Following up on Jim’s publish yesterday, ideas on measurement error and prospects. Observe that GDP shocked on the draw back, at 1.6 ppts q/q AR vs. consensus 2.5 ppts. However, GDP+ grows sooner, as does last gross sales to personal home purchasers.

Determine 1: GDP (daring black), GDPNow as of 4/24 (gentle blue sq.), GDPNow as of 4/26 (blue sq.), NY Fed nowcast as of 4/26 (pink inverted triangle), April WSJ survey imply (gentle inexperienced), CBO estimate of potential GDP (grey), all in bn.Ch.2017$ SAAR. Supply: BEA (2024Q1 advance), Atlanta Fed, NY Fed, CBO Price range and Financial Outlook (February 2024), and writer’s calculations.

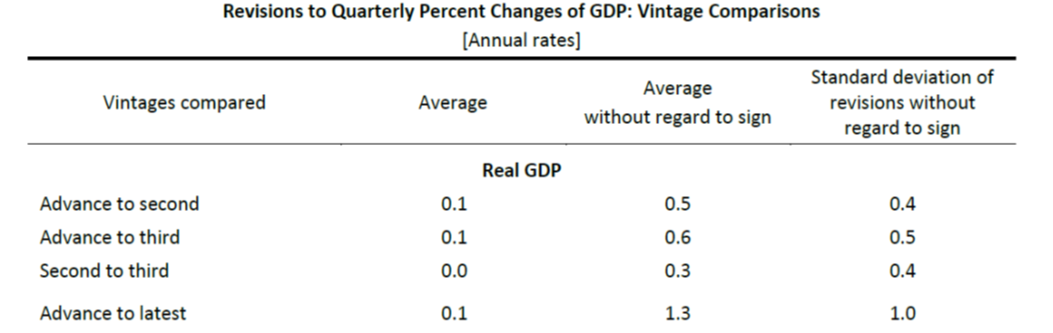

Whereas 1.6 ppts appears far under 2.5 ppts (q/q AR), recall that this advance estimate might be revised, maybe considerably. As famous on this BEA be aware from October 2023 (for pattern interval 1996-2022):

Supply: BEA (2023).

