Following up on the examination of what the time period unfold predicts, right here’s the slope coefficients for the time period unfold, in regressions augmented with brief charge, from 1946-2023Q3 (GDP development 1947-2024Q3).

Determine 1: Regression coefficient of GDP development lead 4 quarters on 10yr-3mo unfold for subsamples. + (***) signifies significance at 11% (1%) msl, utilizing Newey-West normal errors. Supply: Creator’s calculations.

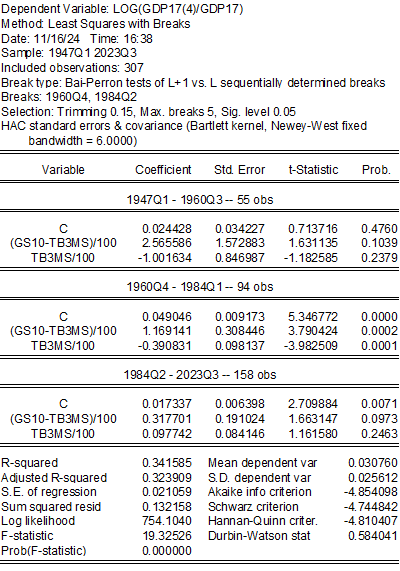

The general least-squares break regression outcome (Bai-Perron) is:

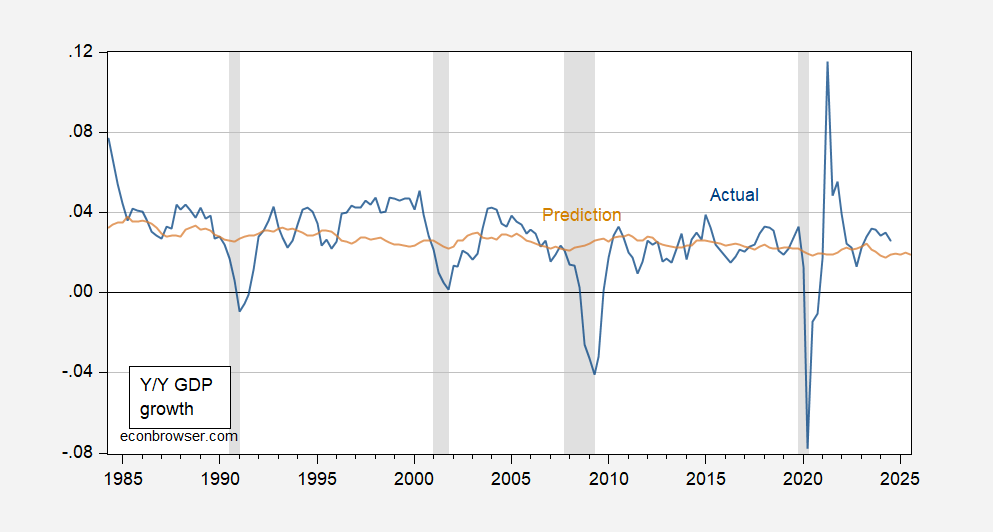

If one runs a easy OLS regression on the final subsample (1984Q2-2023Q3), the adjusted-R2 is barely 0.04. The prediction appears to be like like the next:

Determine 2: 12 months-on-12 months GDP development charge (blue) and predicted (tan). NBER outlined peak-to-trough recession dates shaded grey.

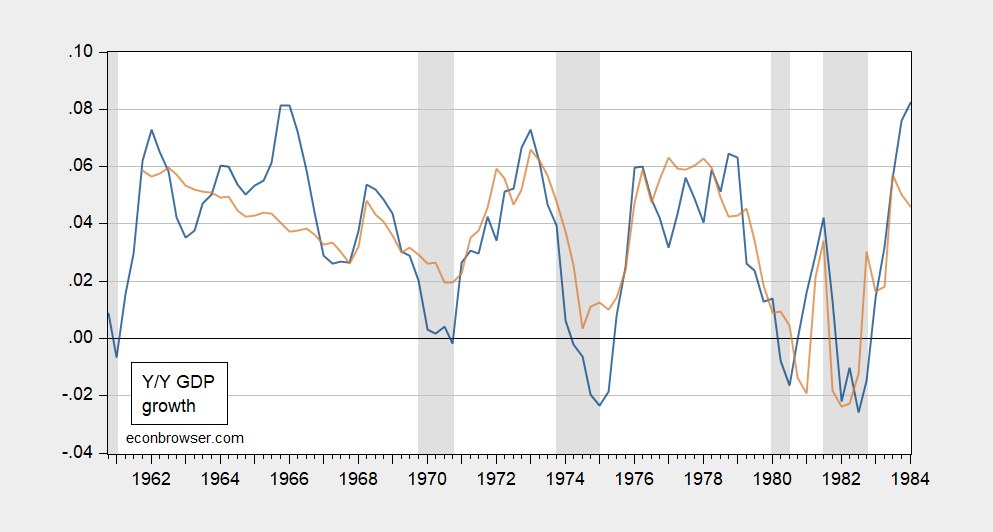

Clearly, the time period unfold Examine with the center interval recognized by the Bai-Perron technique:

Determine 3: 12 months-on-12 months GDP development charge (blue) and predicted (tan). NBER outlined peak-to-trough recession dates shaded grey.

These outcomes counsel that the time period unfold just isn’t presently a fantastic predictor of development (though it might grow to be so once more sooner or later).