PBoC and monetary regulators act, however even with fiscal measures underway, are unlikely to drastically change the trail of the economic system.

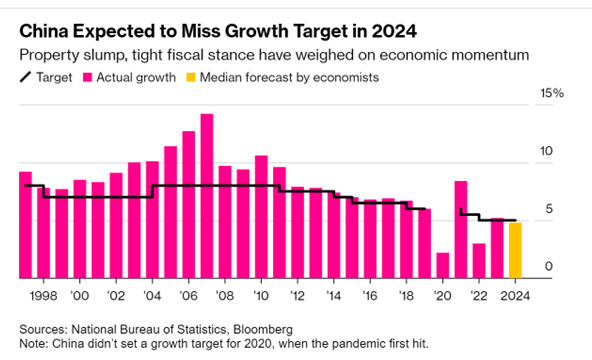

As summarized by Bloomberg:

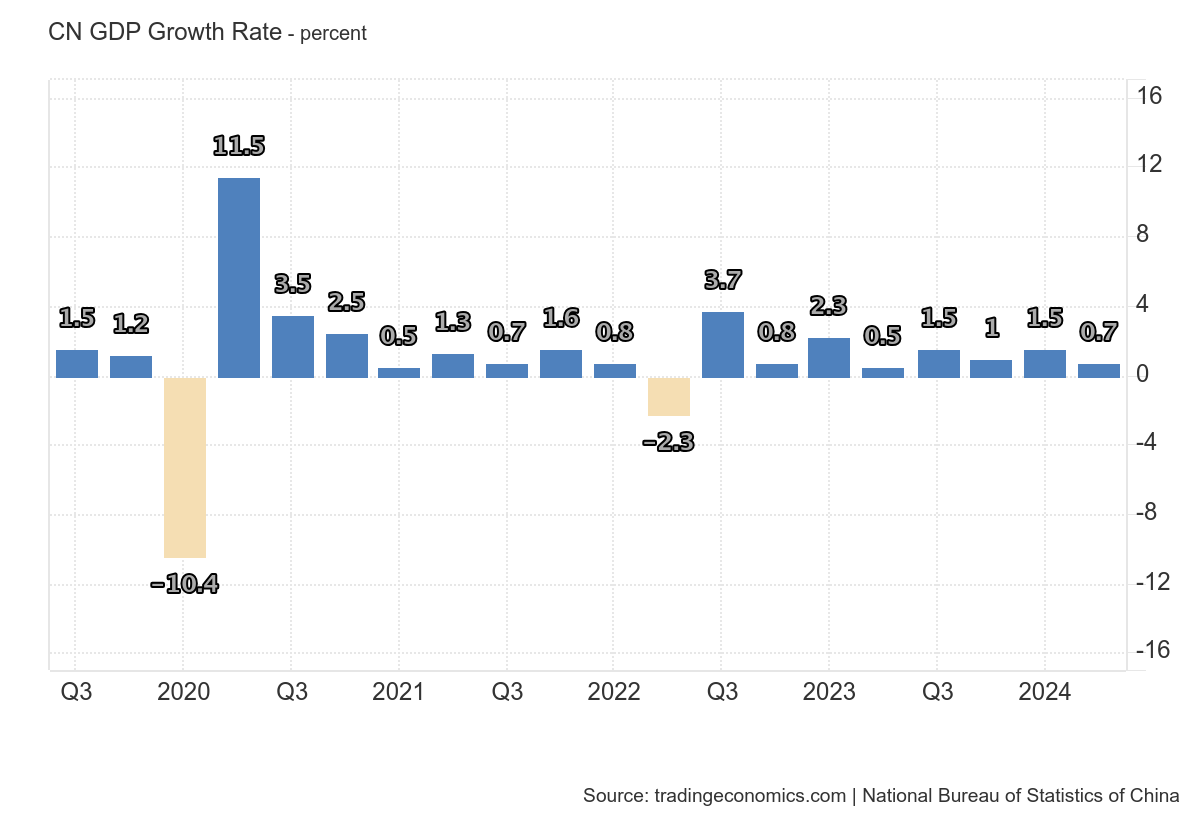

To me, it’s curious it took so lengthy, then adopted by a flurry of exercise within the final 48 hours previous the announcement. I’ve no specific insights into the workings of policymakers underneath the present regime, so I’ll let others debate the sources of delayed motion. Nevertheless, listed here are some macro indicators that present the necessity for some motion — decelerating progress, and deflation. First GDP progress (q/q SA):

Taken at face worth, 0.7% q/q is 2.8% annualized(!). There have been doubts that underneath earlier set of macro and regulatory insurance policies, the 5% goal (y/y I believe) can be hit.

