The summary from article forthcoming within the Journal of Worldwide Cash and Finance.

We start by inspecting determinants of mixture overseas alternate reserve holdings by central banks (dimension of issuing nation’s economic system and monetary markets, means of the foreign money to carry worth, and inertia). However understanding the dedication of reserve holdings in all probability requires going past the combination numbers, as an alternative observing particular person central financial institution habits, together with traits of the holding nation (bilateral commerce with the issuing nation, bilateral foreign money peg, and proxies for bilateral publicity to sanctions), along with the traits of the reserve foreign money issuer. On a currency-by-currency foundation, US greenback holdings are considerably effectively defined by a number of issuer traits; however the different currencies are much less efficiently defined. It might be that the outcomes from currency-by-currency estimation are impaired by inadequate pattern dimension. This consideration gives a motivation for pooling the information throughout the most important currencies and imposing the constraints that reserve holdings are decided in the identical method for every foreign money. On this setting, most financial determinants enter with significance: financial dimension as measured by GDP, bilateral foreign money peg, and bilateral commerce share. Whereas one geopolitical issue (congruence in voting within the UN) is usually vital within the anticipated method (aside from the US greenback), the opposite geopolitical issue (sanctions) doesn’t enter with significance.

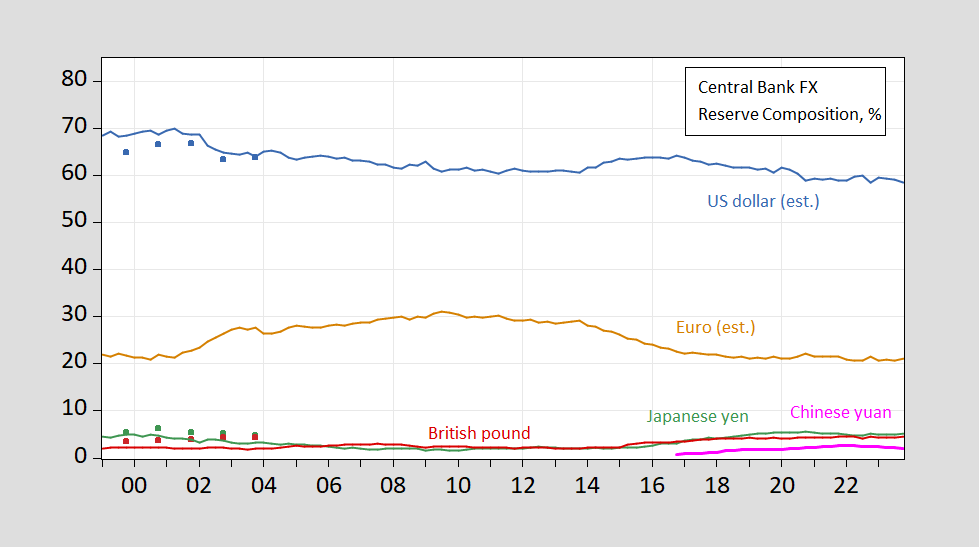

Right here’s an image of the combination foreign money shares, from the IMF’s COFER database, up to date information launched on June eleventh.

Determine 1: Share of overseas alternate reserves held by central banks, in USD (blue), EUR (orange), DEM (tan squares), JPY (inexperienced), GBP (sky blue), Swiss francs (purple), CNY (crimson). For 1999 information onward, estimates primarily based on COFER information, and apportionment of unallocated reserves, described in textual content. Supply: Chinn and Frankel (2007), IMF COFER accessed 6/20/2024, and creator’s estimates.

And right here’s a element, for 1999 onward:

Determine 2: Share of overseas alternate reserves held by central banks, in USD (blue), EUR (orange), JPY (inexperienced), GBP (sky blue), Swiss francs (purple), CNY (crimson). For 1999 information onward, estimates primarily based on COFER information, and apportionment of unallocated reserves, described in textual content. Supply: Chinn and Frankel (2007), IMF COFER accessed 6/20/2024, and creator’s estimates.

