Discover that I don’t say in or out of recession. Nonetheless, with sluggish progress (and per capita progress adverse), there’s loads of dialogue (e.g., right here right this moment). And Trump’s threats of tariffs — even when they don’t come via — might impart sufficient uncertainty to throw the nation into recession.

Q3 q/q progress was 1.5% (annualized). Right here’s m/m GDP progress via October:

It’s nonetheless optimistic, however there have been months of close to zero progress, and all these measures are topic to revision.

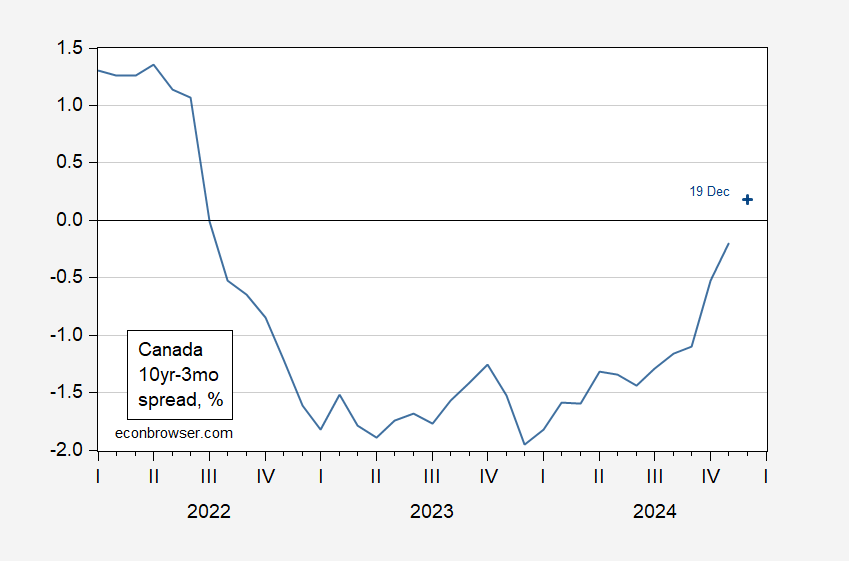

Why the issues about recession? As famous in Chinn and Ferrara (2024), the time period unfold plus monetary situations index and overseas time period unfold has a fairly good monitor report of predicting recessions as recognized by ECRI; over a pattern beginning in 1971, the time period unfold alone has a pseudo-R2 of 0.36. (The arbiter of recessions in Canada, the Enterprise Cycle Council on the C.D Howe Institute has a barely completely different identification of peak and trough for the final cycle, so our outcomes wouldn’t essentially translate.) The 10yr-3mo unfold over the previous two years appears to be like like the next:

Figure 1: Canadian 10yr-3mo unfold, % (blue). December worth is nineteen December. Supply: OECD and Reuters.

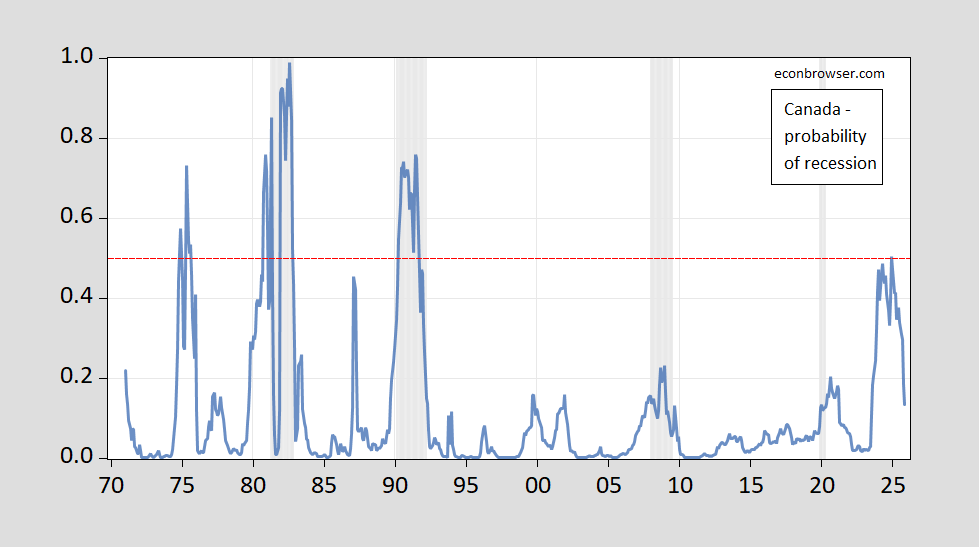

Utilizing the ECRI dates, and assuming no recession had occurred by December 2022, I receive the next estimates for the time period unfold (solely) mannequin, estimated for rates of interest 1971M01 to 2021M12.

Determine 2: Likelihood of Canadian recession 12 months forward utilizing 10yr-3mo time period unfold. ECRI outlined peak-to-trough recession dates shaded grey. Crimson dashed line at 50%. Supply: ECRI, writer’s calculations.

Primarily based on the unfold 12 months in the past, the likelihood of being in a (ECRI-defined) recession in December is 50%.

If I had been to do a conditional forecast, incorporating extra details about the probability of Trump tariffs on (will he or received’t he), my estimates of what occurs in January 2025 onward will surely deviate from a spread-alone indicator.