Listed here are key indicators adopted by the NBER’s Enterprise Cycle Courting Committee (prime indicators employment and individual revenue) plus month-to-month GDP from S&P (nee Macroeconomic Advisers nee IHS Markit):

Determine 1: Nonfarm Payroll (NFP) employment from CES (blue), implied NFP from preliminary benchmark (daring blue), civilian employment (orange), industrial manufacturing (pink), private revenue excluding present transfers in Ch.2017$ (daring gentle inexperienced), manufacturing and commerce gross sales in Ch.2017$ (black), consumption in Ch.2017$ (gentle blue), and month-to-month GDP in Ch.2017$ (pink), GDP (blue bars), all log normalized to 2021M11=0. Supply: BLS by way of FRED, Federal Reserve, BEA 2024Q3 2nd launch, S&P International Market Insights (nee Macroeconomic Advisers, IHS Markit) (12/2/2024 launch), and writer’s calculations.

From S&P International Market Insights:

Month-to-month GDP rose 0.3% in October, largely reversing a 0.4% decline in September that was revised from a beforehand reported 0.3% decline. The rise in month-to-month GDP in October was accounted for by a big improve in internet exports. Last gross sales to home purchasers posted a small decline, whereas nonfarm stock funding posted a small improve.

S&PGMI and Goldman Sachs monitoring as of yesterday have been 1.6% and a couple of.4%, respectively, for This autumn, whereas GDPNow was 3.2%. NY Fed and St Louis Fed have been at 1.9% and 1.31%, respectively, as of 11/29.

Addendum, 11:41 PT:

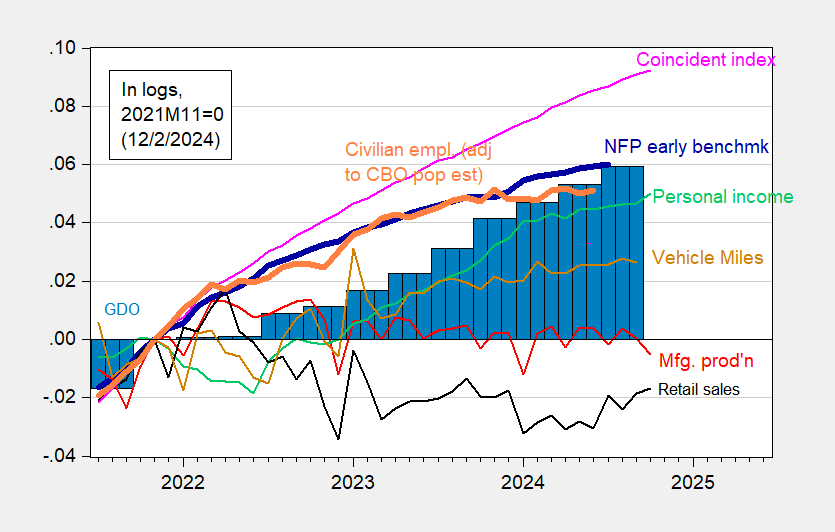

Listed here are various indicators:

Determine 2: Nonfarm Payroll early benchmark (NFP) (daring blue), civilian employment adjusted utilizing CBO immigration estimates by way of mid-2024 (orange), manufacturing manufacturing (pink), private revenue excluding present transfers in Ch.2017$ (gentle inexperienced), retail gross sales in 1999M12$ (black), automobile miles traveled (chartreuse), and coincident index (pink), GDO (blue bars), all log normalized to 2021M11=0. Early benchmark is official NFP adjusted by ratio of early benchmark sum-of-states to CES sum of states. Supply: Philadelphia Fed, Federal Reserve by way of FRED, BEA 2024Q3 2nd launch, and writer’s calculations.