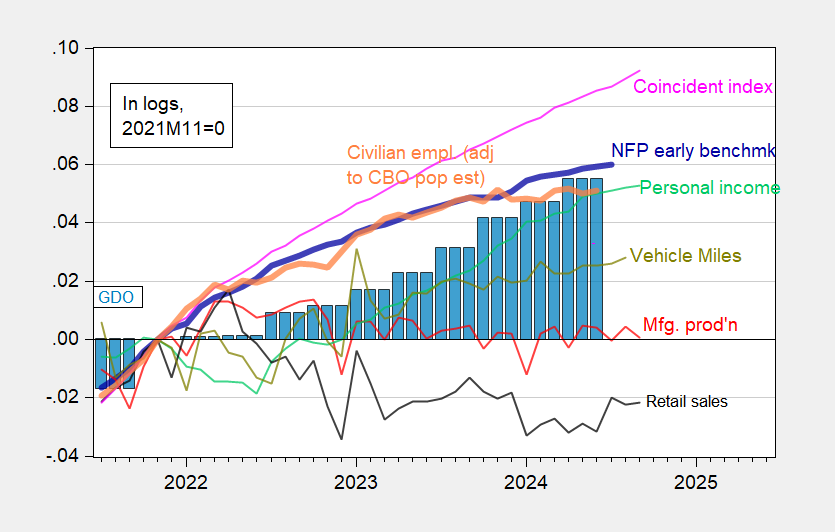

Employment for October and month-to-month GDP for September, within the set of variables adopted by the NBER’s BCDC:

Determine 1: Nonfarm Payroll (NFP) employment from CES (blue), implied NFP from preliminary benchmark (daring blue), civilian employment (orange), industrial manufacturing (pink), private earnings excluding present transfers in Ch.2017$ (daring mild inexperienced), manufacturing and commerce gross sales in Ch.2017$ (black), consumption in Ch.2017$ (mild blue), and month-to-month GDP in Ch.2017$ (pink), GDP (blue bars), all log normalized to 2021M11=0. Supply: BLS through FRED, Federal Reserve, BEA 2024Q3 1st launch, S&P World Market Insights (nee Macroeconomic Advisers, IHS Markit) (11/1/2024 launch), and creator’s calculations.

Accessible various indicators are typically up, together with the coincident index for September, and automobile miles traveled (VMT) for August.

Determine 2: Nonfarm Payroll early benchmark (NFP) (daring blue), civilian employment adjusted utilizing CBO immigration estimates via mid-2024 (orange), manufacturing manufacturing (pink), private earnings excluding present transfers in Ch.2017$ (mild inexperienced), retail gross sales in 1999M12$ (black), automobile miles traveled (VMT) (chartreuse), and coincident index (pink), GDO (blue bars), all log normalized to 2021M11=0. Early benchmark is official NFP adjusted by ratio of early benchmark sum-of-states to CES sum of states. Supply: Philadelphia Fed, Federal Reserve through FRED, BEA 2024Q2 third launch/annual replace, and creator’s calculations.

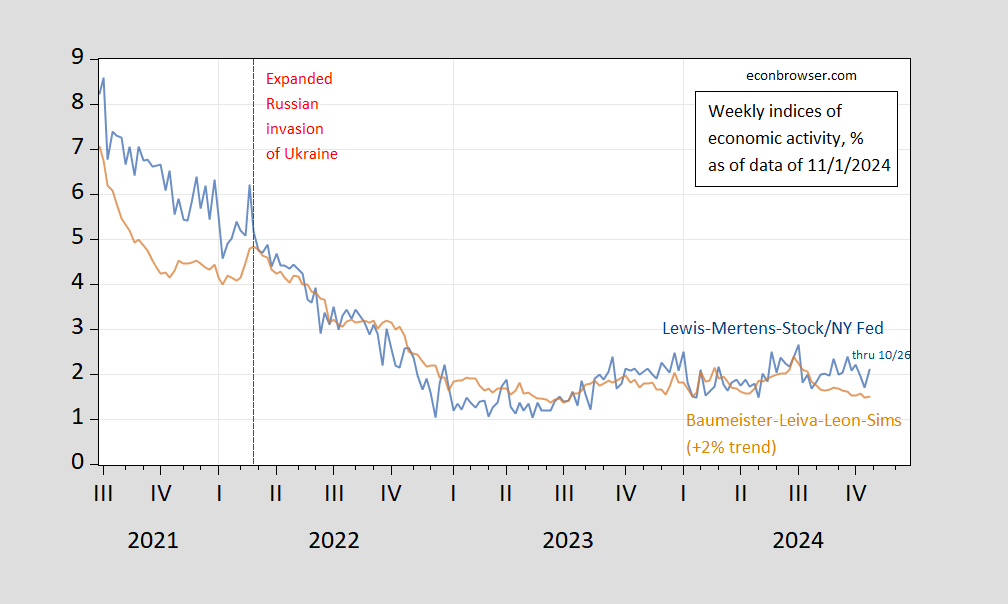

Excessive frequency (weekly) indicators are combined, with the Lewis-Mertens-Inventory WEI at 2.1%, and the Baumeister-Leiva-Leon-Sims WECI at 1.5% (assuming development is 2%).

Determine 3: Lewis-Mertens-Inventory Weekly Financial Index (blue), and Baumeister-Leiva-Leon-Sims Weekly Financial Situations Index for US plus 2% development (tan), all y/y progress fee in %. Supply: NY Fed through FRED, WECI, accessed 11/1/2024, and creator’s calculations.

GDPNow for This fall is at 2.3% at present; NY Fed nowcast at 2.01%.