The restoration continues, with a recession exhausting to see (even incorporating the preliminary benchmark revision with out caveat). A snapshot of indicators adopted by the NBER’s Enterprise Cycle Relationship Committee, plus month-to-month GDP.

Determine 1: Nonfarm Payroll (NFP) employment from CES (blue), implied NFP from preliminary benchmark (daring blue), civilian employment (orange), industrial manufacturing (crimson), private revenue excluding present transfers in Ch.2017$ (daring gentle inexperienced), manufacturing and commerce gross sales in Ch.2017$ (black), consumption in Ch.2017$ (gentle blue), and month-to-month GDP in Ch.2017$ (pink), GDP (blue bars), all log normalized to 2021M11=0. Supply: BLS through FRED, Federal Reserve, BEA 2024Q2 third launch/annual replace, S&P World Market Insights (nee Macroeconomic Advisers, IHS Markit) (10/1/2024 launch), and creator’s calculations.

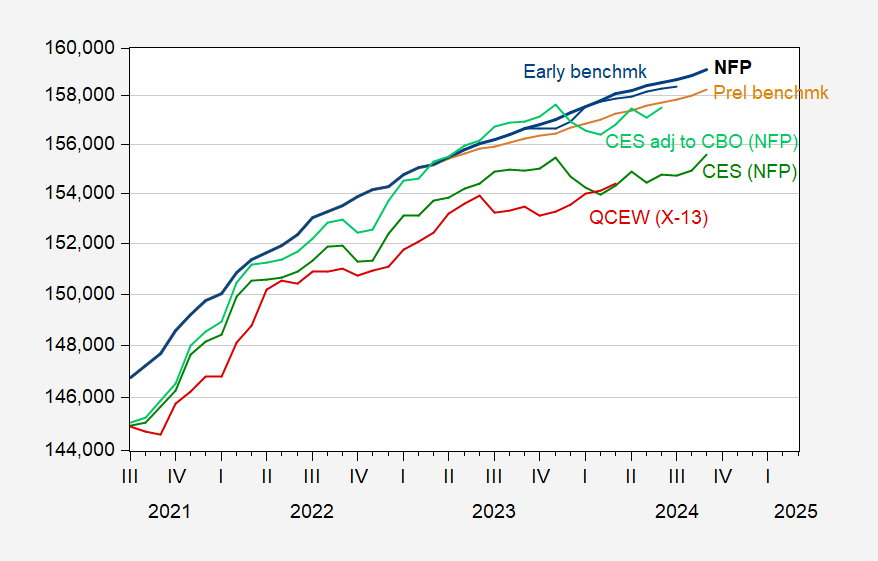

In the event you had been questioning what different indicators of complete nonfarm payroll employment appears to be like like, right here’s a comparability.

Determine 2: Nonfarm payroll employment (daring black), preliminary benchmark (tan), early benchmark (blue), family employment sequence adjusted to NFP idea (inexperienced), family employment sequence adjusted to NFP idea, adjusted to include CBO inhabitants estimates via mid-2024 (gentle inexperienced), and QCEW complete employment seasonally adjusted by creator utilizing X-13 (crimson). Early benchmark adjusts reported NFP by ratio of sum-of-states early benchmark to sum-of-states as reported by CES. Supply: BLS, BLS through FRED, Philadelphia Fed, and creator’s calculations.

There’s a giant hole between NFP and the family sequence adjusted to the NFP idea. A part of that may very well be attributed to the truth that institution NFP counts jobs, whereas family idea NFP counts folks. Nonetheless, he larger distinction is probably going because of using inhabitants controls that undercount complete inhabitants. Adjusting by CBO’s estimates of the BLS/Census undercount, one will get a sequence near the institution NFP (see gentle inexperienced line) via June 2024.

With these knowledge preliminary September knowledge, it’s exhausting to argue a recession has arrived.