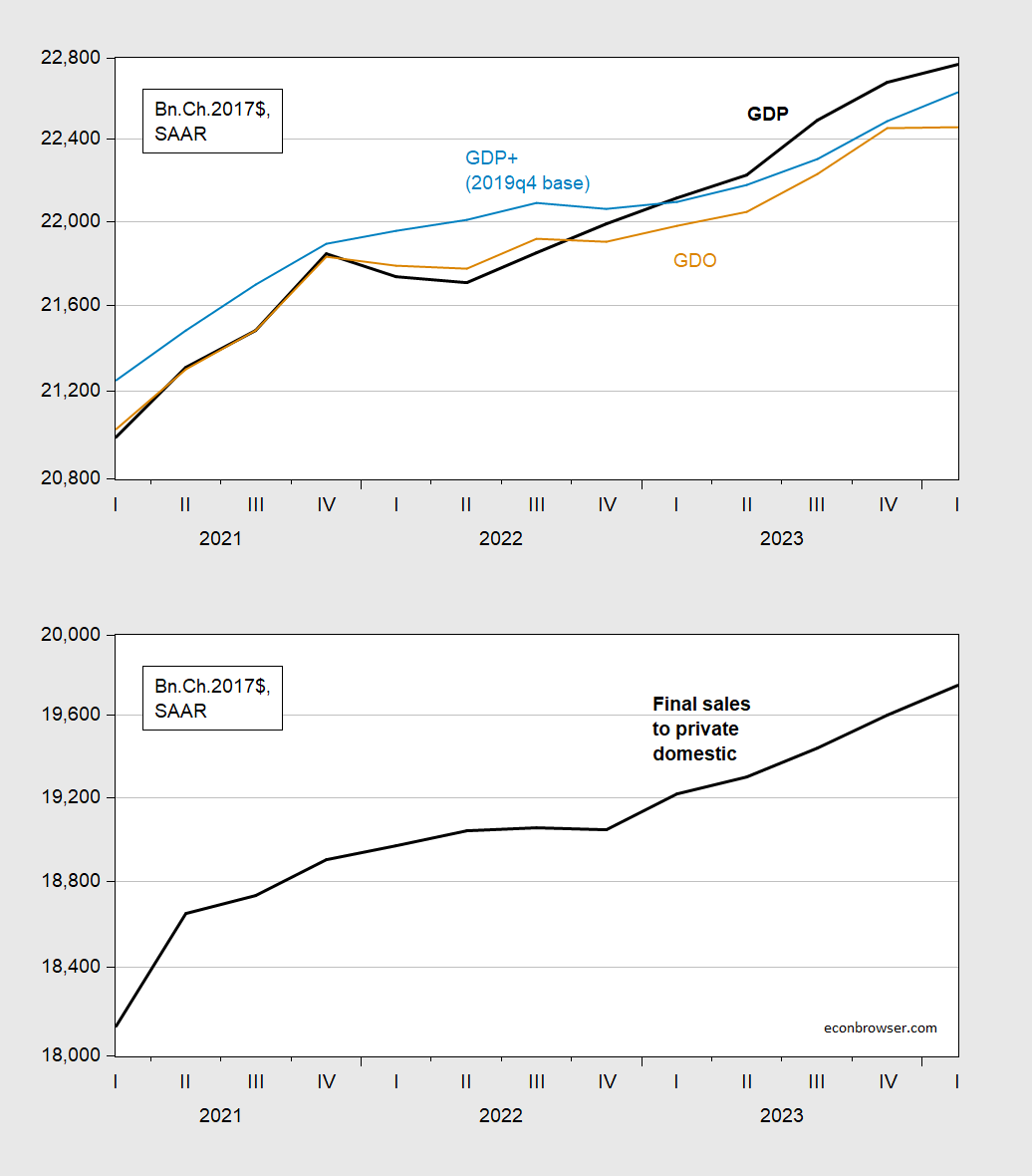

What about different measures of financial exercise. Beneath I plot reported (expenditure facet) GDP, GDO (the typical of GDI and GDP), and GDP+, and in a separate graph, last gross sales to personal home purchasers, which is commonly interpreted as a greater measure of combination demand.

Determine 2: Prime panel: GDP (daring black), GDO (tan), GDP+ listed to stage of 2019Q4 GDP (gentle blue). Backside panel: Last gross sales to personal home purchasers (daring black). All in bn.Ch.2017$ SAAR. GDI is estimated primarily based on 2.2% y/y progress on web working surplus part. Supply: BEA 2024Q1 advance launch, Philadelphia Fed, and writer’s calculations.

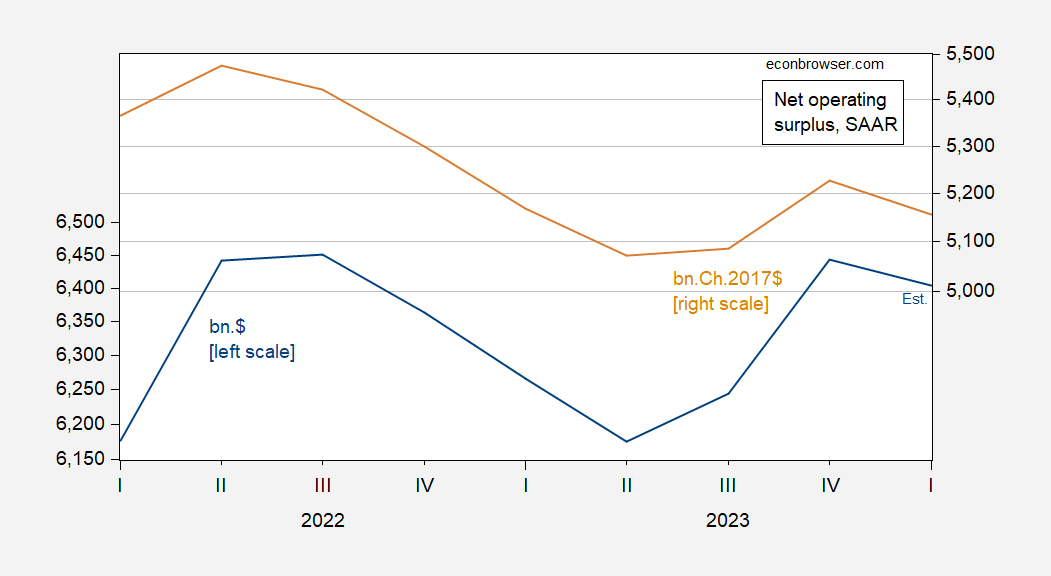

On a q/q AR foundation, estimated GDO isn’t rising in any respect. The lacking part of GDI I crammed in with a 2.2% progress in web working surplus, utilizing a 2.2% forecasted progress in company earnings for Q1. Which means that actual web working surplus is assumed to renew its decline in Q1.

Determine 3: Internet working surplus in bn.$ SAAR (blue, left scale), and in bn.Ch.2017$, SAAR (tan, proper scale). Deflated utilizing GDP deflator. Supply: BEA and writer’s calculations.

Whereas each GDO and GDP+ have decelerated (the previous to 0 ppts), last gross sales continues apace (3% q/q AR), suggesting continued momentum in combination demand.