by Calculated Threat on 1/08/2025 07:00:00 AM

From the MBA: Mortgage Purposes Lower in Newest MBA Weekly Survey

Mortgage purposes decreased 3.7 p.c from one

week earlier, based on knowledge from the Mortgage Bankers Affiliation’s (MBA) Weekly Mortgage

Purposes Survey for the week ending January 3, 2025. This week’s outcomes embrace an adjustment for

the New 12 months’s vacation.The Market Composite Index, a measure of mortgage mortgage utility quantity, decreased 3.7 p.c on

a seasonally adjusted foundation from one week earlier. On an unadjusted foundation, the Index elevated 47

p.c in contrast with the earlier week. The Refinance Index elevated 2 p.c from the earlier

week and was 6 p.c decrease than the identical week one yr in the past. The seasonally adjusted Buy

Index decreased 7 p.c from one week earlier. The unadjusted Buy Index elevated 43 p.c

in contrast with the earlier week and was 15 p.c decrease than the identical week one yr in the past.“Purposes decreased final week as rising mortgage charges continued to discourage patrons from coming into

the market and put a damper on buy exercise. The 30-year mounted fee elevated for the fourth

consecutive week, reaching 6.99 p.c – the very best fee since July 2024,” stated Joel Kan, MBA’s Vice

President and Deputy Chief Economist. “Buy purposes declined for each typical and

authorities loans and dropped to the slowest weekly tempo since February 2024. Refinance purposes

elevated regardless of greater charges, however the improve was in comparison with latest low ranges and was completely

pushed by a rise in VA refinances, which proceed to point out weekly swings.”

…

The typical contract rate of interest for 30-year fixed-rate mortgages with conforming mortgage balances

($766,550 or much less) elevated to six.99 p.c from 6.97 p.c, with factors reducing to 0.68 from 0.72

(together with the origination charge) for 80 p.c loan-to-value ratio (LTV) loans. The efficient fee remained

unchanged from final week.

emphasis added

Click on on graph for bigger picture.

The primary graph exhibits the MBA mortgage buy index.

In accordance with the MBA, buy exercise is down 15% year-over-year unadjusted.

Purple is a four-week common (blue is weekly).

Buy utility exercise is up about 2% from the lows in late October 2023 and is now 15% beneath the bottom ranges in the course of the housing bust.

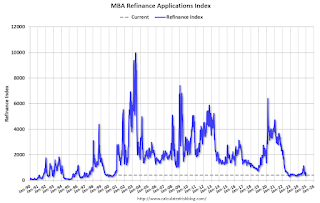

The refinance index may be very low.