Speaking a couple of rethink of the output hole, and the idea of the trend-cycle decomposition in macro coverage tomorrow. Right here’s an image of the output hole from CBO, from two statistical filters (Hodrick-Prescott and Fleischman-Roberts/Fed Board), and the Delong and Summers (BPEA 1988) mannequin.

Determine 1: Output hole calculated utilizing CBO potential GDP (black), HP filter utilized to 1960-2024 (tan), Fleischman and Roberts/Fed Board 2 sided filter (gentle inexperienced), and pseudo-DeLong-Summers (1988) strategy (blue). NBER outlined peak-to-trough recession dates shaded grey. Supply: BEA 2024Q1 advance, CBO (February), Atlanta Fed Taylor Rule utility information accessed 4/26/2024, NBER, and writer’s calculations.

Observe that the HP filter yields implausibly small (in absolute worth) output gaps within the wake of the Nice Recession. Alternatively, each band move filters just like the Baxter King, or the Hamilton filter which depends on a regression technique of extracting the development, point out massive drops and jumps within the development related to the Covid-19 recession (not proven).

The CBO “production function” strategy to estimating development shouldn’t be as affected by the Covid-19 shock, and matches an financial interpretation higher. Nonetheless, it has been topic to substantial variation as estimates of productiveness have shifted; and extra just lately, as immigration has affected the projected labor inventory.

Jim Hamilton has a distinct interpretation of potential GDP which depends upon differentiated (by specialization) labor and capital provide and demand matching. Adjustments within the composition of demand relative to produce may then imply slack. Nonetheless, I don’t have a time collection of this interpretation of potential.

One other tackle potential GDP is that we will’t take the standard trend-cycle decomposition without any consideration. Blanchard, Cerutti and Summers (2015) argue that the development and cycle is perhaps correlated. They observe that development development in GDP has sometimes declined within the wake of recessions. This isn’t a pure consequence in the usual view of enterprise cycles. As an example, within the CBO manufacturing perform strategy, a recession ought to solely have an effect on development development solely to the extent that decreased capital funding and discouraged employees may scale back potential (presumably a small quantity). In a cross nation evaluation, they discover that this isn’t the case.

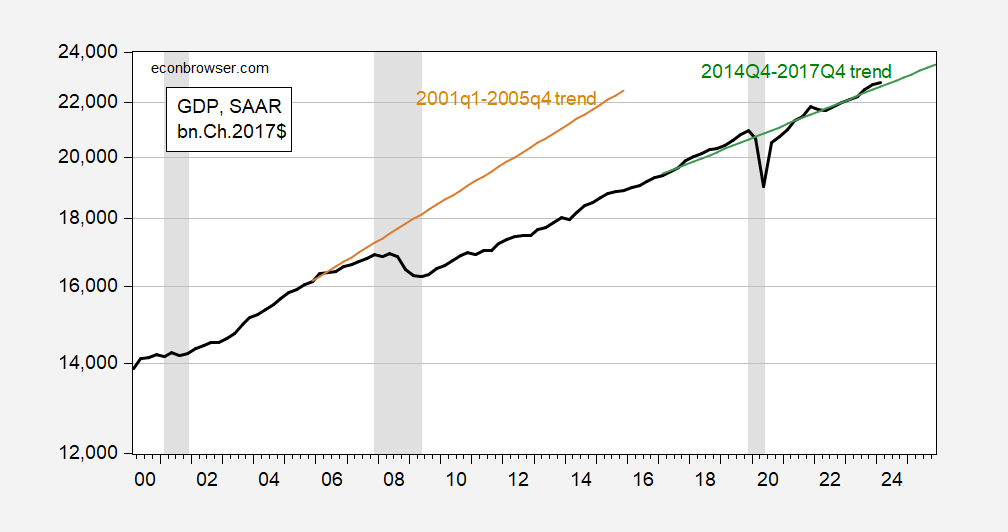

I replace the Blancard-Cerutti-Summers graph for the US, to incorporate extra of the post-Nice Recession interval, and the post-2020 restoration.

Determine 2: GDP (daring black), 2001-2005 linear development (tan), and 2014-17 linear development (inexperienced), all in bn.Ch2017$ on log scale. NBER outlined peak-to-trough recession dates shaded grey. Supply: BEA 2024Q1 advance launch, NBER, and writer’s calculations.

The BCS strategy signifies an enormous imply and development decline. The recession may’ve occurred as a result of brokers perceived anticipated decline within the parts of potential GDP (TFP, capital and labor shares) as conventionally conceived, or due to scarring attributable to a broken monetary system, together with extended interval of stagnant demand (due say to 50 Little Hoovers, together with Wisconsin’s Governor Scott Walker).

Curiously, the 2020 disaster has not apparently made a big effect on imply or development GDP. This means that both the 2020 recession was not induced by a discrete downgrade in expectations concerning the parts of potential GDP, or that scarring was averted by immediate and energetic fiscal and financial insurance policies.