From CBO, a working paper by Andre R. Neveu (FDIC) and Jeffrey Schafer (CBO) on the debt sensitivity of the rate of interest (DSIR):

Supply: Neveu and Schafer (2024).

Every proportion level of improve in debt-to-GDP ends in 2 bps improve in yields.

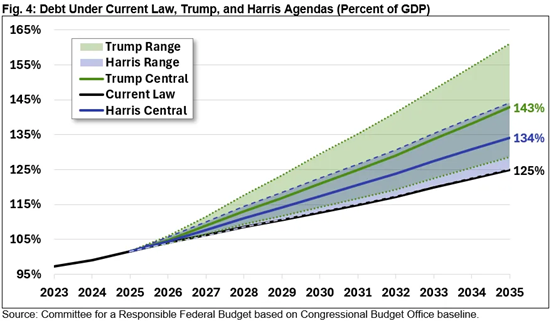

This parameter of curiosity given the potential of a quick upward trajectory in debt-to-GDP, as proven right here:

Supply: CRFB, Oct 28, 2024.

After all, 2bps per ppt could possibly be low or excessive. That is considerably smaller than the estimates we discovered (Chinn and Frankel, 2004) in knowledge as much as 2002.

Possibly Trump will break all his guarantees, and debt proceeds at baseline. Or perhaps he and the Congress will reduce Social Safety and Medicare advantages (doubtful he’d increase taxes on excessive earners). However I’m guessing he’ll simply tank the financial system by elevating tariffs, increasing deportations, and elevating coverage uncertainty, whereas extending the TCJA additional blowing a gap within the funds.