Listed here are key indicators adopted by the NBER’s Enterprise Cycle Relationship Committee, plus month-to-month GDP. Seven days in the past , DiMartino Sales space at 13:50, says it began in Spring/Summer season 2024. Heritage’s EJ Antoni says it began in August. Knowledge for many collection by means of December.

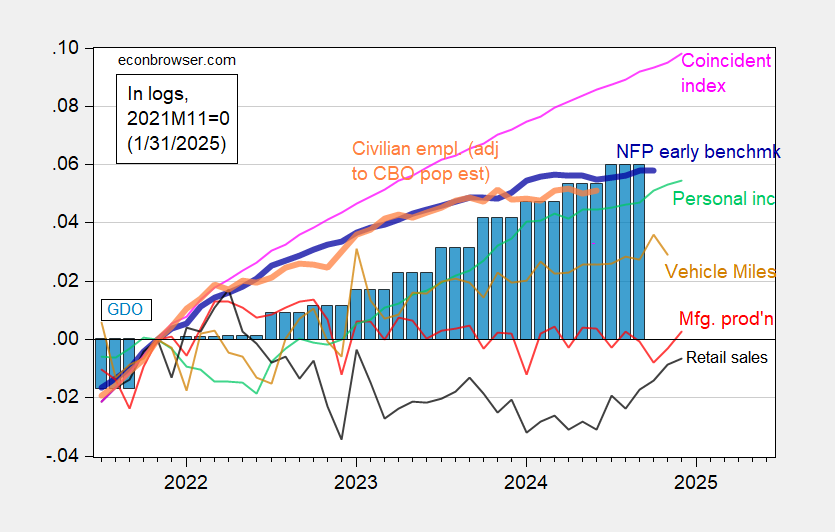

Determine 1: Nonfarm Payroll (NFP) employment from CES (blue), implied NFP from preliminary benchmark (daring blue), civilian employment (orange), industrial manufacturing (crimson), private revenue excluding present transfers in Ch.2017$ (daring mild inexperienced), manufacturing and commerce gross sales in Ch.2017$ (black), consumption in Ch.2017$ (mild blue), and month-to-month GDP in Ch.2017$ (pink), GDP (blue bars), all log normalized to 2021M11=0. Supply: BLS by way of FRED, Federal Reserve, BEA 2024Q4 advance launch, S&P World Market Insights (nee Macroeconomic Advisers, IHS Markit) (1/2/2025 launch), and writer’s calculations.

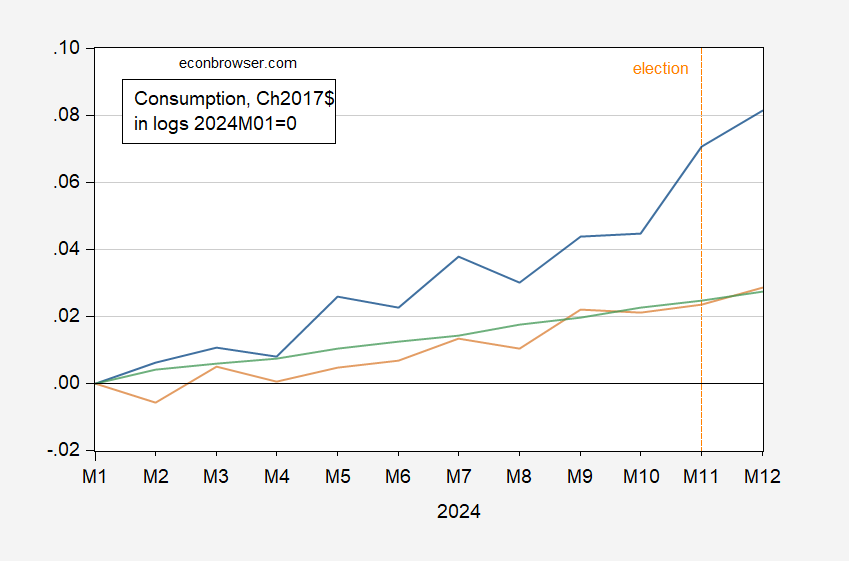

Consumption absolutely jumped in December (and accounting for greater than 100% of This autumn progress, as Jim famous). Ordinarily, I’d say — from a everlasting revenue speculation standpoint — this implies optimism. Nonetheless, these are hardly peculiar instances, notably with respect to expectations about tariffs. Given that buyers, in keeping with Coibion, Gorodnichenko and Weber, appear to consider tariffs are coming, it is smart they may front-load their spending. This might seemingly present up in durables, to a lesser extent nondurables, and nearly nil in companies.

