas inflation to a greenback depreciation.) That is the conclusion of the New Keynesian macroeconomic paradigm when financial coverage is credible. Larger inflation (over the previous yr) leads central banks that concentrate on inflation to tighten. Since we already management for actual rates of interest, that are decided by the present stance of financial coverage, this channel captures expectations of future financial coverage actions.

- Commerce stability on items and companies within the U.S. Because the commerce deficit will increase, the U.S. internet overseas asset place deteriorates. Particularly within the early 21st century, markets turned involved that insurance policies could be undertaken to weaken the greenback to cut back the worth of exterior debt, so increased commerce deficits are related to a depreciating greenback.

- World threat. The greenback is taken into account a “safe-haven” foreign money. Throughout instances when international threat is excessive (as measured right here by bond market spreads), the greenback strengthens.

- Liquidity. Additionally, throughout instances of worldwide stress, markets enhance demand for greenback liquid property. As that demand rises, the “convenience yield” on U.S. Treasury property will increase, and the greenback appreciates.

- Buying Energy Parity. When the relative buying energy of the greenback could be very misaligned, there’s a (weak) tendency to return to the PPP stage.

Mannequin Estimation

The mannequin is estimated currency-by-currency and likewise collectively by panel estimation. The macro variables usually have the signal and magnitude according to financial idea and are normally fairly statistically vital when estimated over the January 1999 to August 2023 interval. (The start line right here is chosen as a result of it corresponds to the arrival of the euro.) Determine A proven right here plots the “fitted values” of the mannequin towards the precise alternate fee.

Particularly, because the mannequin is estimated for the month-to-month change within the alternate fee, the fitted worth for the degrees that’s plotted right here cumulates the mannequin’s estimated change every month to provide the mannequin’s match for the extent of the (log of) the alternate fee. The preliminary worth within the cumulation is chosen to make the general common of the fitted values equal the general common within the information.

One factor to be very clear about right here is that we aren’t forecasting alternate charges. The empirical mannequin makes use of information from, for instance, January 2000 to elucidate the January 2000 alternate fee. Even when the macroeconomic fashions of alternate charges are good fashions, they in all probability should not helpful fashions for forecasting. Largely, alternate charges change from month to month due to unanticipated modifications in explanatory variables. However these unanticipated modifications can not, by definition, be forecast, so forecasting the change in alternate charges turns into very tough even with the perfect mannequin in hand.

The Mannequin Matches

Turning to Determine A, taking the euro alternate fee for example, the fitted values reproduce properly the preliminary appreciation of the U.S. greenback from 1999-2000, adopted by the depreciation of the U.S. greenback from 2001 to 2008. The fitted sequence additionally matches the sharp appreciation of the U.S. greenback in 2008, 2010, and 2013. Each the information and the fitted sequence exhibit an appreciation of the greenback from 2013 onwards. The model- implied sequence additionally matches the sample post-2020 very properly, mimicking the V-shape from 2021 to 2023. The shut correspondence between the pink line and the blue traces holds for all different currencies in numerous sub-periods between 1999 and 2023.

