There’s been a number of dialogue of overcapacity in Chinese language manufacturing, and the ensuing pressures in US and different markets. Right here’s an image of the Chinese language actual change charges.

Determine 1: China commerce weighted CPI deflated actual change fee (blue), and US-China bilateral CPI deflated actual change fee (tan), in logs. Up denotes enhance in worth of Chinese language foreign money. Chinese language CPI adjusted by creator utilizing X-13. Supply: BIS, FRB, BLS through FRED.

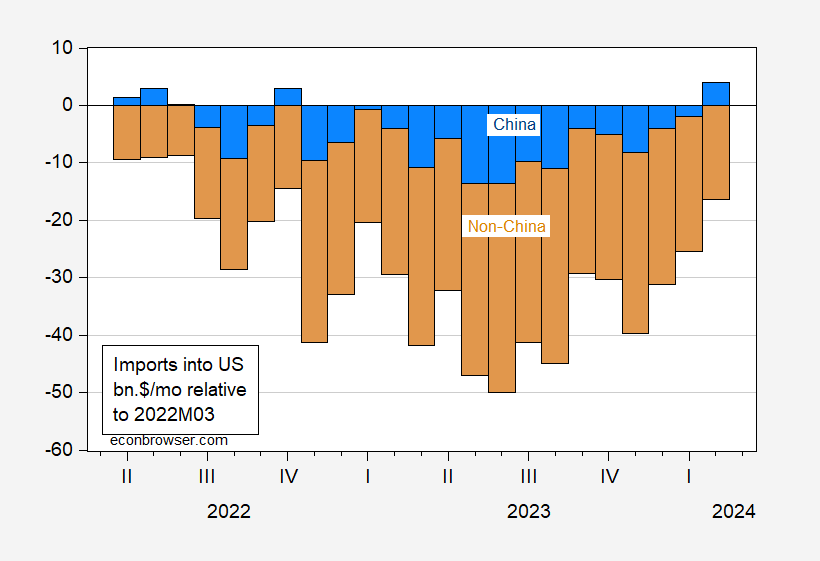

In precept, I’d desire to make use of PPI deflated actual charges, and even unit labor price deflated (see this paper), however these are more durable to return by. The Chinese language commerce weighted worth of the CNY is down 15% in log phrases since its latest peak at 2022M03. In distinction, the decline within the bilateral actual change fee is 20%. From 2021M02, it’s 25%. Apparently, Imports of products from China (as reported within the commerce statistics) usually are not far totally different from 2022M03:

Determine 2: Change in imports from China relative to 2022M03 (blue bar), from non-China (tan bar), in bn.$/month. Imports from China are items, Customs foundation; complete imports of products and companies, Steadiness of Funds foundation. China items imports seasonally adjusted by creator utilizing X-13. Supply: Census, BEA through FRED.

That being stated, it’s clear that a number of Chinese language items are attending to the US through third international locations (trans-shipped, or manufacturing shifted). Actually, what we’d wish to see extra is worth added imported from China; to my information, up-to-date information of this type just isn’t available.

Even then, the bilateral worth added move wouldn’t present the overall strain on tradables costs, since Chinese language imports could possibly be miserable traded costs globally, thereby growing imports into the US.

Is the Chinese language foreign money undervalued? Extra on that later (older recap of approaches, see right here). The most recent Treasury report is from November. The BigMac index, utilizing December information, signifies 26.3% undervaluation utilizing the Penn Impact.

Brad Setser has some ideas, right here.