Charles Payne joins the recession camp.

Present indicators aren’t very supportive of an imminent recession:

Determine 1: Nonfarm Payroll (NFP) employment from CES (blue), implied NFP from preliminary benchmark (daring blue), civilian employment (orange), civilian employment including variety of employees indicating unemployed resulting from climate (orange sq.), industrial manufacturing (purple), private revenue excluding present transfers in Ch.2017$ (daring mild inexperienced), manufacturing and commerce gross sales in Ch.2017$ (black), consumption in Ch.2017$ (mild blue), and month-to-month GDP in Ch.2017$ (pink), GDP (blue bars), all log normalized to 2021M11=0. Supply: BLS by way of FRED, Federal Reserve, BEA 2024Q3 1st launch, S&P International Market Insights (nee Macroeconomic Advisers, IHS Markit) (11/1/2024 launch), and creator’s calculations.

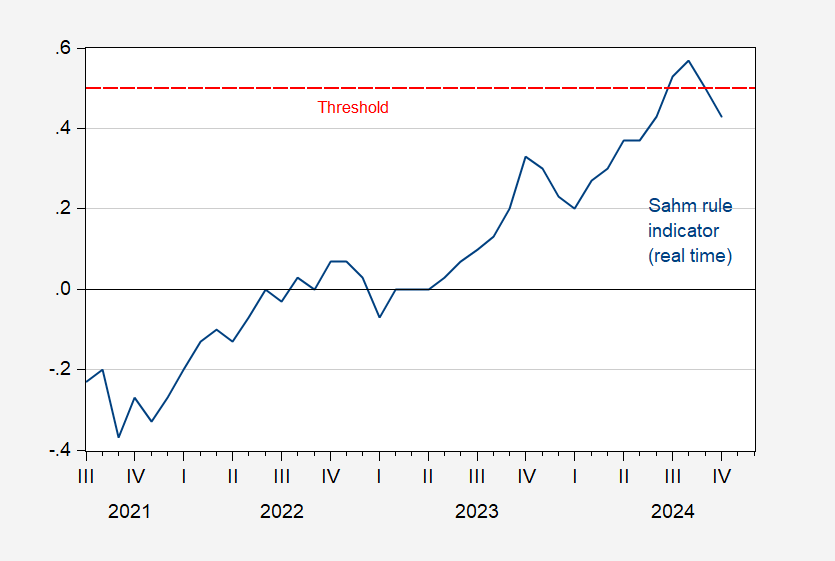

Different indicators present an analogous story. And the Sahm rule (actual time) is now under the set off charge:

Determine 2: Sahm rule (actual time) indicator, % (blue). Set off at 0.5 ppts. Supply: FRED.

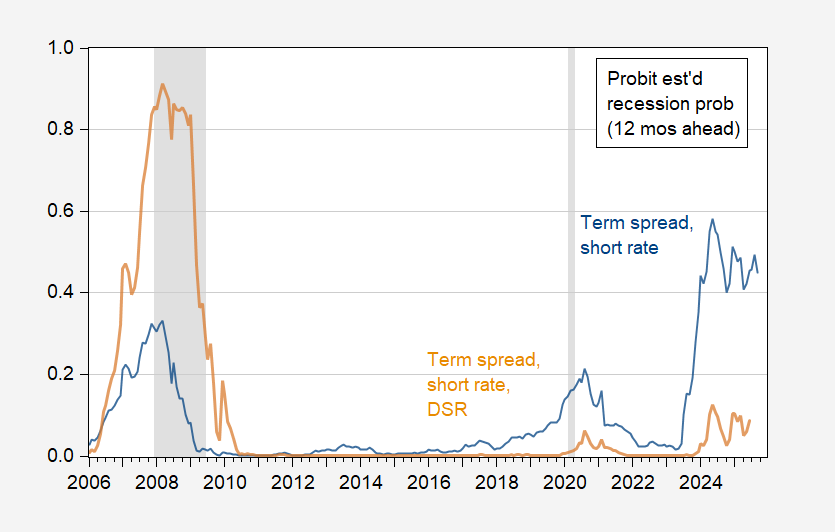

Neither is (my most popular – variation on Chinn-Ferrara (2024)) forecasting equation displaying a recession quickly, though a easy time period unfold mannequin nonetheless indicators warning (see dialogue right here).

Determine 3: Estimated 12 month forward possibilities of recession, from probit regression on time period unfold and quick charge, 1986-2024 (blue), on time period unfold, quick charge and debt-service ratio (tan). NBER outlined peak-to-trough recession dates shaded grey. Supply: Treasury by way of FRED, BIS, NBER, and creator’s calculations.