This Thursday 4:30 CT at UW:

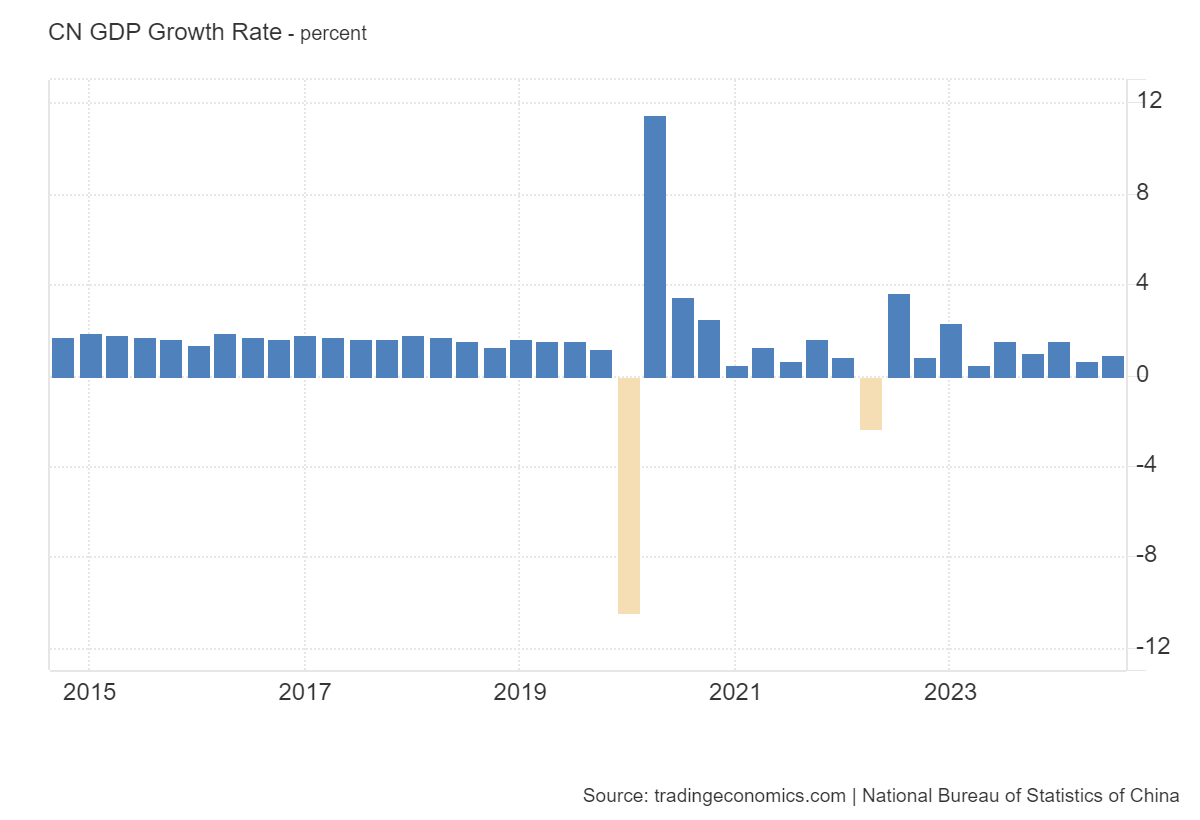

China GDP development via Q3:

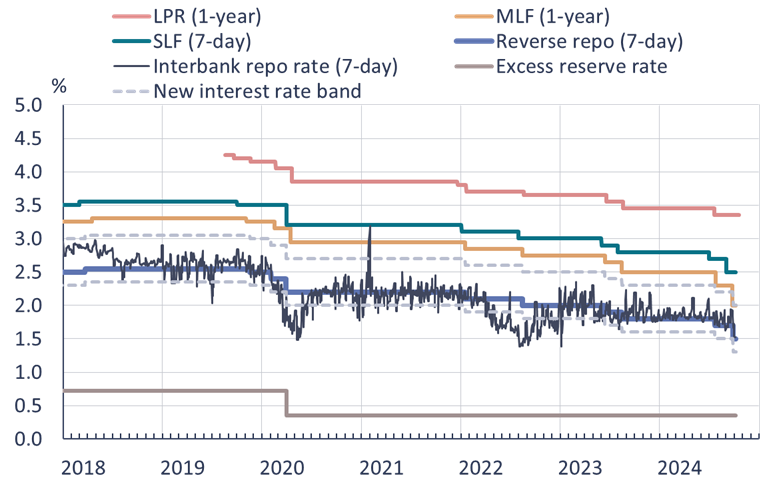

BOFIT evaluations the latest stimulus measures:

My impression is that the failure of the CCP to roll out better fiscal stimulus implies that one shouldn’t count on a giant cyclical rebound (and definitely not one of the measures introduced and even contemplated the components affecting the secular development, together with more and more statist insurance policies in pursuit of different targets). To wit, from Natixis as we speak:

• Two main developments have adopted the Third Plenum in July. First, a collection of financial knowledge releases indicated that the plenum had completed nothing to enhance the nation’s short-term outlook. Second, a collection of stimulus measures have been introduced over a two-week interval, which have to this point didn’t reinvigorate the financial system.

• The federal government is unlikely to enact the reforms essential to help consumption resulting from excessive public debt and restricted fiscal capability, as doing so would require chopping subsidies central to the nation’s industrial coverage. This is able to contradict Xi Jinping’s concentrate on innovation.

• The Individuals’s Financial institution of China might must proceed interventions in each the sovereign bond market and the inventory market, although this might scale back international investor curiosity in Chinese language monetary markets.

• The federal government’s stimulus measures to this point have largely been aimed toward stabilizing asset costs moderately than addressing the deeper problems with demand and overcapacity.

I don’t assume Lardy essentially agrees with this viewpoint (nor the lagging consumption story typically), which is why it’s a good suggestion to hear!