Supply: Bloomberg, 24 Sep 2024.

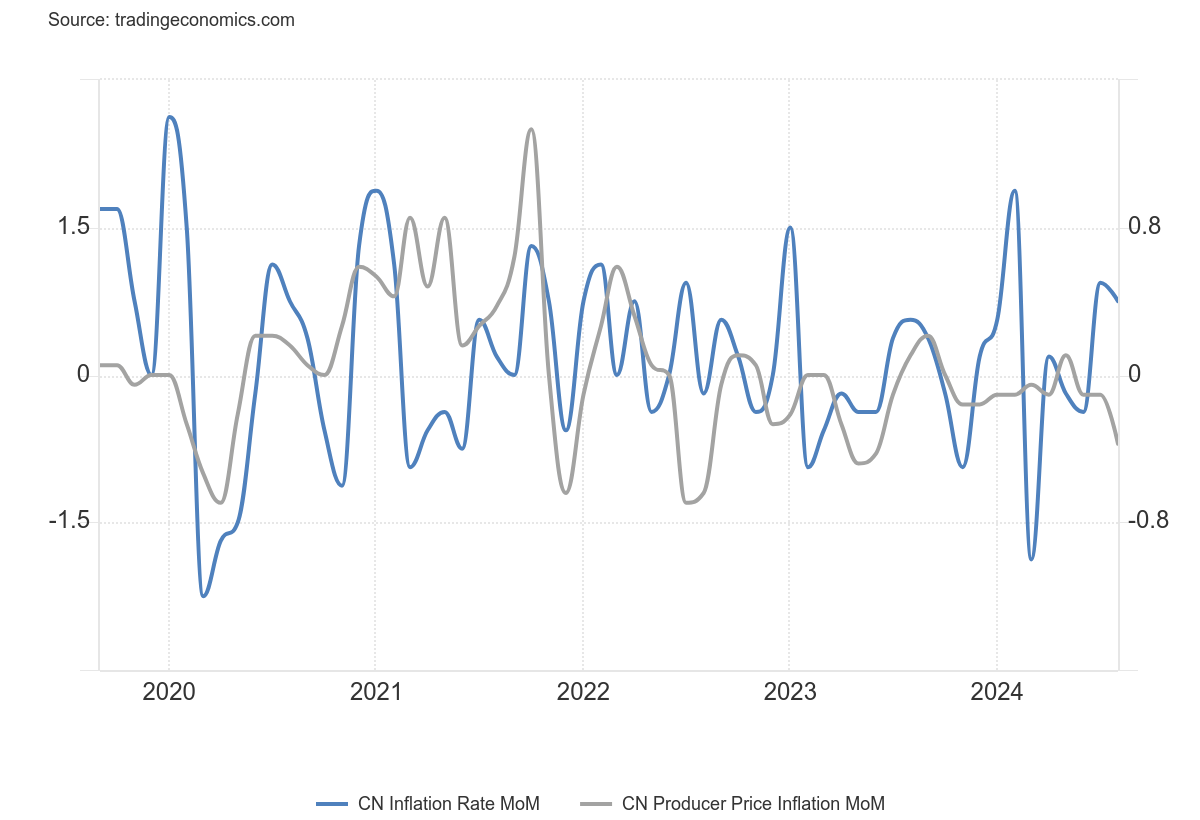

Second, deflation. Extra worrying in some methods is the decline in costs — not within the CPI however on the producer degree, and for the economic system total. CPI and PPI m/m inflation charges (observe distinction of scales, left vs. proper axes). Deflation could be a sign of slowing progress, in addition to exacerbating demand shortfalls.

So whereas shopper costs have risen in current months, producer costs have fallen. As famous within the Bloomberg article, the GDP deflator has additionally fallen, for 5 straight quarters (-3.8% 4 quarter change as of Q2).

