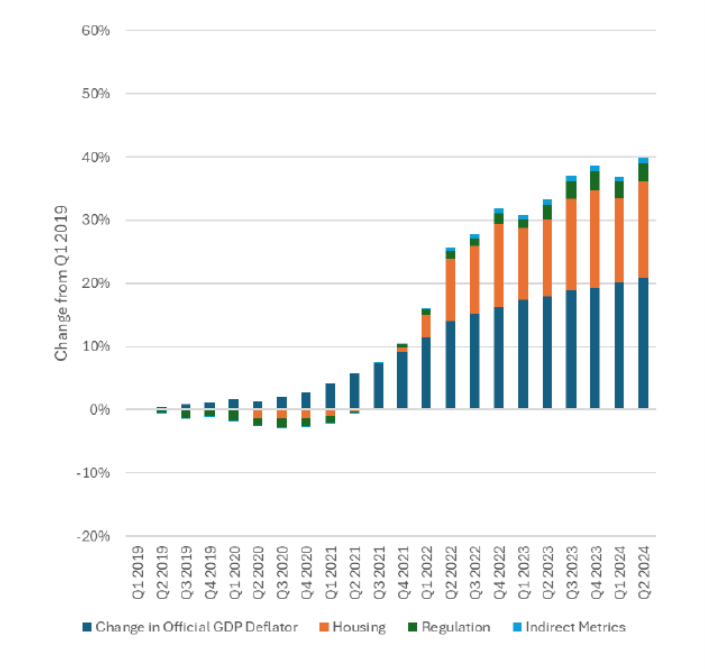

In a current paper, Antoni and St. Onge (2024) have argued that the height in GDP, correctly measured, was in 2021Q4.

Supply: Antoni and St. Onge (2024).

Discover that actual GDP is drastically under that reported within the annual replace a pair weeks in the past. This implies the deflator they use a lot be a lot larger than the official. Certainly, the cumulative deviation of the Antoni-St. Onge deflator from the reported is 20 share factors since 2019Q1.

Supply: Antoni and St. Onge (2024).

A lot of the deviation is accounted for by a special remedy of housing prices. On pages 1-3 of the paper, the authors clarify the issues with the CPI – housing, regulation, oblique prices (e.g., insurance coverage and many others.). Concerning housing prices (pages 1-2):

If the prices to hire and personal change commensurately over time, then this system might be comparatively correct. Sadly, the price of proudly owning a house has risen a lot sooner than rents over the past 4 years and the CPI has grossly underestimated housing value inflation.

One pages 4-5, the authors describe the development of other indices:

Changes to Inflation Indices

To supply an alternate inflation metric that extra precisely displays the rise in the price of residing, a number of alterations have to be made to the standard worth indices used within the nationwide accounts. These modifications will be broadly categorized into three teams: housing, regulatory burdens, and not directly measured costs.

The housing element has had the most important impression by way of adjusting for the true value of residing; within the second quarter of 2024, it elevated the cumulative change within the GDP deflator by roughly 75 p.c. This was because of the mixture of not solely larger dwelling costs but in addition larger rates of interest. That’s, a mortgage fee is manufactured from the quantity borrowed and the rate of interest, and if each home costs and rates of interest are rising then the price of dwelling possession rises on each fronts.

Conversely, utilizing this correct technique the comparatively low rates of interest in 2019, 2020, and early 2021 even have a adverse impression on the GDP deflator. That’s to say, the adjustment diminished inflation throughout these years.

Likewise, Trump-era deregulation led to marginal decreases in the price of residing which weren’t captured by official inflation metrics in 2019 and 2020, a pattern which had totally reversed by the fourth quarter of 2022 underneath Biden-Harris.

Substituting oblique metrics for modified direct ones has a restricted impression on the GDP deflator in the course of the years in query. That is partly because of the inherent difficulties in measuring client expenditures like medical insurance with out double-counting (or double-weighting) different purchases, like medical care or medical care commodities. 5

The cumulative change in actual GDP from 2019Q1 is -2.5%, in keeping with their estimates. Now, whereas the authors describe their different deflator estimates, they achieve this so vaguely that it’s unattainable to breed their calculations. I can’t reproduce the oblique prices (which I don’t suppose must be notably related for the PCE deflator), nor the regulatory prices (if BLS continues to be accounting for regulatory prices the identical method it did once I was a analysis assistant, then the seat belt requirement yielded no utility insofar as Antoni-St Onge is worried). So I think about replicating the housing impact.