Determine A: Evaluating information and mannequin implied alternate charges

The Match has Improved over Time

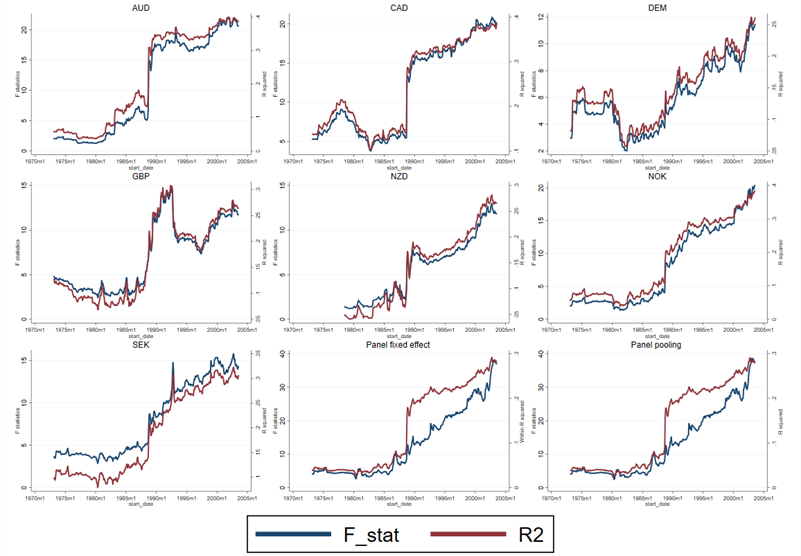

However the mannequin didn’t match over earlier samples. We doc this by estimating the mannequin over 20-year rolling samples starting in 1973. Within the earlier samples, the match was poor – the variables are normally statistically insignificant; typically when they’re vital, they’ve the fallacious signal; and the R-squared values are low. F-tests of the joint significance of the explanatory variables fail to reject the null. However there’s a near-monotonic enhance within the F-statistics and R2s because the samples progress in time, and these statistics basically attain their most within the last 20-year pattern. Determine B plots the R-squared and F statistics over time from these rolling regressions. It reveals that the fashions match poorly within the early samples, however that the match has steadily improved.

Why the Mannequin Didn’t Work within the Outdated Days

What accounts for the poor match of the fashions within the ancient times, and the superb match now? We argue {that a} change in financial regime could clarify this. As we present, financial idea implies that when central banks don’t observe a reputable inflation-targeting coverage, there’s scope for self-fulfilling expectations to affect variables within the economic system, together with inflation, output, and alternate charges. Intuitively, suppose markets conjure up a perception that inflation will likely be increased. If central banks don’t reply forcefully sufficient to this alteration in expectations, actual rates of interest will fall. That may stimulate mixture demand, result in inflation and a weaker foreign money. We contend that as credibility elevated, this phenomenon decreased, and the match of the usual mannequin improved. When financial coverage is credible, an expectation of inflation whipped up out of skinny air won’t be sustained as a result of tighter financial coverage will rapidly be seen to remove the chance of future inflation.

