by Calculated Threat on 5/14/2024 11:00:00 AM

From the NY Fed: Family Debt Rose by $184 Billion in Q1 2024; Delinquency Transition Charges Elevated Throughout All Debt Sorts

The Federal Reserve Financial institution of New York’s Middle for Microeconomic Knowledge in the present day issued its Quarterly Report on Family Debt and Credit score. The report exhibits whole family debt elevated by $184 billion (1.1%) within the first quarter of 2024, to $17.69 trillion. The report is predicated on knowledge from the New York Fed’s nationally consultant Client Credit score Panel.

The New York Fed additionally issued an accompanying Liberty Road Economics weblog put up analyzing bank card utilization and its relationship with delinquency. The Quarterly Report additionally features a one-page abstract of key takeaways and their supporting knowledge factors.

“In the first quarter of 2024, credit card and auto loan transition rates into serious delinquency continued to rise across all age groups,” mentioned Joelle Scally, Regional Financial Principal inside the Family and Public Coverage Analysis Division on the New York Fed. “An increasing number of borrowers missed credit card payments, revealing worsening financial distress among some households.”

Mortgage balances rose by $190 billion from the earlier quarter and was $12.44 trillion on the finish of March. Balances on house fairness traces of credit score (HELOC) elevated by $16 billion, representing the eighth consecutive quarterly improve since Q1 2022, and now stand at $376 billion. Bank card balances decreased by $14 billion to $1.12 trillion. Different balances, which embrace retail playing cards and client loans, additionally decreased by $11 billion. Auto mortgage balances elevated by $9 billion, persevering with the upward trajectory seen since 2020, and now stand at $1.62 trillion.

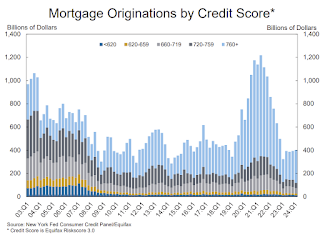

Mortgage originations continued growing on the similar tempo seen within the earlier three quarters, and now stand at $403 billion. Mixture limits on bank card accounts elevated modestly by $63 billion, representing a 1.3% improve from the earlier quarter. Limits on HELOC grew by $30 billion and have grown by 14% over the previous two years, after 10 years of noticed declines.

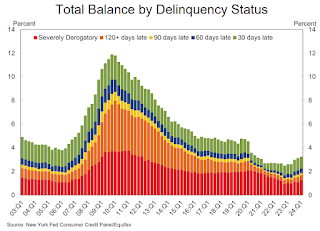

Mixture delinquency charges elevated in Q1 2024, with 3.2% of excellent debt in some stage of delinquency on the finish of March. Delinquency transition charges elevated for all debt varieties. Annualized, roughly 8.9% of bank card balances and seven.9% of auto loans transitioned into delinquency. Delinquency transition charges for mortgages elevated by 0.3 share factors but stay low by historic requirements.

emphasis added

Click on on graph for bigger picture.

Listed below are three graphs from the report:

The primary graph exhibits family debt elevated in Q1. Family debt beforehand peaked in 2008 and bottomed in Q3 2013. Not like following the nice recession, there wasn’t a decline in debt in the course of the pandemic.

From the NY Fed:

Mixture family debt balances elevated by $184 billion within the first quarter of 2024, a 1.1% rise from 2023Q4. Balances

now stand at $17.69 trillion and have elevated by $3.5 trillion for the reason that finish of 2019, simply earlier than the pandemic recession.

The general delinquency charge elevated in Q1. From the NY Fed:

Mixture delinquency charges elevated within the first quarter of 2024. As of March, 3.2% of excellent debt was in some stage

of delinquency, up by 0.1 share level from the fourth quarter. Nonetheless, total delinquency charges stay 1.5 share factors decrease

than the fourth quarter of 2019.

From the NY Fed:

Credit score high quality of newly originated loans was regular, with 3% of mortgages and 16% of auto loans originated to debtors

with credit score scores underneath 620, roughly unchanged from the fourth quarter. The median credit score rating for newly originated mortgages was

flat at 770, whereas the median credit score rating of newly originated auto loans was 4 factors larger than final quarter at 724, the best on

file.

There’s far more within the report.