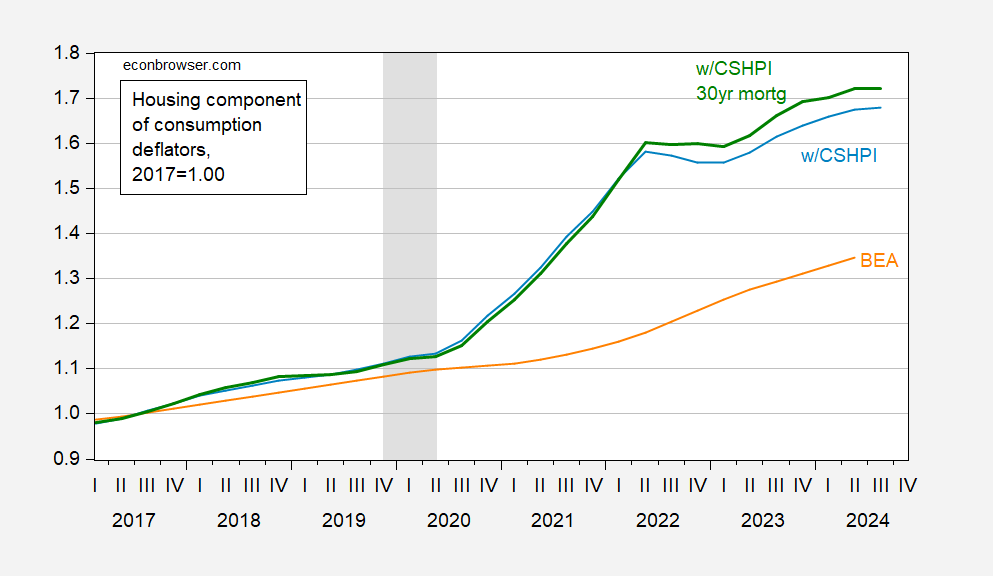

I rebase the Case-Shiller nationwide housing worth index (nationwide sequence; the 20 metropolis model could be barely larger) to 2017 = 1. I multiply this by the mortgage charge issue (1+i). In Determine 1, I current the BEA consumption housing deflator, the Case-Shiller housing worth index, and the index adjusted by the 30 12 months mortgage charge.

Determine 1: BEA shelter element of the PCE (orange), Case-Shiller Home Value Index – nationwide (gentle blue), home worth occasions mortgage charge issue index (daring inexperienced), all 2017=1.00. NBER outlined peak-to-trough recession dates shaded grey. Supply: BEA, S&P Dow Jones, Fannie Mae through FRED, NBER, and creator’s calculations.

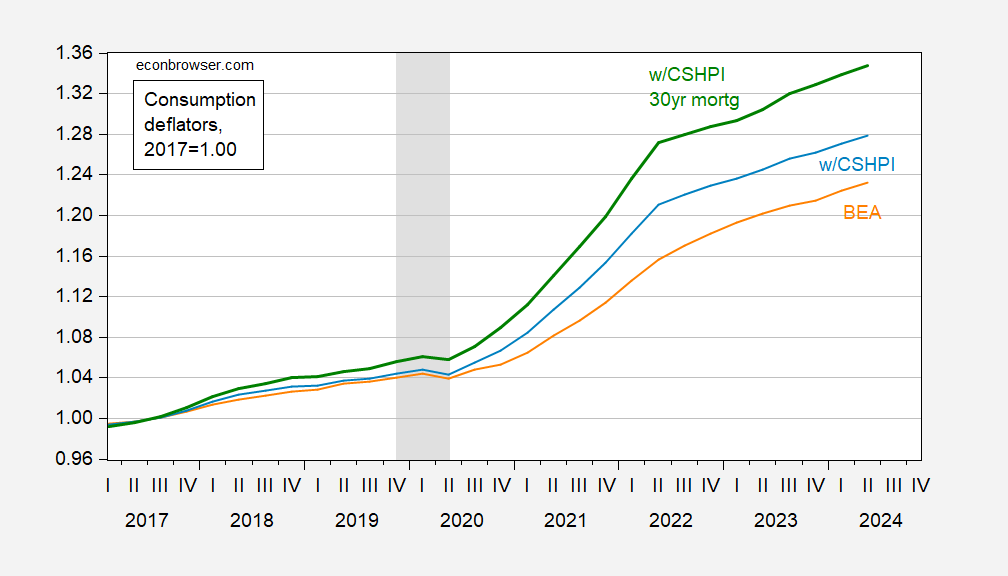

Within the PCE deflator, shelter accounts for about 15% of the full weight (lower than the 26% within the CPI), and calculate the general alternate consumption deflator as:

