Hiro Ito and Robert McCauley have compiled a dataset(first mentioned on this 2019 working paper) of the forex composition of worldwide reserves over the 1999-2021 interval. This dataset was utilized in Ito and McCauley (2020), Chinn, Ito and McCauley (2022), and Chinn, Ito and Frankel (2024).

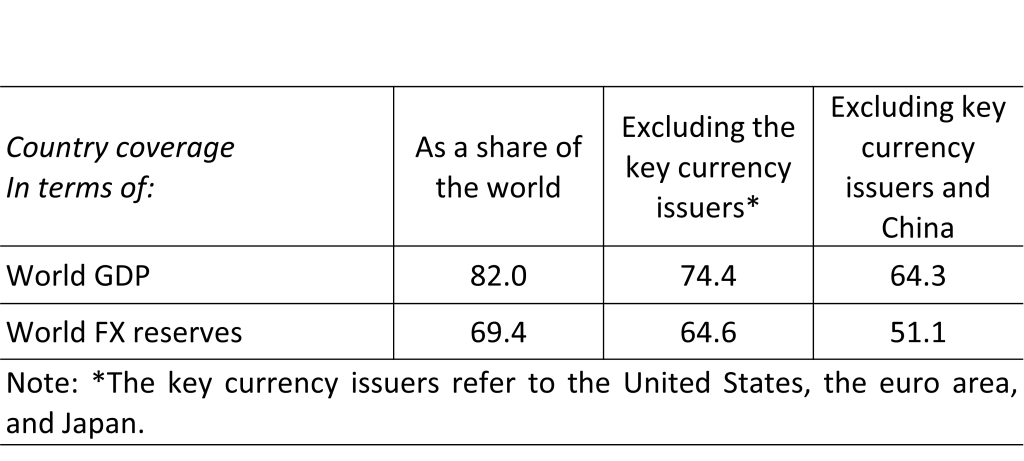

The IMF’s COFER solely presents combination forex shares. Different datasets of particular person central financial institution reserves are much less complete, and/or report gross reasonably than internet values (Iancu, et al. 2020).

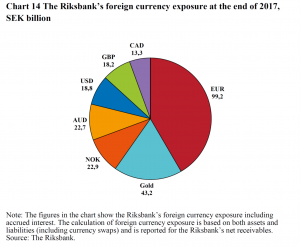

For a person central financial institution, the variations could be placing. Determine 13 for Sweden’s Riksbank is predicated on Iancu et al. (2020) knowledge, Determine 14 is predicated on Ito and McCauley (2022) knowledge.

