GDP per capita, consumption per capita, disposable earnings per capita:

Determine 1: GDP per capita now (blue), and 4 years in the past (tan), each in bn.Ch.2017$ SAAR. Supply: BEA.

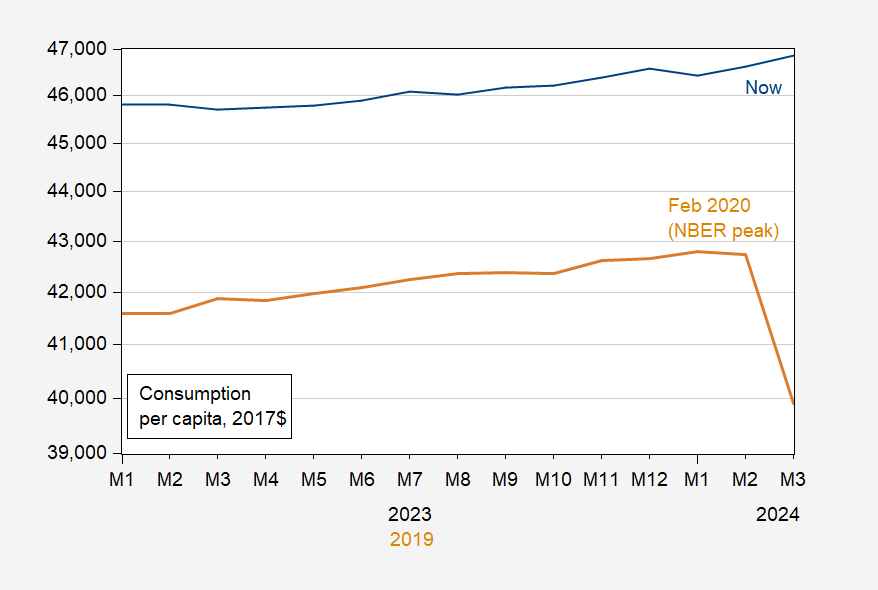

Determine 2: Consumption per capita now (blue), 4 years in the past (tan), in 2017$ SAAR. Supply: BEA.

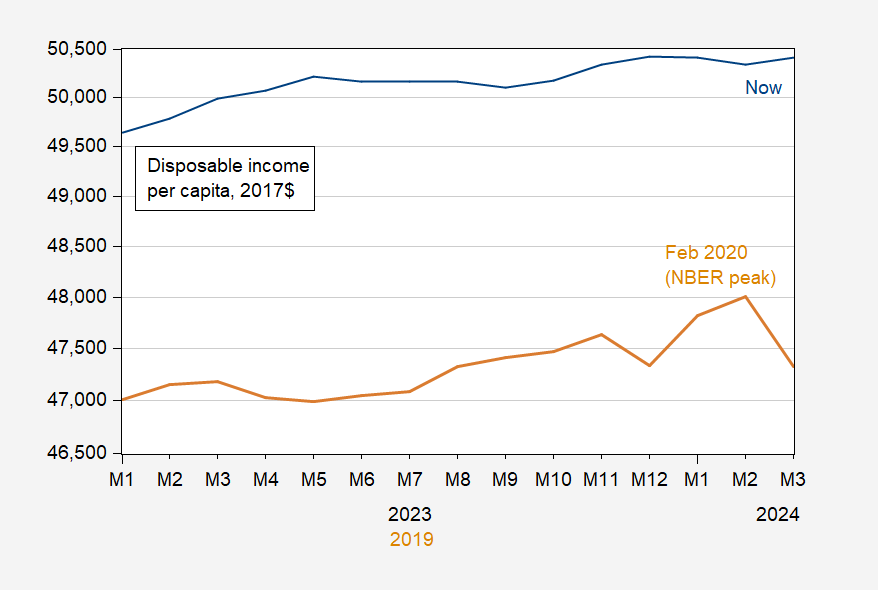

Determine 3: Disposable private earnings per capita now (blue), 4 years in the past (tan), in 2017$ SAAR. Supply: BEA.

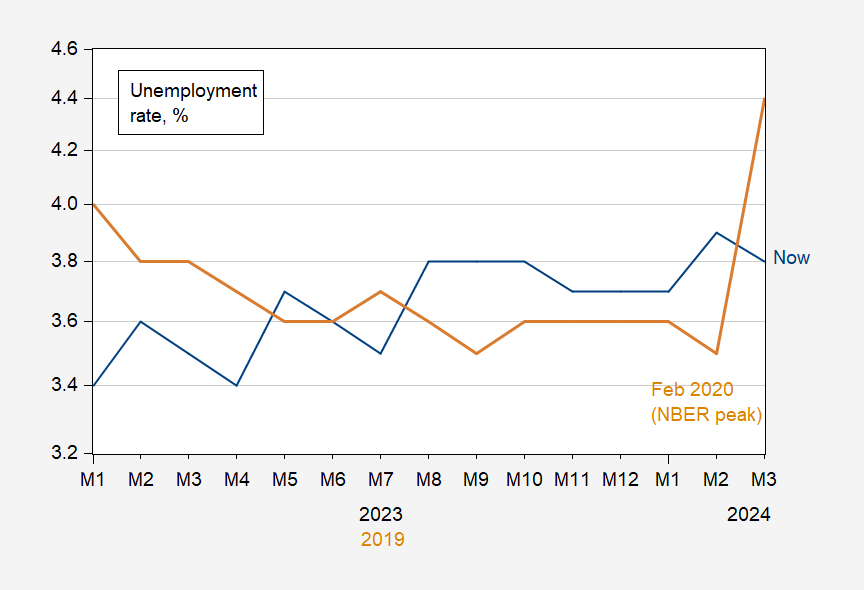

Determine 4: Unemployment charge now (blue), 4 years in the past (tan), in %. April commentary is Bloomberg consensus. Supply: BLS.

