The Philadelphia Fed’s Coincident Index is out, 2.1% m/m annualized (2.6% y/y):

Determine 1: Implied nonfarm Payroll early benchmark (NFP) (daring blue), civilian employment adjusted utilizing CBO immigration estimates (orange), manufacturing manufacturing (purple), private revenue excluding present transfers in Ch.2017$ (daring inexperienced), manufacturing and commerce gross sales in Ch.2017$ (black), consumption in Ch.2017$ (mild blue), and month-to-month GDP in Ch.2017$ (pink), GDO (blue bars), all log normalized to 2021M11=0. Supply: Philadelphia Fed, Federal Reserve by way of FRED, BEA 2024Q3 third launch, S&P International Market Insights (nee Macroeconomic Advisers, IHS Markit) (12/2/2024 launch), and writer’s calculations.

Of the above, solely private revenue ex-transfers (mild inexperienced) is a NBER BCDC key collection (BCDC key collection proven right here).

A favourite indicator of mine is heavy truck gross sales.

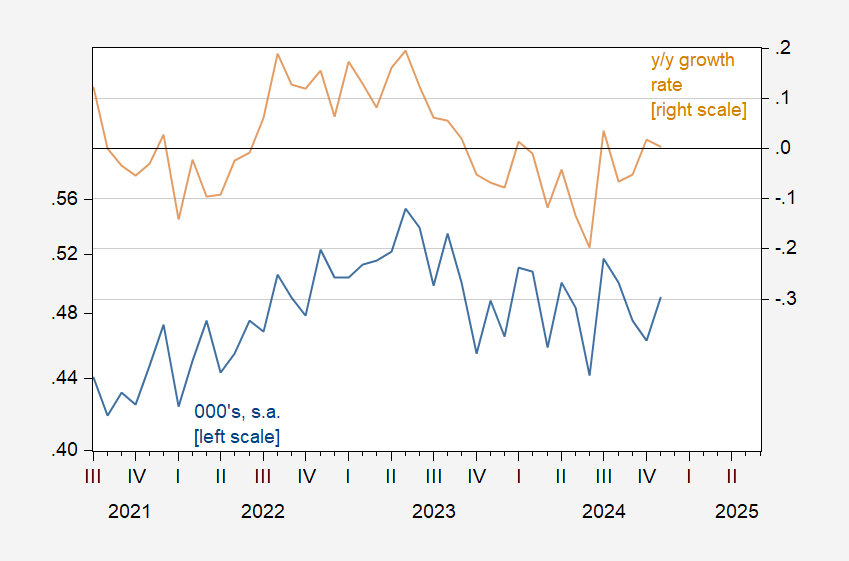

Determine 2: Heavy truck gross sales, 000’s (blue, left log scale), year-on-year progress price (tan, proper scale). Supply: BEA by way of FRED, and writer’s calculations.

It’s laborious to see whether or not this means recession, despite the fact that we’re previous a neighborhood peak. For context, right here’s the evolution of those collection earlier than the final two recessions.

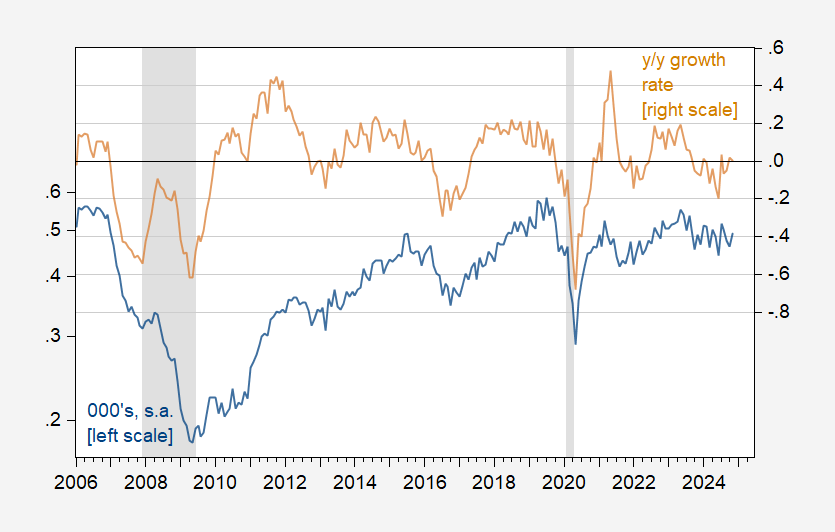

Determine 3: Heavy truck gross sales, 000’s (blue, left log scale), year-on-year progress price (tan, proper scale). NBER outlined peak-to-trough recession dates shaded grey. Supply: BEA by way of FRED, NBER, and writer’s calculations.

On the idea of the y/y progress price, you didn’t suppose we had been headed to recession in 2019, you then shouldn’t suppose we’re in 2024.