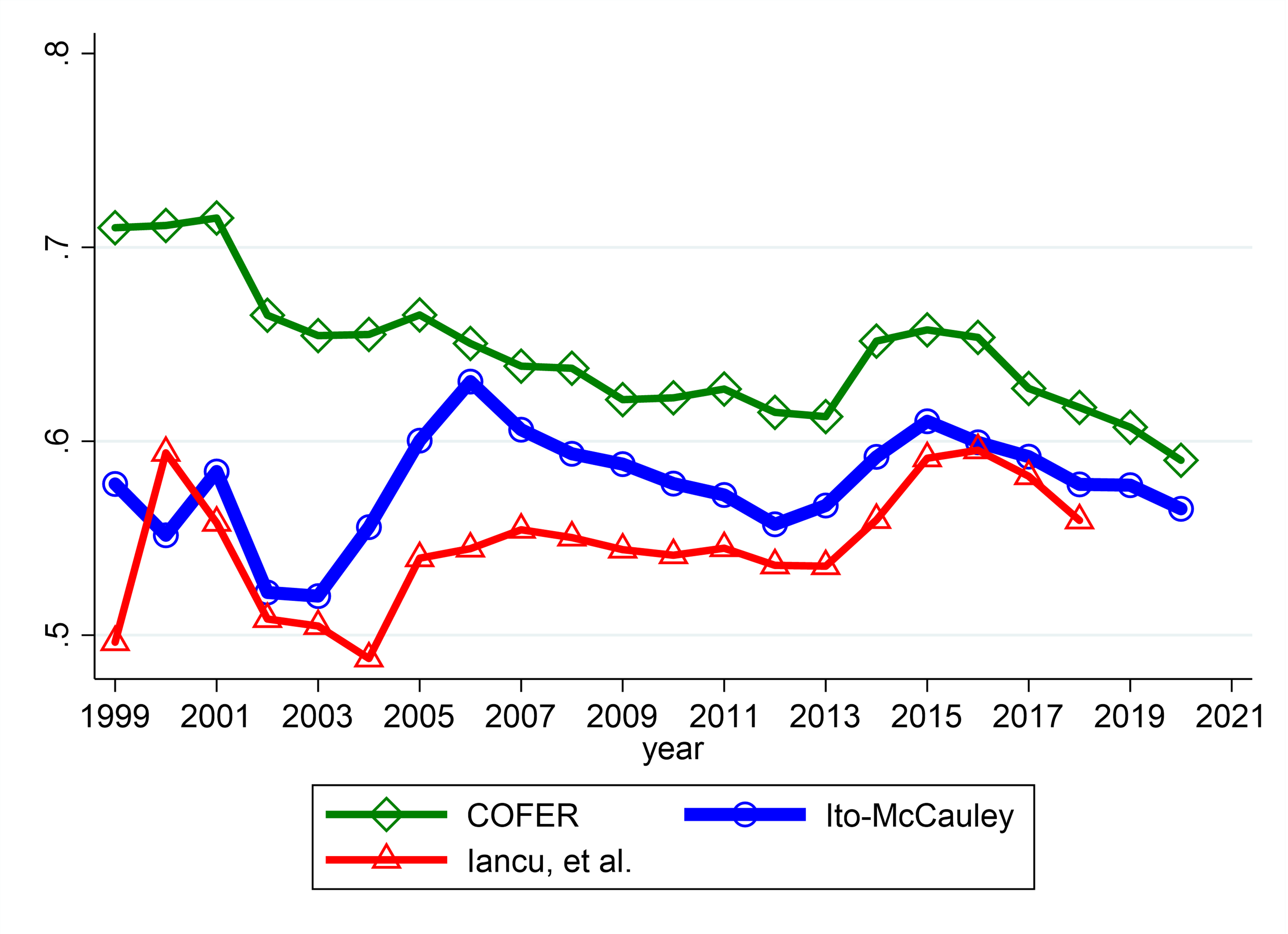

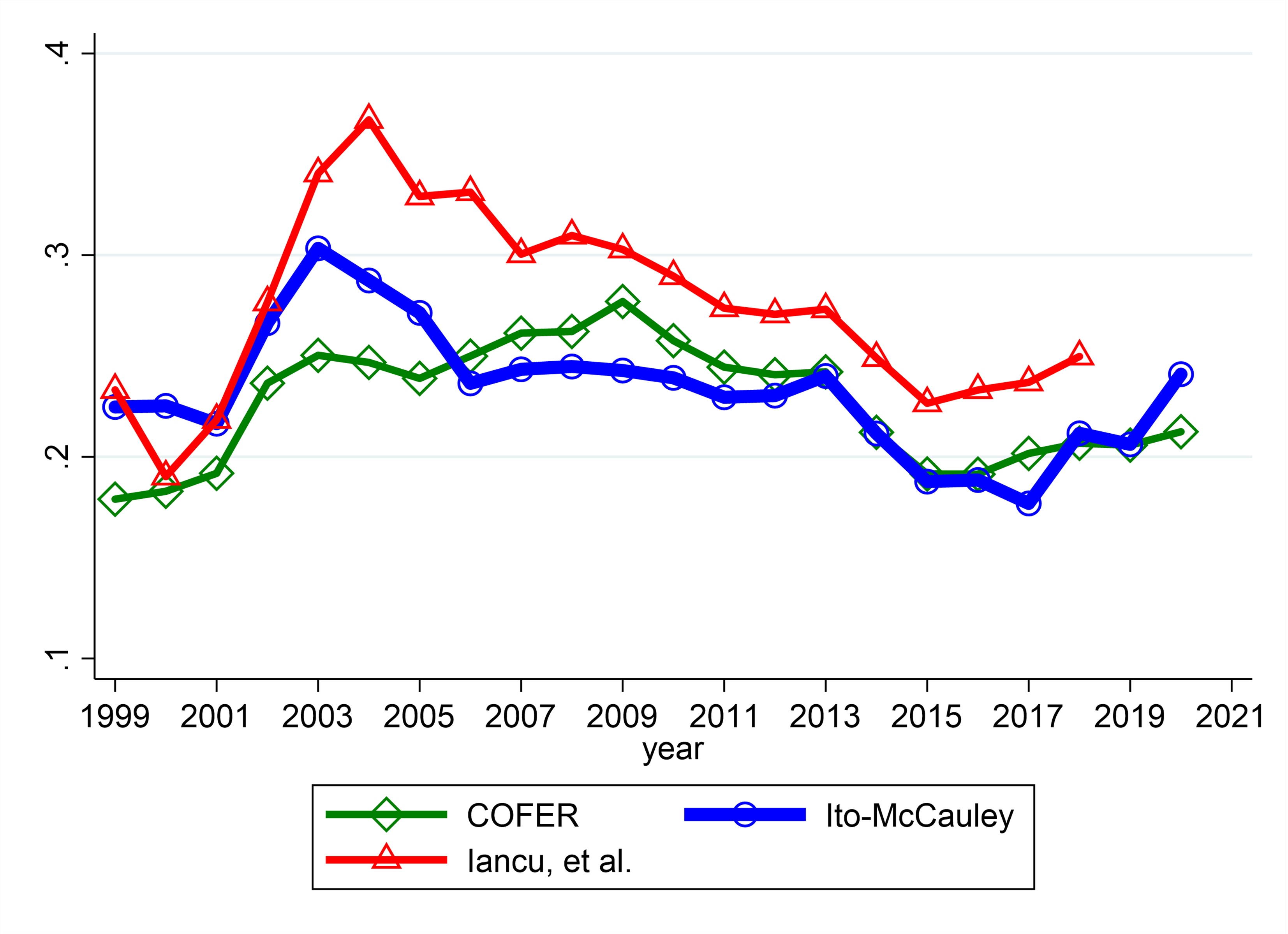

Within the combination, there are variations between the related knowledge units. The primary determine is for USD shares, the second is for EUR shares.

