As of yesterday COB:

Determine 1: Ten 12 months breakeven (blue), 5 12 months breakeven (crimson), in %. Supply: Treasury through FRED.

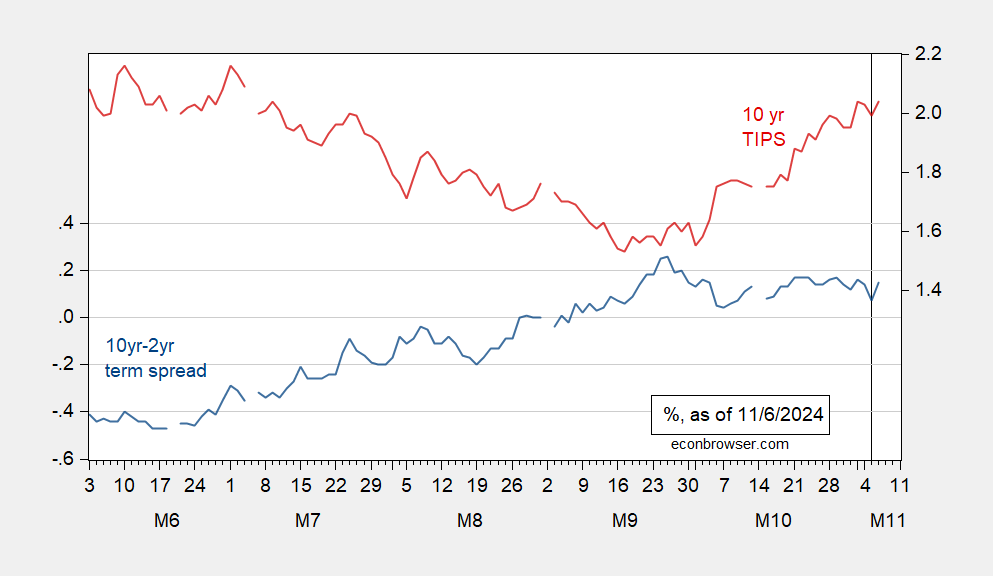

Determine 2: 10yr-2yr Treasury time period unfold (blue, left scale), ten 12 months TIPS yield (crimson, proper scale), in %. Supply: Treasury through FRED.

Inflation expectations (not less than a proxy) are up, as anticipated. Nevertheless, time period spreads are comparatively unchanged from earlier than the election. In an earlier time, I’d’ve thought this was indicating not a lot change in perceived progress charge of GDP, however no longer so certain.