There was a loud minority of analysts considering we have been in, or imminently in, recession (see a listing right here). It’ll be fascinating to see how these views are revised. Nevertheless, as I famous, whereas the info was not supportive of being in a recession as of October, three potentialities might reconcile observations with such views: (1) the mannequin is flawed, (2) the recession is right here, however we don’t realize it, or (3) the recession continues to be to return.

As an example, right here’s the probit mannequin predictions from a typical time period unfold plus brief price 12-month forward mannequin, estimated each 1986M01-2023M10 (so assumes no recession occurred as of October 2024) and 1986M01-2018M12 (the latter means it omits the 2020 pandemic recession).

Determine 1: Estimated chance of recession 12 months forward utilizing 10yr-3mo time period unfold and 3mo price, estimated over complete 1986-2023M10 pattern (blue), over restricted 1986-2018 pattern (tan). NBER peak-to-trough recession dates shaded grey. Supply: NBER and creator’s calculations.

Going by these estimated recession possibilities, the chance of being in a recession in January 2025 is 79% utilizing the complete pattern. Utilizing a pre-pandemic pattern, it’s 50%. Nevertheless, as famous in Chinn and Ferrara (2024), this easy specification is dominated when it comes to pseuo-R2 and AUROCs by specs together with overseas time period spreads and debt-service ratios. Augmenting the time period unfold & brief price specification with debt service ratio (and utilizing real-time debt-service ratios) yields the next graph.

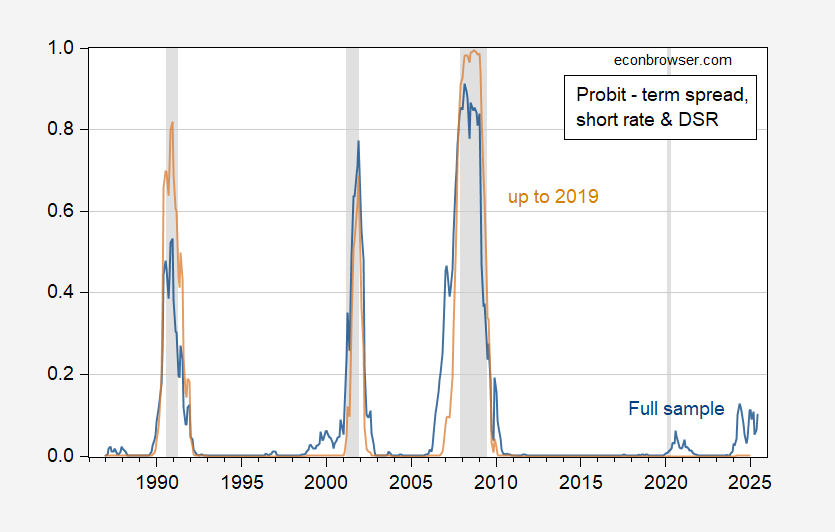

Determine 2: Estimated chance of recession 12 months forward utilizing 10yr-3mo time period unfold, 3mo price, and debt-service ratio, estimated over complete 1986-2023M10 pattern (blue), over restricted 1986-2018 pattern utilizing related classic of debt-service ratio (tan). NBER peak-to-trough recession dates shaded grey. Supply: NBER and creator’s calculations.

The pseudo-R2 for the time period unfold plus brief price is 0.21, whereas that for the debt-service augmented specification is 0.56 (full pattern estimates).

The pre-pandemic estimates point out zero chance of recession as much as December 2024, whereas a full pattern estimate yields 11% chance in January 2025. Including in a overseas time period unfold (a la Ahmed and Chinn (2024)) pushes up that chance to 23%.

If the proper mannequin is the DSR-augmented specification, then a recession within the subsequent 12 months shouldn’t be foreseen by the markets. However, if one thing surprising happens between now and 12 months from now (e.g., pandemic, warfare), then the result is likely to be very completely different from the market’s expectation.

Addendum: 5pm CT

Or…one might see what the betting markets are saying about two consecutive quarters of adverse GDP progress in 2025 (presumably utilizing advance launch for the 2nd consecutive quarter…)

Supply: Kalshi, 9 Nov 24, 5pm CT.

Polymarket makes use of the NBER BCDC name as a payout criterion.