Determine 2: Shopper durables consumption (blue), nondurables (tan), and companies (inexperienced), all in Ch.2017$ in logs, 2024M01=0. Supply: BEA, and writer’s calculations.

The 2 month p.c change (so from October to December) in durables is about two normal deviations (2022M01-2024M10 pattern).

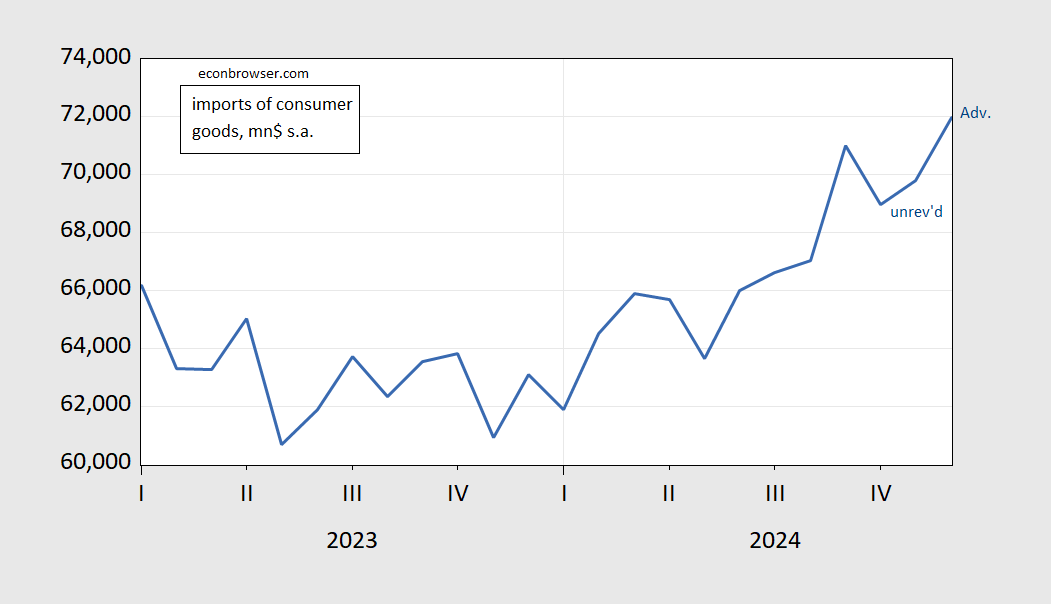

Laborious to say if tariff fears confirmed up within the import information — however listed below are client items imports by means of December (information as much as November unrevised).

Determine 3: Imports of client items, mn$ monthly, s.a. (blue). December 2024 is advance financial statistics launch.