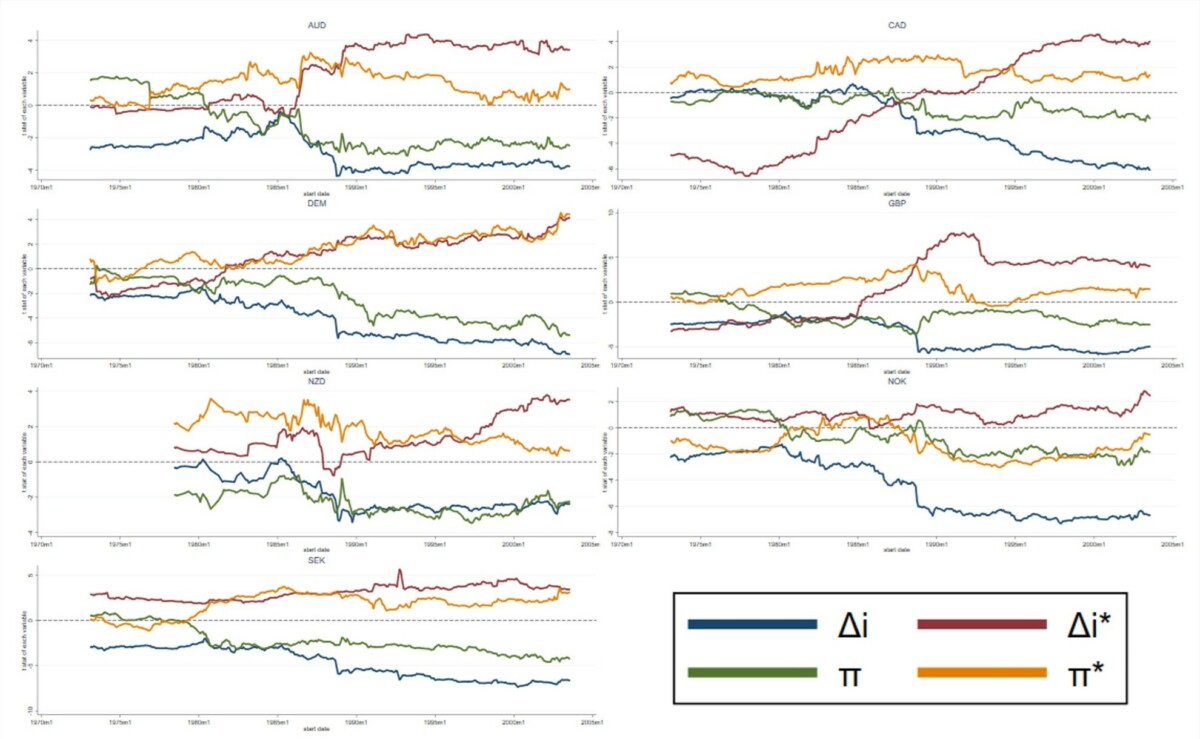

That the advance in match is expounded to the financial variables is clear in Determine C, which plots the t-statistics for the actual rate of interest variables (Δi, Δi*) and the measures of inflation (π and π*) from rolling 20-year regressions. The t-statistic measures the contribution of the variable (the estimated regression coefficient) scaled by the precision of the estimate (the inverse of the usual error of the estimate), so it offers us a good suggestion of how vital every variable is in explaining alternate fee actions. In these graphs, if the idea is appropriate, the t-statistics ought to be detrimental for the U.S. interest-rate and inflation variables and optimistic for the overseas variables. Values which can be above roughly 2.0 are statistically vital. We are able to see from Determine C, with just a few exceptions, that the variables have been not often vital within the early a part of the pattern and infrequently had the fallacious signal, however within the later samples, they’ve the best signal and are vital.

The rate of interest and inflation variables are vital as a result of they point out whether or not financial coverage alternate charges are responding to credible financial insurance policies. If insurance policies are credible, increased actual rates of interest ought to make the foreign money stronger, and better inflation ought to sign future insurance policies will likely be tighter and likewise will admire the foreign money. That sample doesn’t maintain within the earlier samples however does within the later samples.

Determine B: F-statistic and R-squared of 20-year rolling window regressions

Determine C: t statistics of 20-year rolling window regressions

Financial coverage for the U.S. started to shift in the course of the Volcker period, in order that Taylor guidelines estimated on information starting within the mid-Eighties provide assist for financial stability. The superior international locations in our pattern adopted inflation focusing on just a few years later: New Zealand in 1990, Canada in 1991, the U.Ok. in 1992, Sweden and Australia in 1993, Norway in 2001. One of many pillars of European Central Financial institution coverage, starting in 1999, is inflation focusing on. Germany formally adopted inflation focusing on in 1992 earlier than the arrival of the euro, although focusing on inflation was at all times on the core of Bundesbank coverage.

The paper produces additional proof to assist the shift in financial coverage in these international locations and its gradual growing credibility. The vital contribution right here is that the success of the empirical mannequin doesn’t rely totally on the danger and liquidity variables, that are vital in monitoring the actions of the greenback throughout instances of worldwide monetary stress. The variables that symbolize the stance of financial coverage within the U.S. and the opposite international locations are key to accounting for the great match of the mannequin immediately and its poor match prior to now. It’s pure to attribute this alteration over time to the altering nature of financial coverage.

Empirical Change Charge Fashions are Higher than You Assume

Clearly, the match of the mannequin will not be excellent. There could certainly be different components driving alternate charges, together with non-market “noise trading” that has been emphasised in some current research. Nonetheless, it’s seemingly {that a} main motive the match will not be excellent is as a result of economists can not completely measure the variables that idea says ought to drive the alternate fee: the stance of financial coverage, the extent of worldwide threat, the demand for liquidity, and so on. Determine A definitely reveals that the empirical mannequin is ready to seize main components driving greenback alternate charges.

This publish written by Charles Engel and Steve Pak Yeung Wu.