A comparability:

Determine 1: GDP (daring black), WSJ January survey imply (pink), CBO January projection (mild blue), Biden administration (mild inexperienced), IMF WEO January forecast (blue triangle), all in billion Ch.2017$ SAAR. Supply: BEA, WSJ, CBO, IMF, Financial Report of the President, 2025, and writer’s calculations.

Be aware that CBO tasks below present regulation, Troika sometimes on administration insurance policies, IMF situations on sure assumptions, and WSJ is imply of varied forecaster assumptions.

Determine 2 shows the imply forecast and a measure of divergence (trimmed 20%):

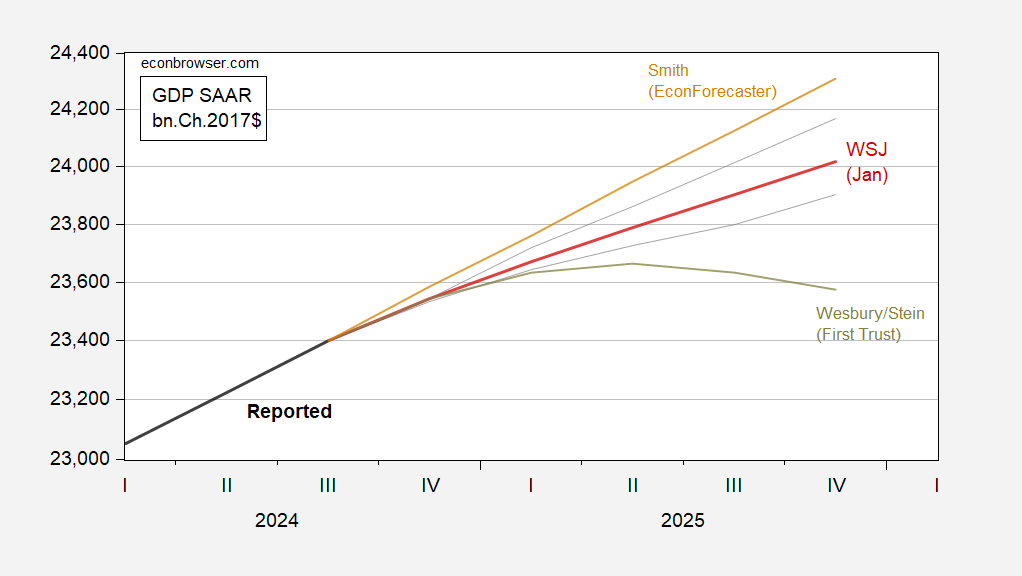

Determine 2: GDP (daring black), WSJ January survey imply (pink), 20% trimmed hello, low for 2025 this fall/this fall (grey strains), highest forecast (tan), lowest (grey inexperienced). Supply: BEA, WSJ, and writer’s calculations.

James F. Smith is (once more) on the high (I need what he’s smoking!), whereas just one respondent is forecasting a downturn (Wesbury and Stein at First Belief). So far as I could make out, Mr. Wesbury’s and Mr. Stein’s forecast relies on a retrenchment in financial exercise because of the excesses through the covid interval.