July nominal consumption progress at consensus (+0.5%). Month-on-Month annualized actual consumption progress at 4.5%, with June revised up from 2.6% to three.2%. Furthermore, annualized private revenue ex-transfers grew 1.9% in July. Here’s a snapshot of some key indicators adopted by the NBER Enterprise Cycle Relationship Committee.

Determine 1: Nonfarm Payroll (NFP) employment from CES (daring blue), implied NFP from preliminary benchmark (daring blue), civilian employment (orange), industrial manufacturing (pink), private revenue excluding present transfers in Ch.2017$ (daring inexperienced), manufacturing and commerce gross sales in Ch.2017$ (black), consumption in Ch.2017$ (mild blue), and month-to-month GDP in Ch.2017$ (pink), GDP (blue bars), all log normalized to 2021M11=0. Supply: BLS through FRED, Federal Reserve, BEA 2024Q2 2nd launch, S&P International Market Insights (nee Macroeconomic Advisers, IHS Markit) (8/1/2024 launch), and writer’s calculations.

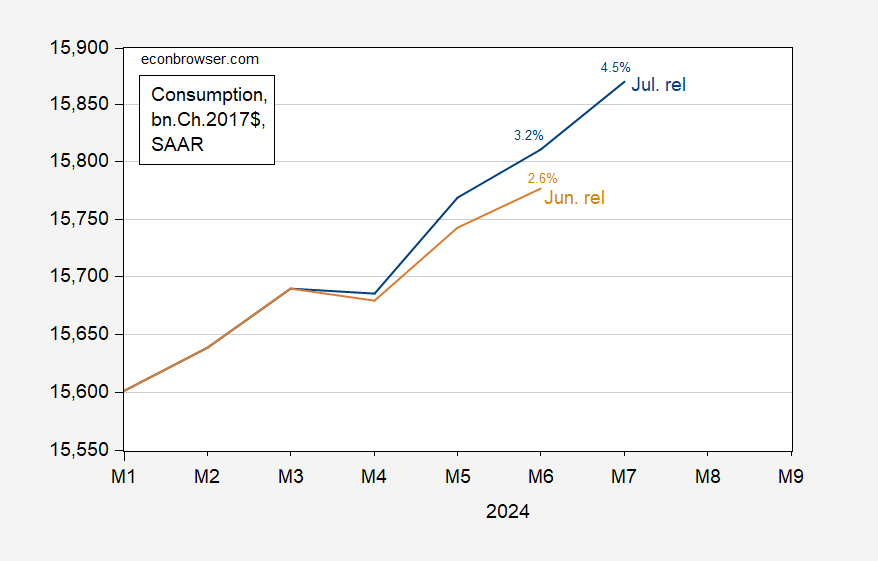

Right here’s a element of the consumption sequence, as of newest, and June launch.

Determine 2: Consumption from July launch (blue), from June launch (tan), all in bn.Ch.2017$ SAAR. Small % numbers point out m/m annualized progress charges (log phrases). Vertical axis is on a log scale. Supply: BEA.

Because the sequence are plotted on a log scale, the elevated slope in July signifies that consumption progress has accelerated. If an incipient recession was within the playing cards, one would count on — a la the everlasting revenue speculation — consumption to average (even when solely half of shoppers had been intertemporally optimizing).

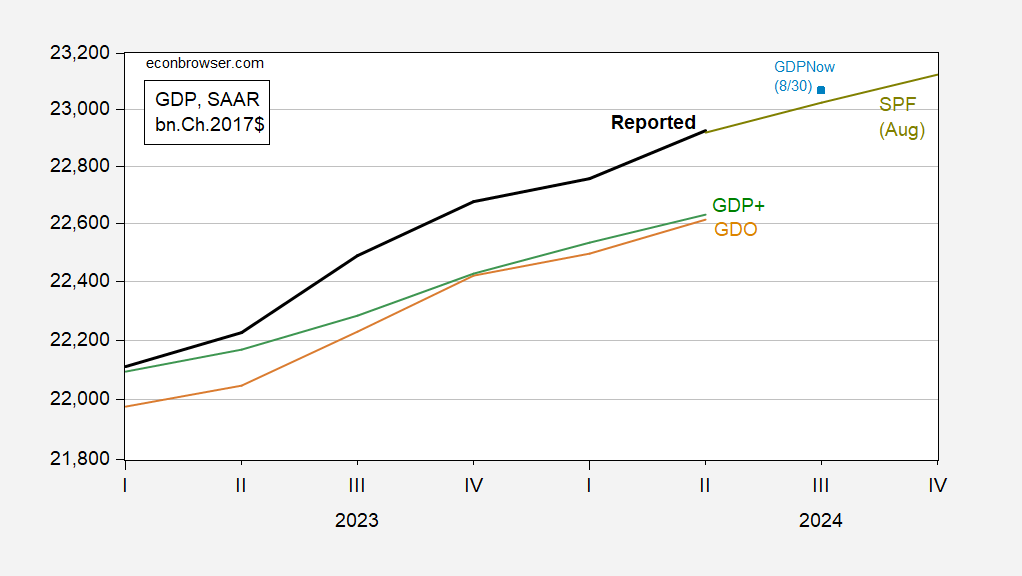

GDPNow is 2.5% as of right this moment, up from 2.0% on 8/26. NY Fed’s nowcast is at 2.49% as of right this moment.

Determine 3: GDP as reported (daring black), GDPNow as of 8/30 (blue sq.), GDP median forecast from Survey of Skilled Forecasters (chartreuse line), GDO (tan), GDP+ (inexperienced), all in bn.Ch.2017$ SAAR. GDP+ calculated by iterating GDP+ progress charges on 2019Q4 GDP degree. Supply: BEA 2024Q2 2nd launch, Atlanta Fed, Philadelphia Fed (SPF 8/9), Philadelphia Fed (GDP+ 8/29), and writer’s calculations.

The Lewis-Mertens-Inventory Weekly Financial Index (for information releases via 8/24) exhibits progress of two.27%.

Retaining in thoughts these information are going to be revised, they normally will not be suggestive of an incipient recession, contra right here and right here.