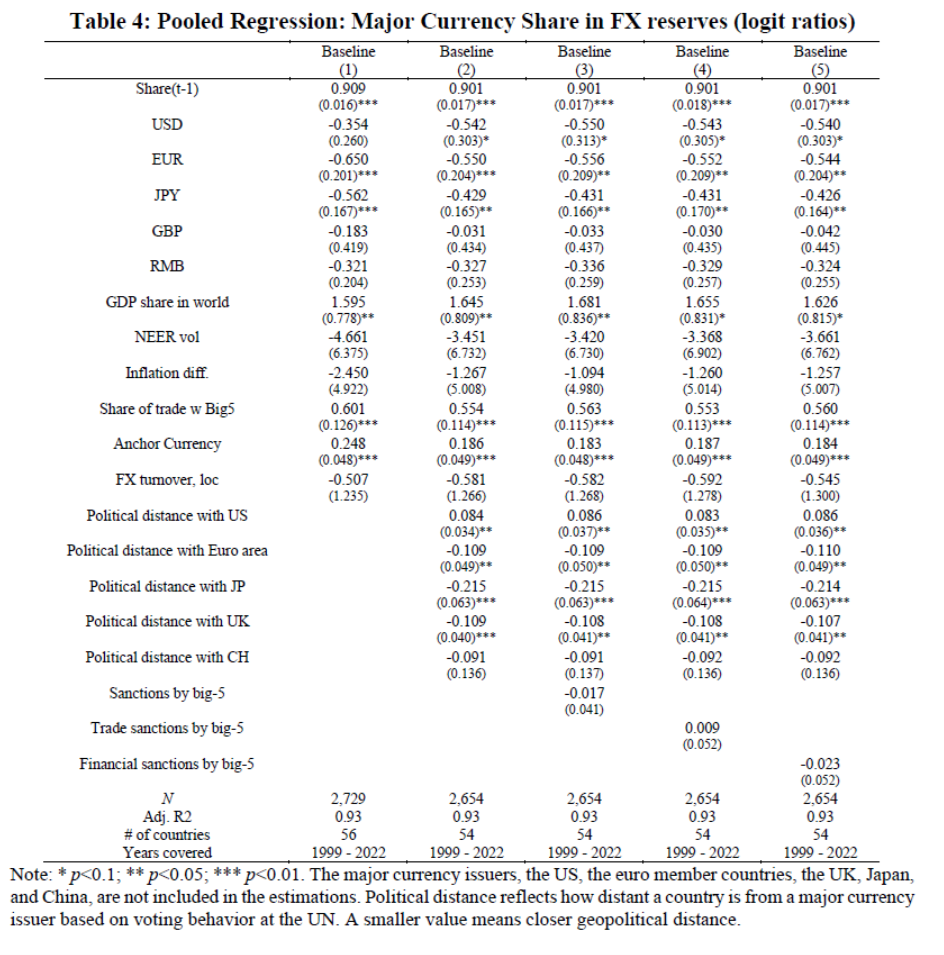

Equations used to estimate mixture shares pre-EMU are fairly ineffective in predicting shares now. Therefore, on this new paper, we depend on particular person central financial institution information to estimate the determinants of shares. The outcomes of a pooled cross-country cross-currency, unconstraining the geopolitical distance coefficient to fluctuate throughout foreign money, are reported in Desk 4.

Supply: Chinn, Frankel, Ito (forthcoming, JIMF).

Following the leads to Chinn and Frankel (2007), we discover financial dimension issues, in addition to inertia. Whereas we discover retailer of worth measures (inflation, alternate charge volatility) have a unfavourable influence, these results aren’t statistically vital. This particular information set (central financial institution by 12 months) permits us to analyze the influence of commerce flows and peg, which seems to be vital. We replicate the discovering obtained by Goldberg and Hannaoui (2024) that extra geopolitically distant nations (as measured by coincidence in UN GA voting) maintain larger greenback shares, whereas the reverse is true for the opposite currencies. Whereas monetary sanctions have a unfavourable influence, the measured sensitivity is just not statistically vital.

Whereas we don’t explicitly report how greenback shares have declined, it’s helpful to notice that different research (see Arslanalp, Eichengreen and Simpson-Bell (2024), and references therein) have documented that the slack is just not basically being largely take up by the RMB, however different unconventional currencies.

See additionally Eswar Prasad’s current International Affairs piece, the Third annual Fed-FRBNY convention on the worldwide roles of the greenback, Kamin and Sobel (2024), Atlantic Council “Dollar Dominance Monitor”.