That’s the virtually gleeful conclusion in an article within the Washington Examiner final December. Now, it’s true they based mostly that conclusion on a Legislative Analyst’s Workplace report. Nevertheless, that conclusion was based mostly on the (inappropriate) use of the (nationwide stage) Sahm rule to state stage unemployment charges. And as Dr. Sahm has remarked, this isn’t the proper strategy to go — fairly one wants to look at the suitable threshold for a given state earlier than utilizing it to deduce a recession.

Nicely, let’s check out some indicators.

Determine 1: California Nonfarm Payroll Employment (darkish blue), Philadelphia Fed early benchmark measure of NFP (pink), Civilian Employment (tan), actual wages and salaries linearly interpolated, deflated by nationwide chained CPI (sky blue), GDP (crimson), coincident index (inexperienced), all in logs 2021M11=0. Supply: BLS, BEA, Philadelphia Fed [1], [2], and creator’s calculations.

Now we have a considerably bifurcated image — much like that on the nationwide stage — the place employment measures (NFP, early benchmark NFP, and coincident index) present progress by way of 2023, whereas deflated wages and salaries haven’t recovered to 2021M11 ranges by 12 months’s finish. GDP was rising by way of 2023 although.

Be aware that the coincident index — based mostly on nonfarm payroll employment, common hours labored in manufacturing by manufacturing staff, the unemployment fee, and CPI-deflated wage and wage disbursements — outpaces different measures considerably. For what it’s price, the Philadelphia Fed’s state-level enterprise cycle chronology doesn’t point out a recession in 2023.*

As for recession within the offing, the UCLA Anderson College forecast (March 13) notes:

The California financial system is forecasted to proceed to develop sooner than the U.S. however not by a lot. The dangers to the forecast are the identical as these for the nation: political and geopolitical. There may be the potential for rates of interest to disrupt the present enlargement on the draw back, and elevated worldwide immigration and accelerated onshoring of technical manufacturing on the upside.

The unemployment fee for the primary quarter of this 12 months is predicted to common 4.7%, and the common for 2024, 2025 and 2026 is predicted to be 4.6%, 3.8% and three.9%, respectively. The forecast for 2024, 2025 and 2026 is for complete employment progress charges to be -0.6%, 2.1% and 1.5%. Non-farm payroll jobs are anticipated to develop at a 1.4%, 1.7% and 1.2% fee throughout the identical two years.

Actual private earnings is forecast to develop by 2.0% in 2024, 2.9% in 2025 and a pair of.7% in 2026. Regardless of the upper rates of interest, the continued demand for a restricted housing inventory coupled with state insurance policies that induce new homebuilding ought to outcome to start with of a restoration this 12 months, adopted by strong progress in new residence manufacturing thereafter. Our expectation is for 123,000 internet new models to be permitted in 2024, and permitted new models to develop to 159,500 by the tip of 2026. For sure, this stage of residence constructing implies that the prospect for the non-public sector to construct out of the housing affordability downside over the following three years is nil.

* Some readers may recall the nice 2017 California-in-recession debate with PoliticalCalculations, right here. The Philadelphia Fed fails to establish a recession for California in 2017-18.

Ironman speculated {that a} recession had begun, on the idea of 12 month shifting common on sequence based mostly on the family survey. Right here’s the precise end result.

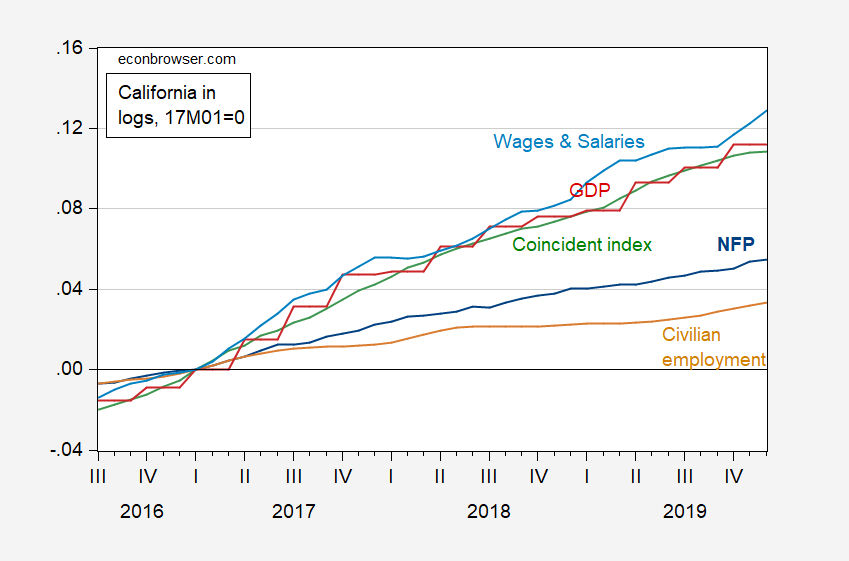

Determine 2: California Nonfarm Payroll Employment (darkish blue), Civilian Employment (tan), actual wages and salaries linearly interpolated, deflated by nationwide chained CPI (sky blue), GDP (crimson), coincident index (inexperienced), all in logs 2021M11=0. Supply: BLS, BEA, Philadelphia Fed [1], and creator’s calculations.

Conclusion: Beware the family survey employment sequence on the state stage.