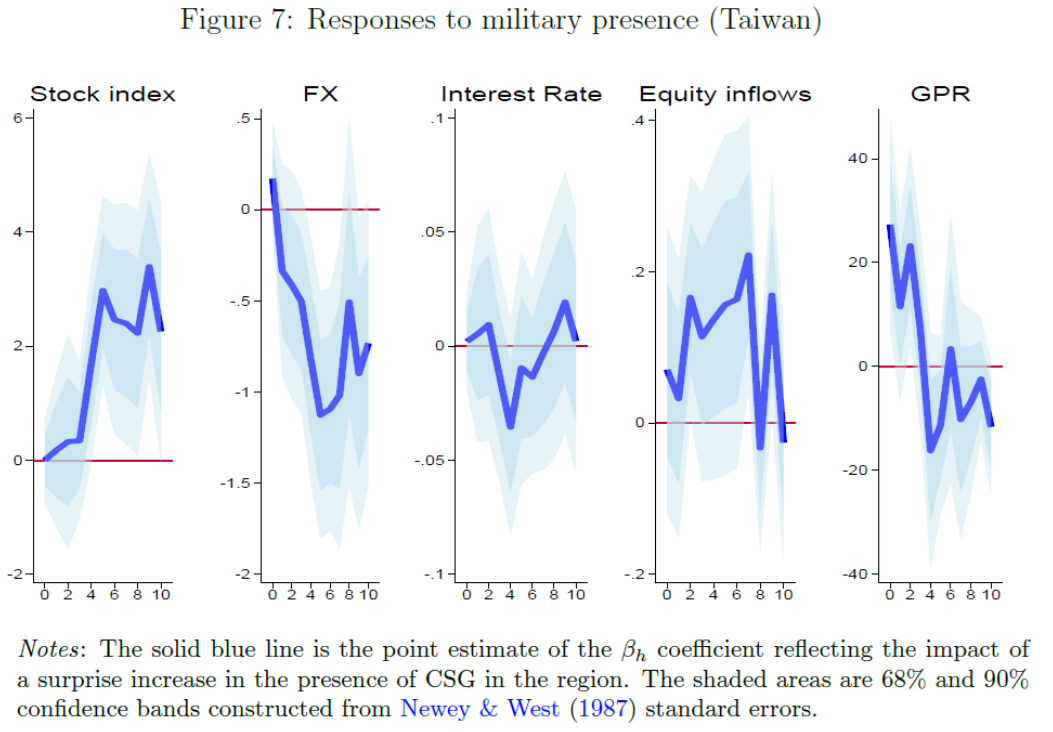

Asia, specifically East Asia and the South China Sea, is among the areas which can be notably uncovered to geopolitical danger. We examine the impression of an elevated presence of the U.S. navy in Asia on asset costs and capital inflows within the area. For that function, we assemble a novel index from native newspapers reporting on the presence of U.S. Provider Strike Teams within the area and estimate the market impression of a shock change on this index. Our findings reveal {that a} increased navy presence causes a rise in inventory costs, an appreciation of the native foreign money, and an influx of international capital, but in addition the next stage of geopolitical danger. Curiously, through the first Trump administration, some results change the signal. We additionally distinguish between newspapers reporting on the deployments of U.S. plane carriers associated to tensions with North Korea and people associated to tensions with China.

Listed below are the impulse response capabilities for variables related to Korea and Taiwan.

Notice that FX is outlined so down is an appreciation of the native foreign money. CSG = “carrier strike group”.

Therefore, the inventory market, foreign money and fairness inflows reply considerably to sudden appearances of CSGs. In distinction, no such impact is discovered for China.

As an apart, listed here are CSG and ARG deployments as of 6 January 2025:

Supply: USNI, accessed 1/11/2025.

DoD’s annual report on Navy and Safety Developments involving the PRC is right here.