Determine 1: USD shares of worldwide reserves from IMF COFER (inexperienced), Iancu et al. (purple), and Ito and McCauley (blue).

Determine 2: EUR shares of worldwide reserves from IMF COFER (inexperienced), Iancu et al. (purple), and Ito and McCauley (blue).

The variations are attributable to protection (COFER covers in precept all reporting IMF members, whereas Iancu et al. and Ito-McCauley cowl totally different units of nations), and therapy of reserves.

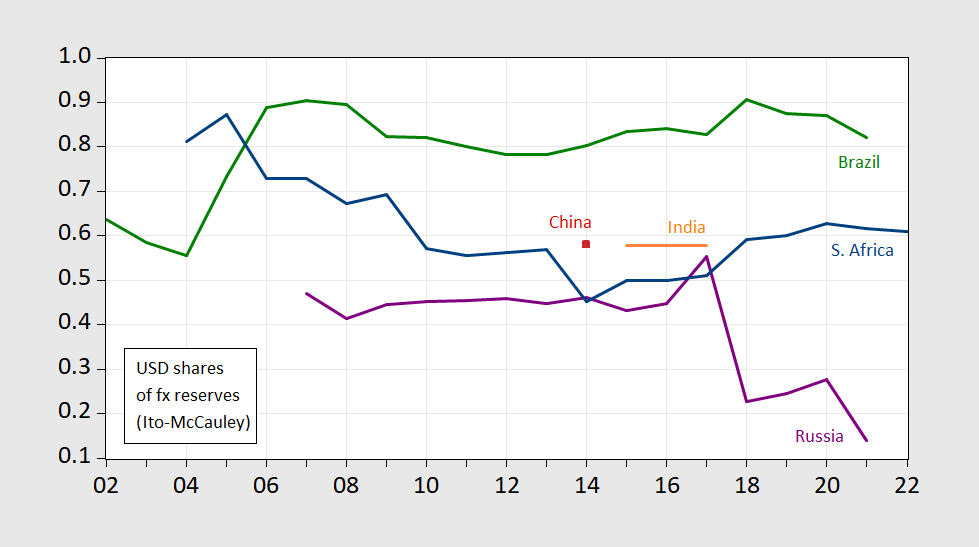

Now we have used this knowledge set to analyze whether or not de-dollarization is happening within the BRICS.

Determine 3: Share of international change holdings in USD, by central financial institution. Supply: Ito-McCauley database,.

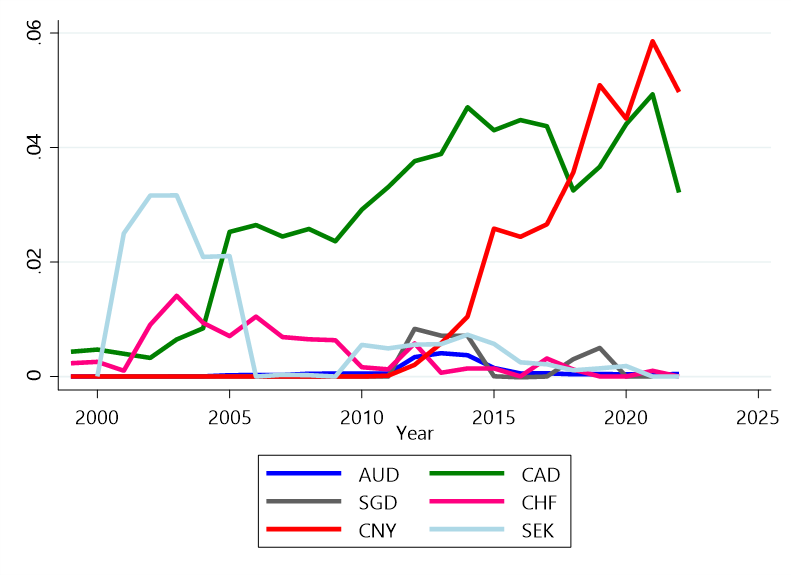

Hiro Ito has additionally executed an early examine on nontraditional reserves via 2022:

Determine 4: Geometric common of reserve holdings (expressed in USD) for reporting central banks. Very incomplete knowledge for 2022. Supply: Ito calculations on unpublished model of Ito-McCauley dataset.

The info set web site is right here (obtainable in both Excel or Stata codecs). Sadly, the protection on this publicly obtainable knowledge set is smaller (63 nations) than that utilized in Chinn-Ito-McCauley (73 nations) or Chinn-Ito-Frankel (2024), because of confidentiality restrictions imposed by a number of Latin American central banks.

Just lately, Laser, Milhailov and Weidner (2024) have circulated a database on particular person central financial institution holdings for eight currencies. I think protection for the reserve currencies comparable to CAD, AUD and CNY goes to be pretty spotty (and spotty for all currencies in 2022 and significantly 2023), given what info we’ve within the Ito-McCauley dataset.