CBO launched its ten yr outlook at the moment. Continued however decelerating development, barely much less optimistic than Administration, noticeably lower than the IMF, and FT-Sales space survey.

Determine 1: GDP reported (daring black), CBO (tan), Administration (mild blue sq.), IMF (pink), FT-Sales space survey (crimson triangle), Survey of Skilled Forecasters (inexperienced line), GDPNow of 1/17 (blue +), all in bn.Ch.2017$ SAAR. IMF, FT-Sales space, GDPNow ranges calculated by iterating development fee on related lagged stage. Supply: BEA 2024Q3 third launch, CBO Price range and Financial Outlook, January 2025, Financial Report of the President, 2025, IMF WEO January 2025, FT-Sales space, Philadelphia Fed, Atlanta Fed, and writer’s calculations.

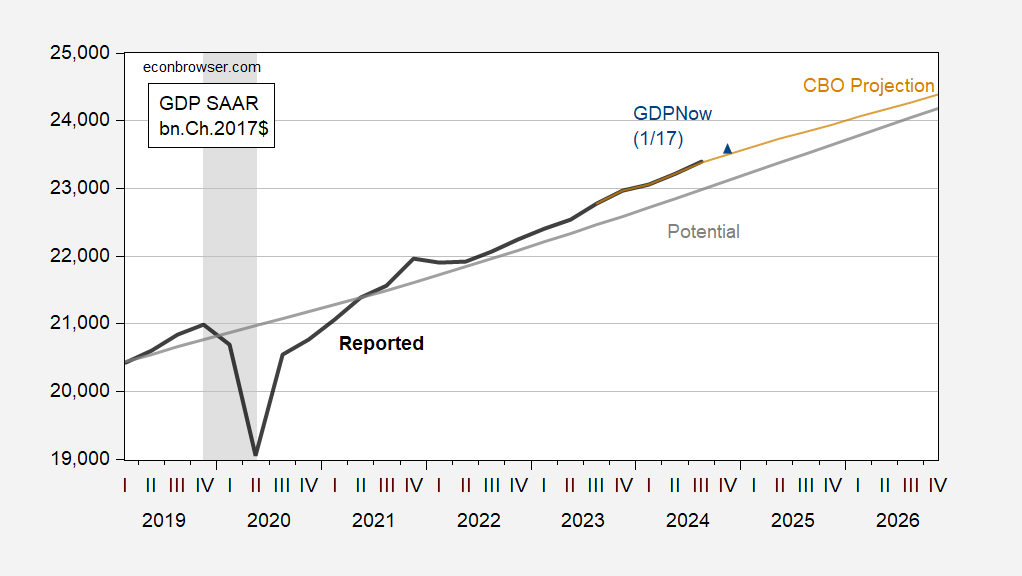

The economic system is projected by CBO to proceed to develop (below present legislation), and the output hole to stay constructive for quarters to return. As of 2024Q3, the output hole was 1.8% (log phrases), utilizing the newest estimate of potential GDP (in comparison with 2.6% utilizing the June 2024 classic of potential GDP). The output hole will likely be 1% in 2024Q4 in accordance with the Atlanta Fed’s nowcast of GDP.

Determine 2: GDP reported (daring black), CBO (tan), potential GDP estimate from CBO (grey),GDPNow of 1/17 (blue +), all in bn.Ch.2017$ SAAR. NBER outlined peak-to-trough recession dates shaded grey. GDPNow ranges calculated by iterating development fee on related lagged stage. Supply: BEA 2024Q3 third launch, CBO Price range and Financial Outlook, January 2025, Atlanta Fed, and writer’s calculations.