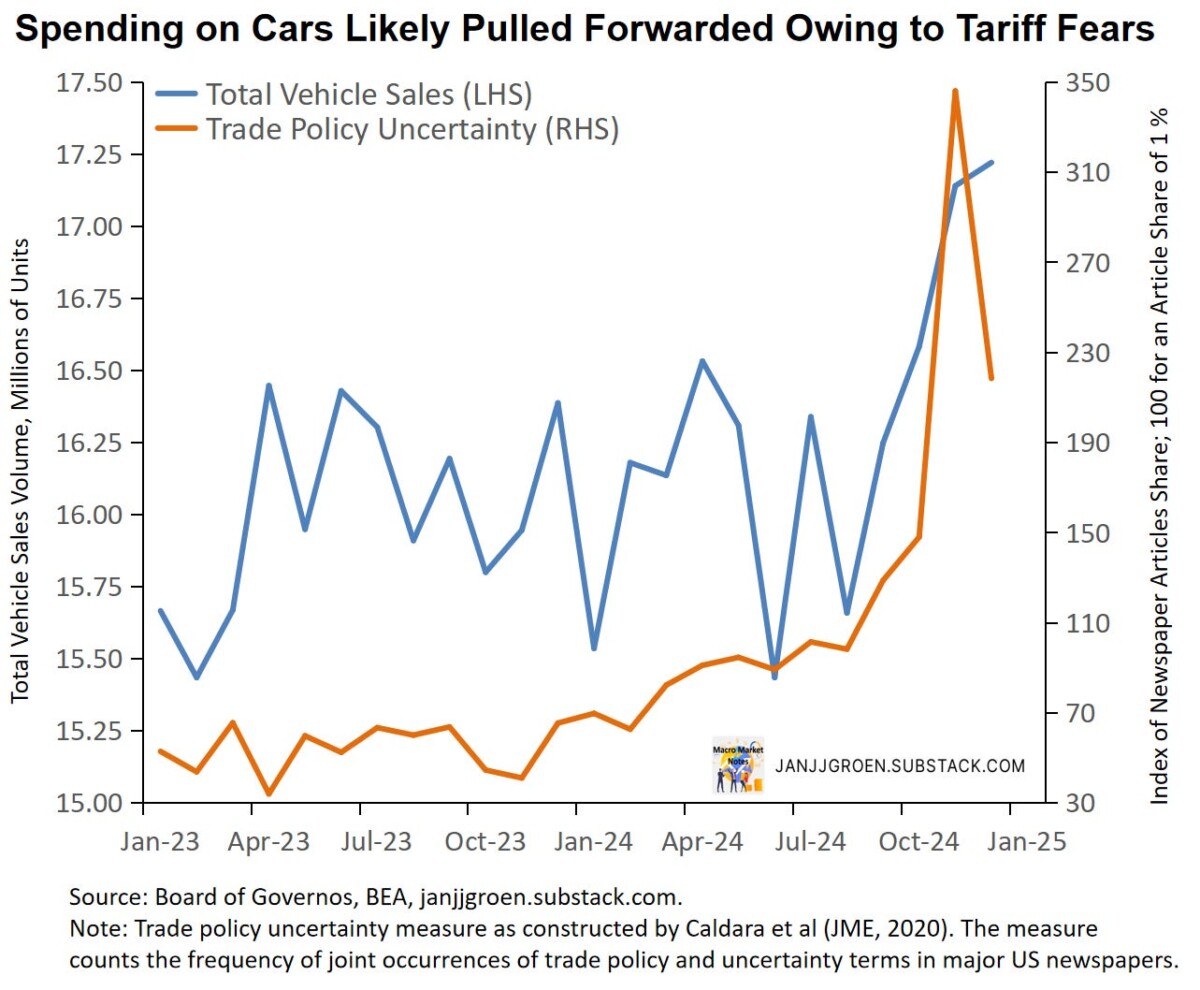

Addendum 11:30am PT: Jan Groen in a submit at this time gives proof of the impression on automobile imports, which is essential given how built-in the North American automobile trade is.

Supply: Groen (2025).

Nonetheless, with private revenue ex-transfers, nonfarm payroll employment, civilian employment, and industrial manufacturing all up (admittedly topic to revision), it appears troublesome to conclude the recession got here in Spring 2024, or August 2024, as DiMartino and EJ Antoni assert.

Lastly, a verify with some various indicators (a few of doubtful nature).

Determine 4: Implied nonfarm Payroll early benchmark (NFP) (daring blue), civilian employment adjusted utilizing CBO immigration estimates (orange), manufacturing manufacturing (crimson), private revenue excluding present transfers in Ch.2017$ (daring inexperienced), manufacturing and commerce gross sales in Ch.2017$ (black), consumption in Ch.2017$ (mild blue), and coincident index (pink), GDO (blue bars), all log normalized to 2021M11=0. Supply: Philadelphia Fed [1], Philadelphia Fed [2], Federal Reserve by way of FRED, BEA 2024Q3 third launch, , and writer’s calculations.

Notice that the coincident index for December (launched at this time) additionally rose, as did manufacturing manufacturing and actual retail gross sales (each reported earlier).