by Calculated Threat on 5/28/2024 09:00:00 AM

S&P/Case-Shiller launched the month-to-month Dwelling Value Indices for March (“March” is a 3-month common of January, February and March closing costs).

This launch consists of costs for 20 particular person cities, two composite indices (for 10 cities and 20 cities) and the month-to-month Nationwide index.

From S&P S&P CoreLogic Case-Shiller Index Hits New All-Time Excessive in March 2024

The S&P CoreLogic Case-Shiller U.S. Nationwide Dwelling Value NSA Index, overlaying all 9 U.S. census

divisions, reported a 6.5% annual acquire for March, the identical improve because the earlier month. The ten-

Metropolis Composite noticed a rise of 8.2%, up from a 8.1% improve within the earlier month. The 20-Metropolis

Composite posted a slight year-over-year improve to 7.4%, up from a 7.3% improve within the earlier

month. San Diego continued to report the very best year-over-year acquire among the many 20 cities this month

with an 11.1% improve in March, adopted by New York and Cleveland, with will increase of 9.2% and

8.8%, respectively. Portland, which nonetheless holds the bottom rank after reporting three consecutive months

of the smallest year-over-year progress, posted the identical 2.2% annual improve in March because the earlier

month.

…

The U.S. Nationwide Index, the 20-Metropolis Composite, and the 10-Metropolis Composite all continued their upward

pattern from final month, displaying pre-seasonality adjustment will increase of 1.3%, 1.6% and 1.6%,

respectively.After seasonal adjustment, the U.S. Nationwide Index posted a month-over-month improve of 0. 3%, whereas

the 20-Metropolis and the 10-Metropolis Composite each reported month-over-month will increase of 0.3% and 0.5%,

respectively.“This month’s report boasts another all-time high,” says Brian D. Luke, Head of Commodities, Actual &

Digital Property at S&P Dow Jones Indices. “We’ve witnessed data repeatedly break in each inventory and

housing markets over the previous yr. Our Nationwide Index has reached new highs in six of the final 12

months. Throughout that point, we’ve seen report inventory market efficiency, with the S&P 500 hitting contemporary

all-time highs for 35 buying and selling days prior to now yr.“San Diego stands out with a formidable 11.1% annual acquire, adopted carefully by New York, Cleveland,

and Los Angeles, indicating a powerful demand for city markets.”

emphasis added

Click on graph for larger image.

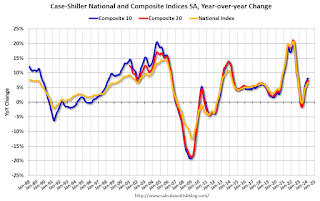

The first graph shows the nominal seasonally adjusted Composite 10, Composite 20 and National indices (the Composite 20 was started in January 2000).

The Composite 10 index was up 0.5% in March (SA). The Composite 20 index was up 0.3% (SA) in March.

The National index was up 0.3% (SA) in March.

The Composite 10 SA was up 8.2% year-over-year. The Composite 20 SA was up 7.4% year-over-year.

The Nationwide index SA was up 6.5% year-over-year.

Annual worth modifications have been near expectations. I will have extra later.