Palt_PCE = [(PCSHPI×(1+imort30y)]0.15×(Prest-of-PCE)0.85

Determine 2: BEA PCE deflator (orange), Case-Shiller Home Value Index – nationwide (gentle blue), home worth occasions mortgage charge issue index (daring inexperienced), all 2017=1.00. NBER outlined peak-to-trough recession dates shaded grey. Supply: BEA, S&P Dow Jones, Fannie Mae through FRED, NBER, and creator’s calculations.

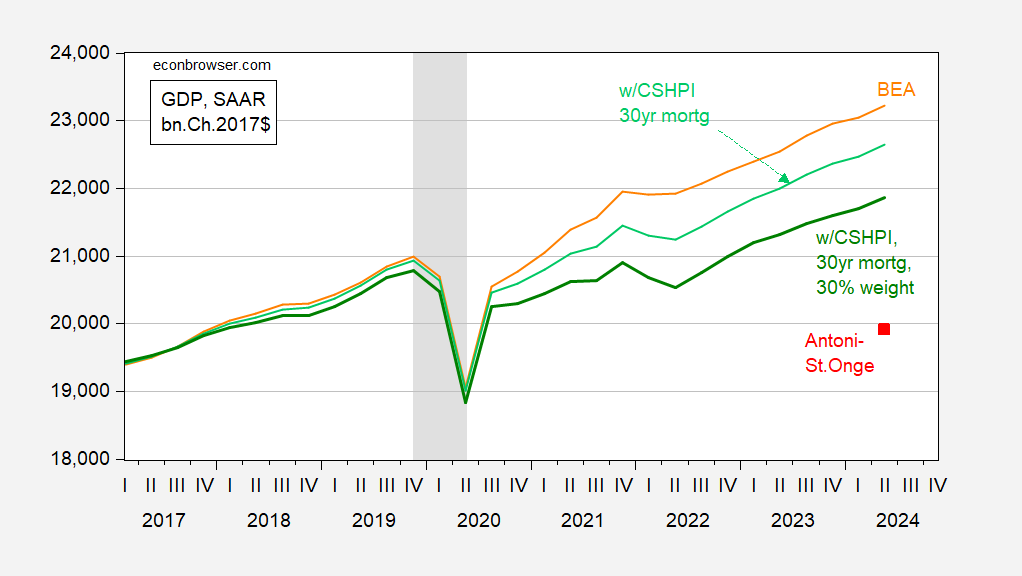

How does this impression GDP? Making use of this different consumption deflator to consumption solely, after which including different consumption to actual GDP ex-consumption, yields the sunshine inexperienced line under.

Determine 3: BEA GDP (orange), GDP incorporating PCE utilizing Case-Shiller Home Value Index – nationwide occasions mortgage charge issue index, utilizing BEA weight of 15% (gentle inexperienced), utilizing 30% (darkish inexperienced), Antoni-St.Onge estimate (pink sq.), all in bn.Ch.2017$ SAAR. NBER outlined peak-to-trough recession dates shaded grey. Supply: BEA, S&P Dow Jones, Fannie Mae through FRED, NBER, and creator’s calculations.

Notice that the sequence I acquire isn’t near the Antoni-St.Onge sequence (2024Q2 worth at pink sq.). For the reason that authors don’t clarify the development of their different PCE deflator, however do clarify the CPI development, I strive utilizing the 30% weight related to the CPI (as a substitute of the 15% within the PCE). This yields the darkish inexperienced line — which continues to be far above the Antoni-St.Onge esitmate.

In sum, I can not replicate the Antoni-St.Onge results of recession since 2022. Till the authors present an spreadsheet of calculations, we’ll should conclude that the authors are utilizing statistical “mystery meat”, have invoked a Stockman-ian magic asterisk, or laid on some statistical “special sauce”.

The info used on this publish is accessible right here in an Excel spreadsheet.