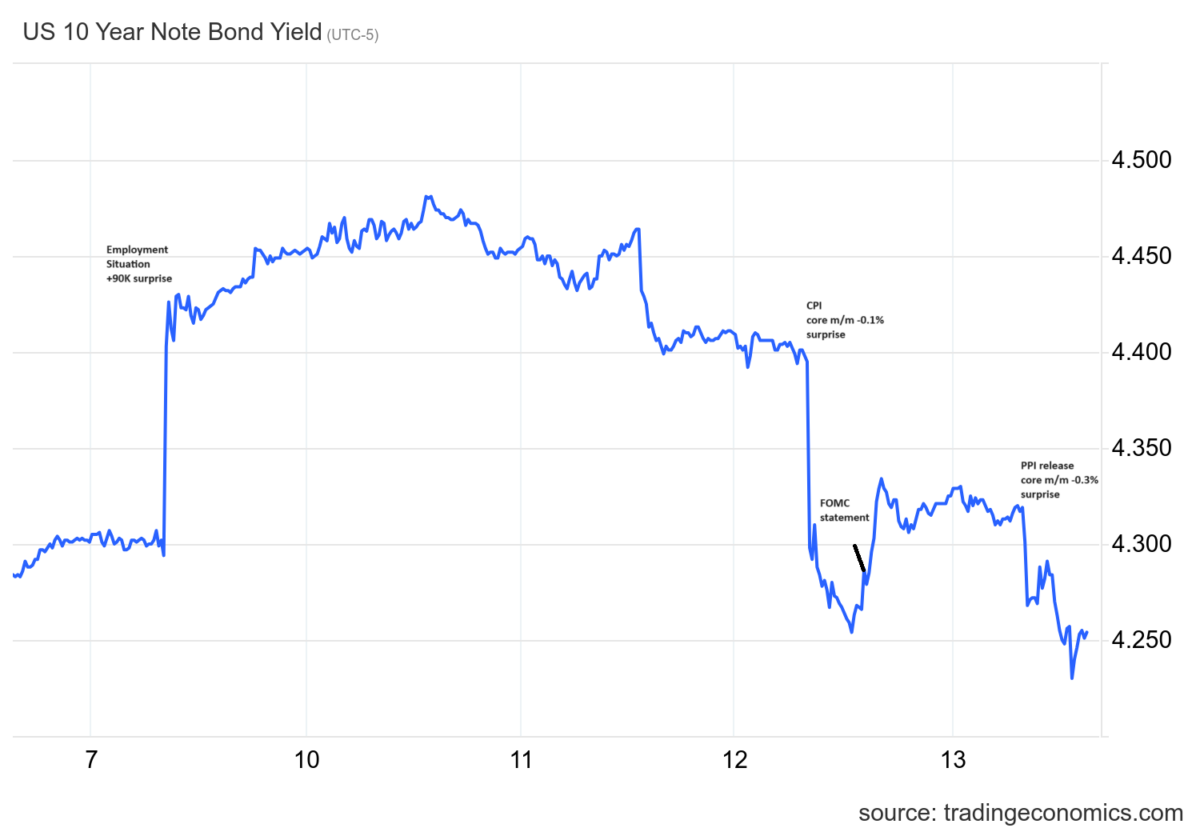

Following up on the PPI launch (mentioned together with different core measures) mentioned right here, how have markets responded, by way of Fed funds futures, the ten 12 months fee?

Supply: CME accessed 6/12, 6/13/2024, 1:30pm CT.

The trajectory of Fed funds implied by futures is additional depressed.

The ten 12 months yield additionally dropped. In perspective:

Supply: TradingEconomics, accessed 6/13/2024, edited by writer.

We’ve got constant reactions — aside from the PPI launch — within the nominal worth of the US greenback, as proven within the beneath determine (over the identical interval):

Supply: TradingEconomics, accessed 6/13/2024, edited by writer.

In fact, the greenback’s worth towards a basket of foreign currency is affected by occasions and expectations revisions overseas, in addition to at dwelling.