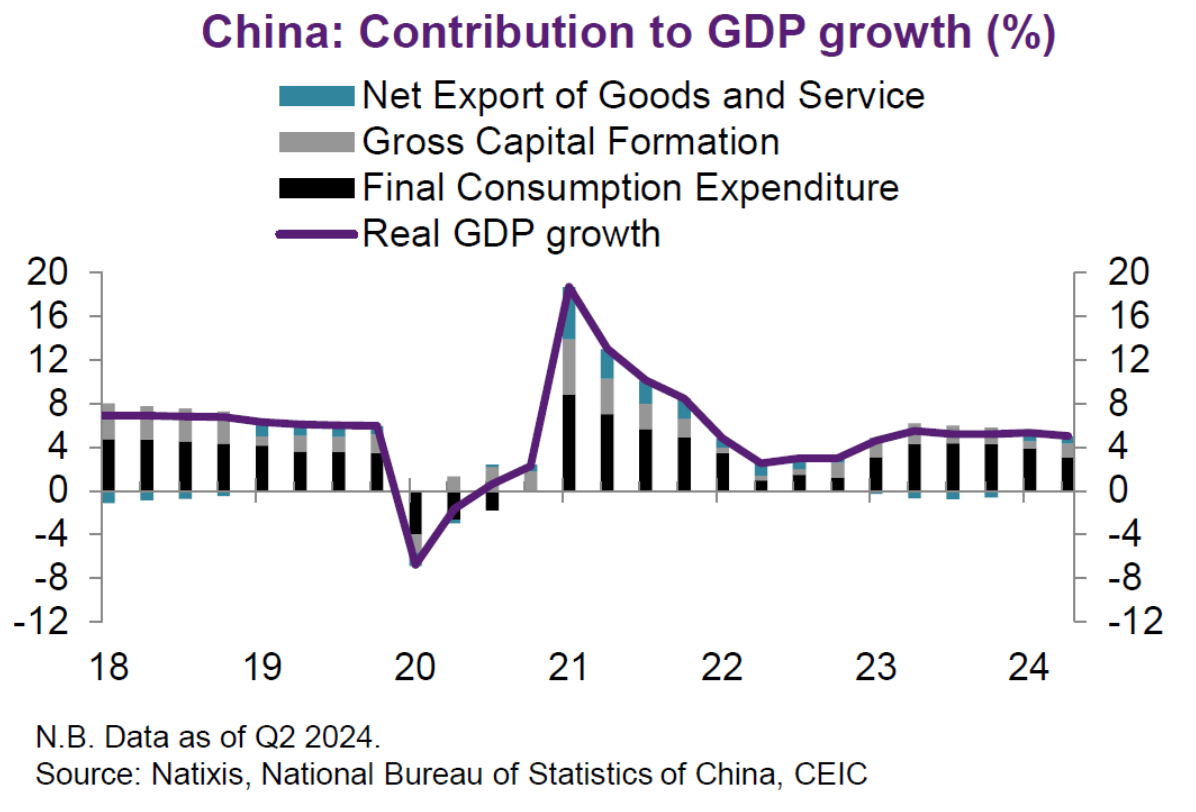

The quandary is proven within the decomposition of GDP:

Supply: Garcia Herrero & Xu, Natixis, 13 Sep 2024.

Even if the above is a mechanical decomposition (an accounting identification), one can nonetheless make some inferences in regards to the constraints to progress. Consumption is the primary contributor to progress – however shoppers are reluctant to spend within the wake of the collapse of the housing sector. Deflation makes debt extra burdensome (consider the monetary accelerator). Web exports might contribute extra to GDP, however with the surge in Chinese language exports already eliciting commerce obstacles not solely within the US, but additionally in Europe, it’s arduous to consider a giant increment coming from further internet exports.

What’s going to make things better? It relies upon what “fix” means. Return to +5% progress? Or simply continued progress with out collapse. I believe the consensus view is +5% progress is off the desk. So avoiding a full-blown disaster, with hopefully optimistic progress charges is the objective.

Eswar Prasad notes the necessity to speed up productiveness progress (which impacts the long term, however — relying on how carried out — additionally the quick run by way of expectations):

Recognizing the necessity to enhance productiveness and shift away from low-skill manufacturing, the federal government lately articulated a “dual circulation” progress coverage, which augments continued engagement with world commerce and finance with higher reliance on home demand, technological self-sufficiency, and homegrown innovation. However the strategy has run into difficulties. China nonetheless wants overseas expertise to improve its business, and rising financial and geopolitical rifts with the US and the West might restrict China’s entry to overseas expertise and hi-tech merchandise, in addition to to markets for its exports. Furthermore, the federal government’s current crackdown on personal companies in sectors reminiscent of expertise, training, and well being has had a chilling impact on entrepreneurship.

The continued decline in inward FDI suggests there’s been no reversal within the situations for FDI into China – unsurprising given the Xi administration has not likely modified the general financial framework, together with “dual circulation”. (After all, FDI into China might need additionally occurred due to makes an attempt to friendshore, in addition to the prospect of restrictions of governmental restrictions on outbound FDI).

So, don’t search for a fast repair. And anticipate even much less, if the Xi administration continues to put main weight on political dominance versus GDP progress (see e.g. Arthur Kroeber ).