by Calculated Danger on 5/15/2024 07:00:00 AM

From the MBA: Mortgage Functions Enhance in Newest MBA Weekly Survey

Mortgage functions elevated 0.5 % from one week

earlier, in keeping with information from the Mortgage Bankers Affiliation’s (MBA) Weekly Mortgage Functions

Survey for the week ending Could 10, 2024.The Market Composite Index, a measure of mortgage mortgage utility quantity, elevated 0.5 % on

a seasonally adjusted foundation from one week earlier. On an unadjusted foundation, the Index elevated 0.3

% in contrast with the earlier week. The Refinance Index elevated 5 % from the earlier

week and was 7 % greater than the identical week one yr in the past. The seasonally adjusted Buy

Index decreased 2 % from one week earlier. The unadjusted Buy Index decreased 2 %

in contrast with the earlier week and was 14 % decrease than the identical week one yr in the past.“Treasury yields continued to maneuver decrease final week and mortgage charges declined for the second week in a

row, with the 30-year mounted charge down 10 foundation factors to 7.08 %, the bottom degree since early April,”

stated Joel Kan, MBA’s Vice President and Deputy Chief Economist. “The decline in charges led to a small

increase to refinance functions, together with one other robust week for VA refinances. Nonetheless, the general

degree of refinance exercise stays low. Buy functions decreased, pushed largely by a 9 %

drop in FHA buy functions. Typical dwelling buy functions had been down round one

%.Added Kan, “Whereas the downward transfer in charges advantages potential homebuyers, mortgage charges are nonetheless

a lot greater than they had been a yr in the past, whereas for-sale stock stays tight.”

…

The common contract rate of interest for 30-year fixed-rate mortgages with conforming mortgage balances

($766,550 or much less) decreased to 7.08 % from 7.18 %, with factors reducing to 0.63 from 0.65

(together with the origination price) for 80 % loan-to-value ratio (LTV) loans.

emphasis added

Click on on graph for bigger picture.

The primary graph reveals the MBA mortgage buy index.

In keeping with the MBA, buy exercise is down 14% year-over-year unadjusted.

Crimson is a four-week common (blue is weekly).

Buy utility exercise is up barely from the lows in late October 2023, and under the bottom ranges through the housing bust.

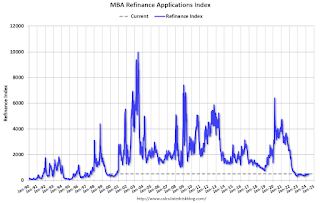

With greater mortgage charges, the refinance index declined sharply in 2022, and has largely flat lined since then.