COFER information via December 2023:

Determine 1: International alternate reserves in JPY as share of tota reserves (blue), AUD (gentle blue), CAD (inexperienced), CNY (crimson). Supply: IMF COFER, entry 6/18/2024, and creator’s calculations.

Peak CNY was 2022Q1 at 2.6%, whereas newest is at 2.1%.

When it comes to day by day international alternate turnover, CNY was rising via April of 2022.

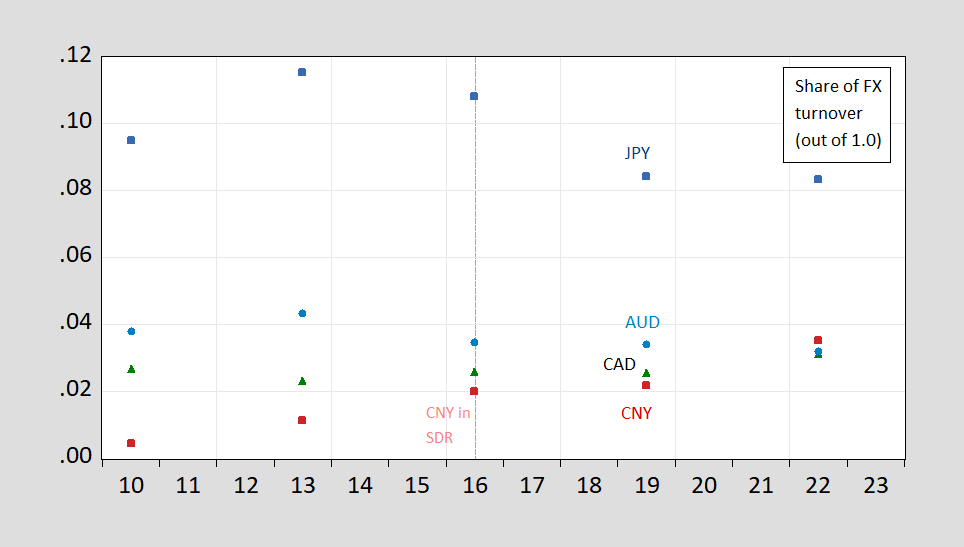

FIgure 2: International alternate turnover share in April in CAN (blue sq.), in AUD (gentle blue circle), in CAD (inexperienced triangle), in CNY (crimson sq.), out of 1.00. Supply: BIS Triennial Survey, 2022.

What’s occurred to turnover since 2022 is an attention-grabbing query, notably in gentle of the burgeoning commerce between Russia and China, and therefore invoicing/settlement in CNY. Right here’s CSIS’s estimate of invoicing in RMB from 2011 to 2023Q1.

Supply: DiPippo and Palazzi (2024).

This final graph signifies how the CNY can achieve in use as worldwide forex, pushed by commerce which China dominates in, whereas shedding favor as a reserve forex, or a automobile forex. Nonetheless, the hole between what occurs within the monetary sphere, vs. the commerce sphere, reinforces for me the proposition that so long as buyers stay suspicious of Chinese language authorities intents with respect to political threat (together with tighter capital controls), one shouldn’t anticipate additional giant beneficial properties in use of the CNY as a reserve forex.