Together with month-to-month GDP out at this time from S&P World Market Insights, and preliminary benchmark NFP:

Determine 1: Nonfarm Payroll (NFP) employment from CES (daring blue), implied NFP from preliminary benchmark (daring blue), civilian employment (orange), industrial manufacturing (crimson), private earnings excluding present transfers in Ch.2017$ (daring inexperienced), manufacturing and commerce gross sales in Ch.2017$ (black), consumption in Ch.2017$ (gentle blue), and month-to-month GDP in Ch.2017$ (pink), GDP (blue bars), all log normalized to 2021M11=0. Supply: BLS by way of FRED, Federal Reserve, BEA 2024Q2 2nd launch, S&P World Market Insights (nee Macroeconomic Advisers, IHS Markit) (9/3/2024 launch), and writer’s calculations.

S&P GMI notes:

Month-to-month GDP rose 0.4% in July following a flat studying in June that was revised decrease by 0.2 share level. The rise in July was absolutely (and roughly equally) accounted for by will increase in private consumption expenditures and nonresidential mounted funding. Outdoors of those elements, a leap in nonfarm stock funding in July was roughly offset by a decline in web exports.

Therefore, even taking actually the preliminary benchmark (see this publish concerning why you may not need to), July indicators will not be suggestive of a recession beginning in July (protecting in thoughts all sequence will probably be additional revised over time).

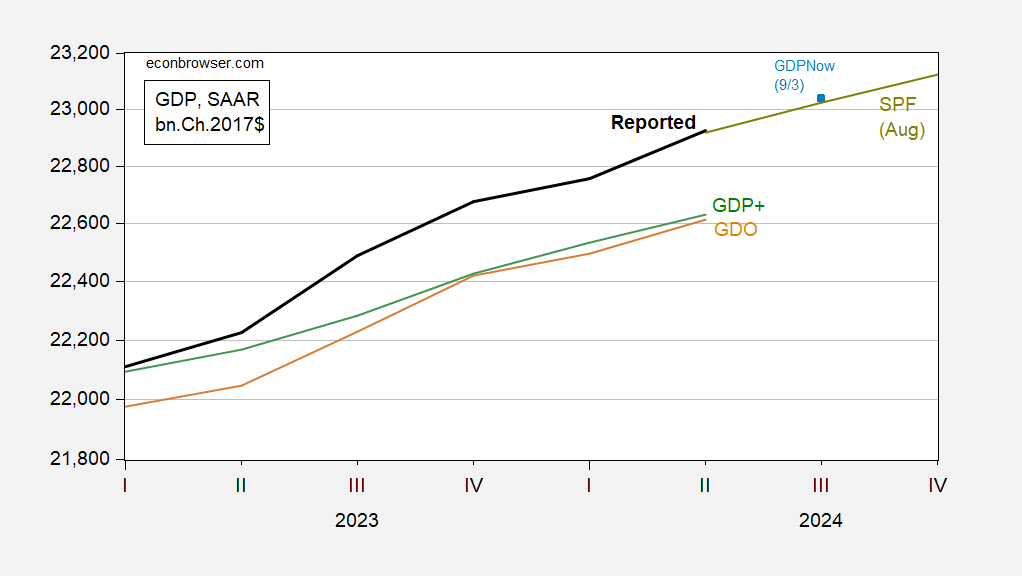

GDPNow for Q3 now at 2%, down from 2.5% on 8/30. 2% continues to be development development, so I might be loath to say the downturn is right here in Q3.

Determine 3: GDP as reported (daring black), GDPNow as of 9/3 (blue sq.), GDP median forecast from Survey of Skilled Forecasters (chartreuse line), GDO (tan), GDP+ (inexperienced), all in bn.Ch.2017$ SAAR. GDP+ calculated by iterating GDP+ development charges on 2019Q4 GDP degree. Supply: BEA 2024Q2 2nd launch, Atlanta Fed, Philadelphia Fed (SPF 8/9), Philadelphia Fed (GDP+ 8/29), and writer’s calculations.