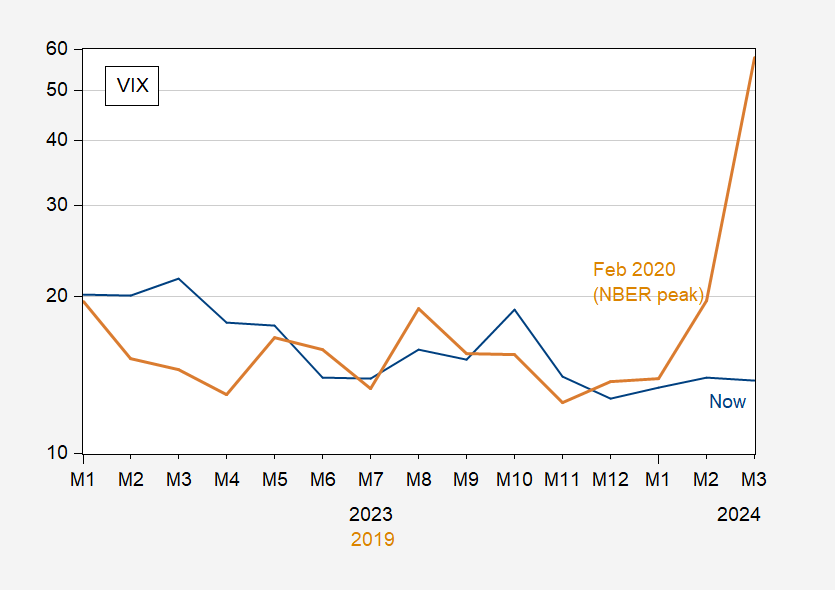

Determine 5: VIX now (blue), 4 years in the past (tan). Supply: CBOE by way of FRED.

Determine 6: Financial Coverage Uncertainty index (blue), 4 years in the past (tan). Supply: Policyuncertainty.com by way of FRED.

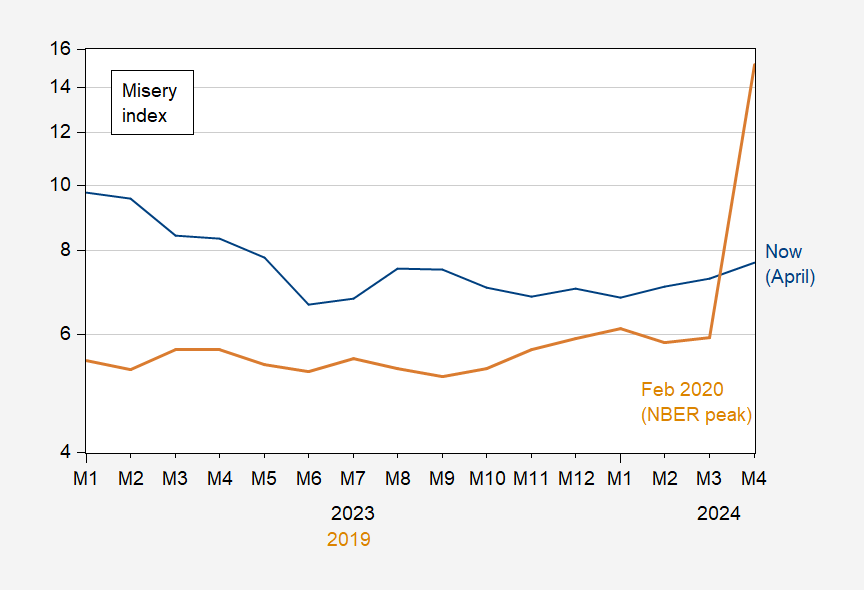

Determine 7: Distress index now (blue), 4 years in the past (tan), in %. April commentary of unemployment is Bloomberg consensus, inflation is from Cleveland Fed nowcast as of 4/30/2024. Supply: BLS, Cleveland Fed, and writer’s calculations.

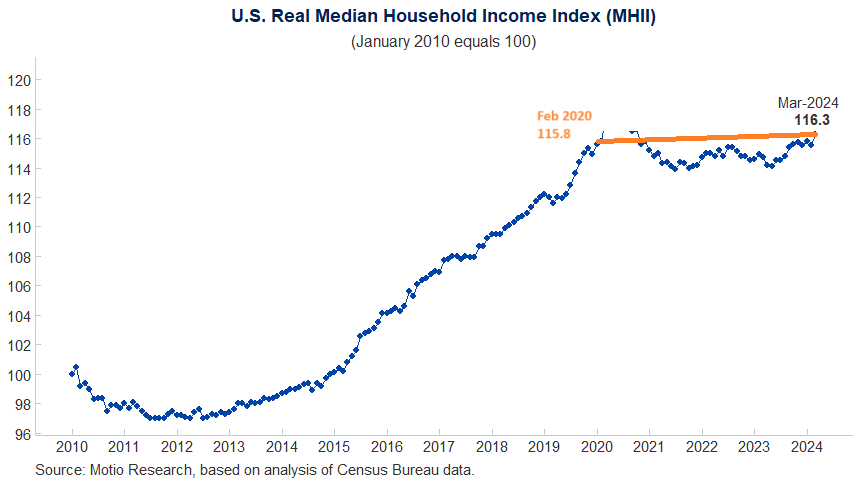

I don’t have a time collection for actual median family earnings index, however I can evaluate the March 2024 worth to February 2020 (which Motio analysis signifies is the doubtless peak) worth of 115.8.

Supply: Motio Analysis.

I’d say, by these measures, the reply is “yes”, even utilizing median earnings.