by Calculated Threat on 4/29/2024 03:02:00 PM

The BEA launched the underlying particulars for the Q1 advance GDP report on Friday.

The BEA reported that funding in non-residential buildings decreased at a 0.1% annual tempo in Q1.

Click on on graph for bigger picture.

The first graph reveals funding in places of work, malls and lodging as a % of GDP.

Funding in places of work (blue) elevated barely in Q1 and was up 4.1% year-over-year. And declined barely as a % of GDP.

Funding in multimerchandise buying buildings (malls) peaked in 2007 and was down about 1% year-over-year in Q1. The emptiness fee for malls remains to be very excessive, so funding will in all probability keep low for a while.

Lodging funding decreased in Q1 in comparison with This fall, and lodging funding was up 1% year-over-year.

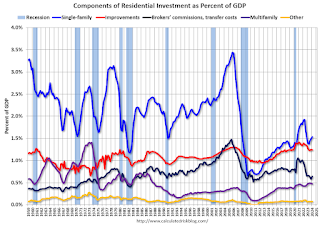

The second graph is for Residential funding elements as a % of GDP. In accordance with the Bureau of Financial Evaluation, RI contains new single-family buildings, multifamily buildings, house enchancment, Brokers’ commissions and different possession switch prices, and some minor classes (dormitories, manufactured properties).

Funding in single household buildings was as much as $433 billion (SAAR) (about 1.5% of GDP) and was up 16% year-over-year.

Funding in multi-family buildings was down in Q1 in comparison with This fall to $133 billion (SAAR), however nonetheless up 12% YoY.

Funding in house enchancment was at a $351 billion (SAAR) in Q1 (about 1.2% of GDP). Dwelling enchancment spending was robust throughout the pandemic however has declined as a % of GDP just lately.

Notice that Brokers’ commissions (black) elevated sharply as current house gross sales elevated within the second half of 2020 however declined when mortgage charges elevated. Brokers’ commissions had been up 3% year-over-year in Q1.