A reader sends me a missive with this line, and (amongst others) an image of producing employment. I reproduce (on an annual foundation) this sequence again to 1960 within the determine beneath.

Employment in manufacturing did take a plunge in 2001. I didn’t comprehend it was going to take fairly the plunge it did, however I did see employment declining (then serving on CEA).

Determine 1: Manufacturing employment, manufacturing & nonsupervisory, 000’s (blue, left log scale), and manufacturing worth added in bn.Ch.2017$ (black, proper log scale). Supply: BLS, BEA.

Worth added rises. Why? Specialization in excessive worth added elements of worth chains (cf worldwide textbooks) as predicted by comparative benefit in duties.

Mechanically, how can these developments in employment and worth added do what they do? Effectively, it’s because of one thing known as “productivity”. The identical motive why employment in agricultural manufacturing (not processing, however farming and many others.) is down but worth added output is up.

Simply sayin’.

The reader additionally feedback:

Simply coincidentally and under no circumstances associated to any of this, China’s economic system and rise as a navy energy soared in regards to the flip of the century… or so we’re alleged to consider.

The drop in manufacturing employment is not, for my part, unrelated to the entry of China into the world buying and selling system. Comparative benefit would counsel reallocation ought to happen (good points from commerce happen due to adjustments in consumption and manufacturing, in any case). And there’s little doubt China has developed as a financial energy and strategic competitor. On the second level, I wouldn’t be writing all these posts on PRC actions round Taiwan.

However good to maintain issues in thoughts. First, the US stays the world’s largest economic system evaluated at market trade charges.

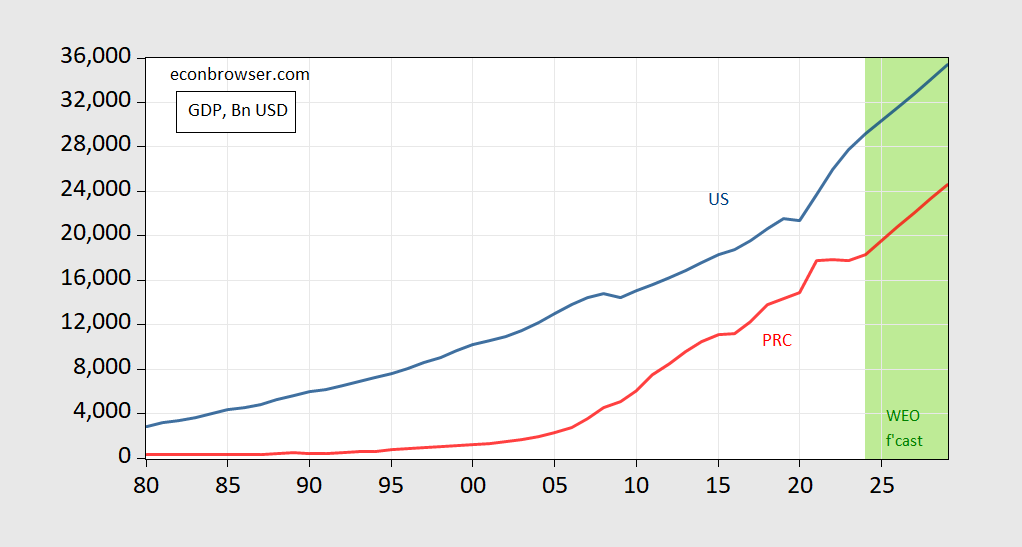

Determine 2: US GDP (blue), China (pink), in bn. US$. Supply: IMF WEO (October).

There is no such thing as a longer a projected crossover, as had been projected in earlier years.

Whereas PPP {dollars} can be extra helpful for evaluating requirements of dwelling, market charges are extra for contemplating financial energy on the earth economic system, and skill to venture affect. What about per capita in PPP Worldwide $?

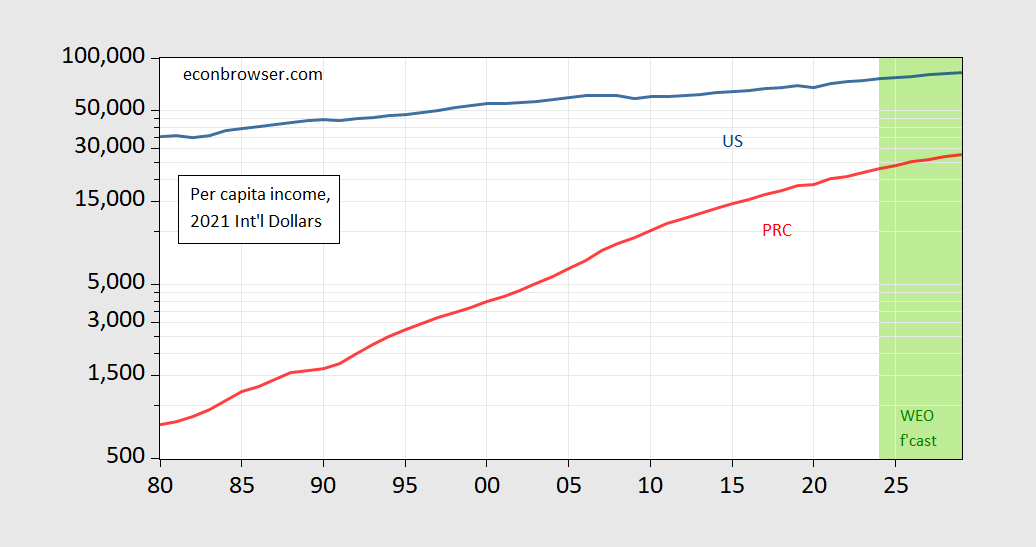

Determine 3: US GDP per capita (blue), China per capita (pink), in bn. PPP 2021 Worldwide$ . Supply: IMF WEO (October).

Arduous to see fast convergence in PPP per capita.

This doesn’t imply China doesn’t have actual world financial affect. I’d simply say we wish to maintain issues in perspective.