by Calculated Danger on 5/28/2024 01:35:00 PM

Two key factors:

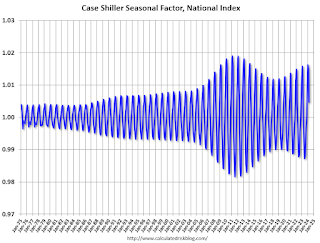

1) There’s a clear seasonal sample for home costs.

2) The surge in distressed gross sales throughout the housing bust distorted the seasonal sample. This was as a result of distressed gross sales (at cheaper price factors) occurred at a gentle charge all yr, whereas common gross sales adopted the traditional seasonal sample. This made for bigger swings within the seasonal issue throughout the housing bust.

Click on on graph for bigger picture.

This graph reveals the month-to-month change within the NSA Case-Shiller Nationwide index since 1987 (by March 2024). The seasonal sample was smaller again within the ’90s and early ’00s and elevated as soon as the bubble burst.

The seasonal swings declined following the bust, nevertheless the pandemic worth surge modified the month-over-month sample.

The swings within the seasonal components had been lowering following the bust however have elevated once more lately – this time and not using a surge in distressed gross sales.

If we use the seasonal components from 2018 and 2019, home costs had been up 0.8% in Q1 (in comparison with the present components with costs up 1.2% in Q1).