So be ready. From Feng, Han, and Li (2023):

As famous within the article, equipment, electronics and optical tools accounted for lots of imports as a share of complete US imports for these classes, so these pass-through coefficients pertain to substantial quantities of imports.

Now, I can’t say the excessive pass-through estimates are a shock, given Cox and Russ (2020) and references cited therein, however for some folks, it bears repeating (over and again and again).

Now, Zerohedge in a uncommon second of coherence, notes the opportunity of Beijing devaluing the CNY in response to tariffs. Effectively, duh! After all, depreciation wouldn’t be costless, given fears that this is able to spur capital flight. Nonetheless, possibly helpful to contemplate what occurred the final time Mr. Trump began a commerce warfare with China.

Determine 1: CNY/USD, in logs 2018M04=0. Supply: Federal Reserve.

The CNY depreciated over 12% towards the US greenback.

Addendum:

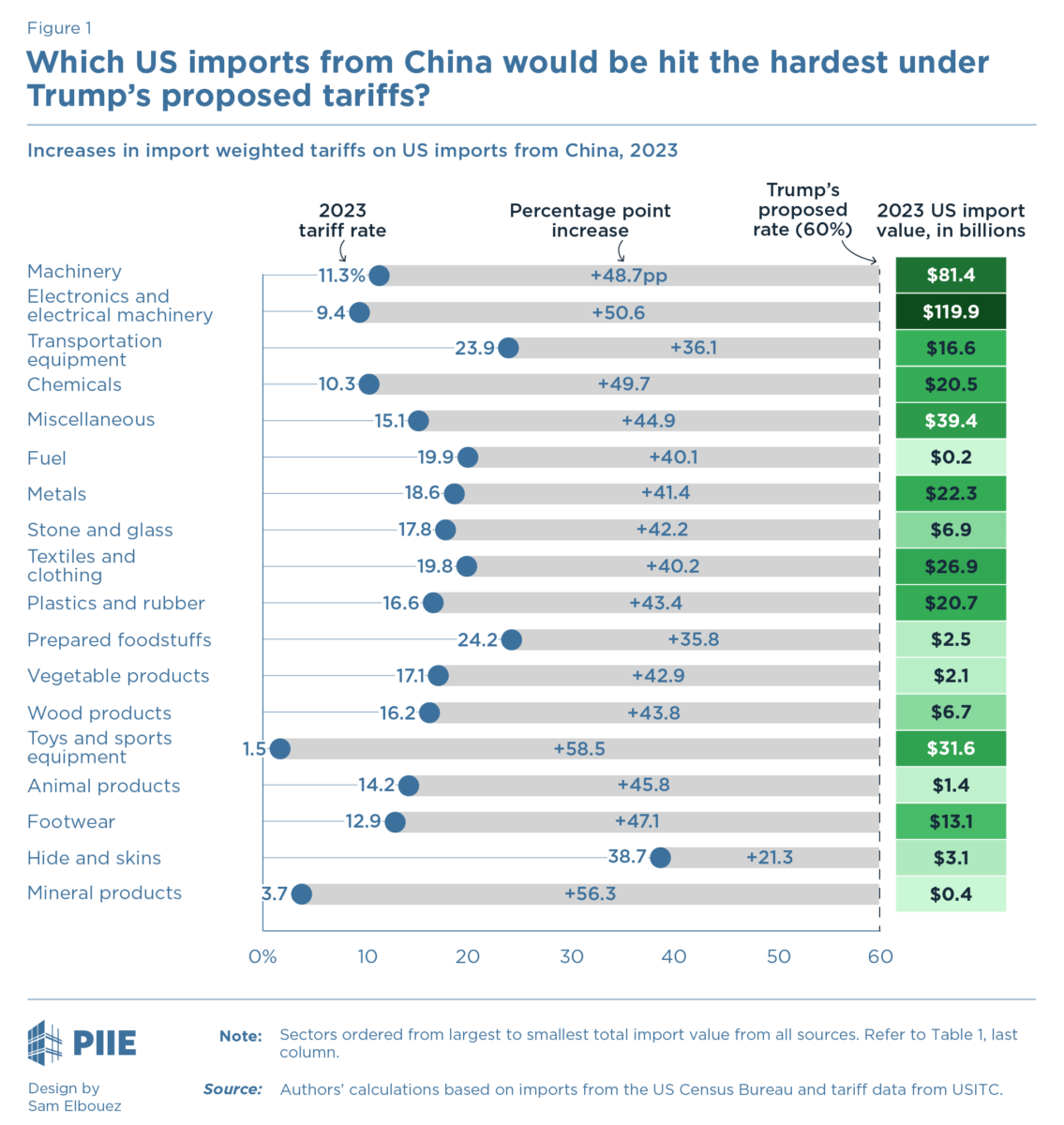

Contreras, Beautiful and Yan present a extra detailed evaluation of hits below 60% tariffs.